- Community

- Topics

US En

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

You'll need to sign in or create an account to connect with an expert.

Residents not stationed in Oregon that didn’t have a permanent residence in Oregon during any part of the tax year, maintained a permanent residence outside of Oregon for the entire tax year, and spent less than 31 days in Oregon during the tax year are considered nonresidents for Oregon tax purposes and only owe Oregon tax if receive income from other Oregon sources.

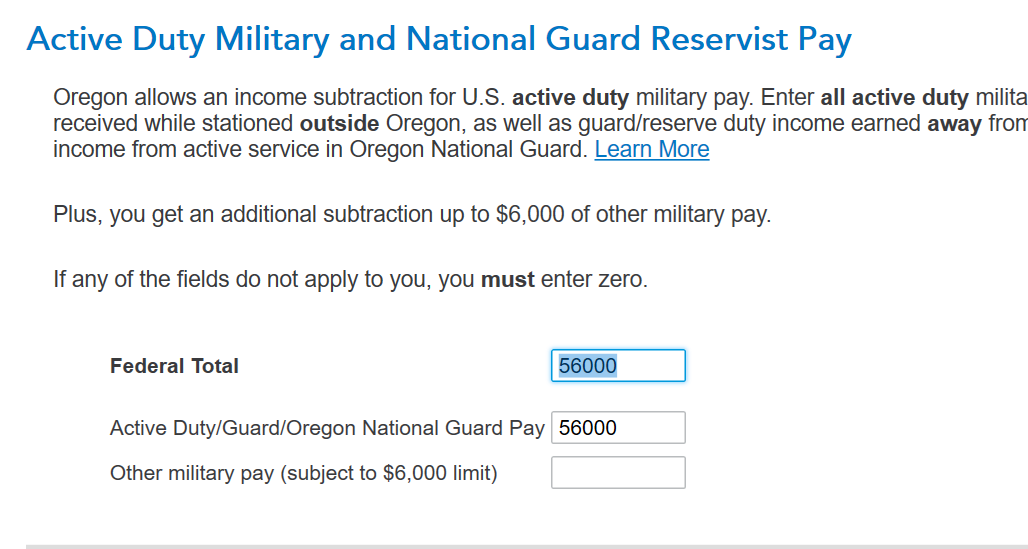

If you fit these parameters, you may exclude your military pay. When you begin preparing your Oregon return, there will be a screen that appears like the screenshot I have included below. Once you put in the military pay into the screen, this should exclude your Oregon income. If you paid withholding tax to Oregon, that entire amount should be refunded back to you.

Still have questions?

Make a postAsk questions and learn more about your taxes and finances.

Kruk

New Member

Militaryspouse

Returning Member

Stupidasur3

Level 4

ronjrsm32

Returning Member

vishalg_99

Level 1

Did the information on this page answer your question?

Yes

Yes

No

No

You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead.