- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax help for military filers

Residents not stationed in Oregon that didn’t have a permanent residence in Oregon during any part of the tax year, maintained a permanent residence outside of Oregon for the entire tax year, and spent less than 31 days in Oregon during the tax year are considered nonresidents for Oregon tax purposes and only owe Oregon tax if receive income from other Oregon sources.

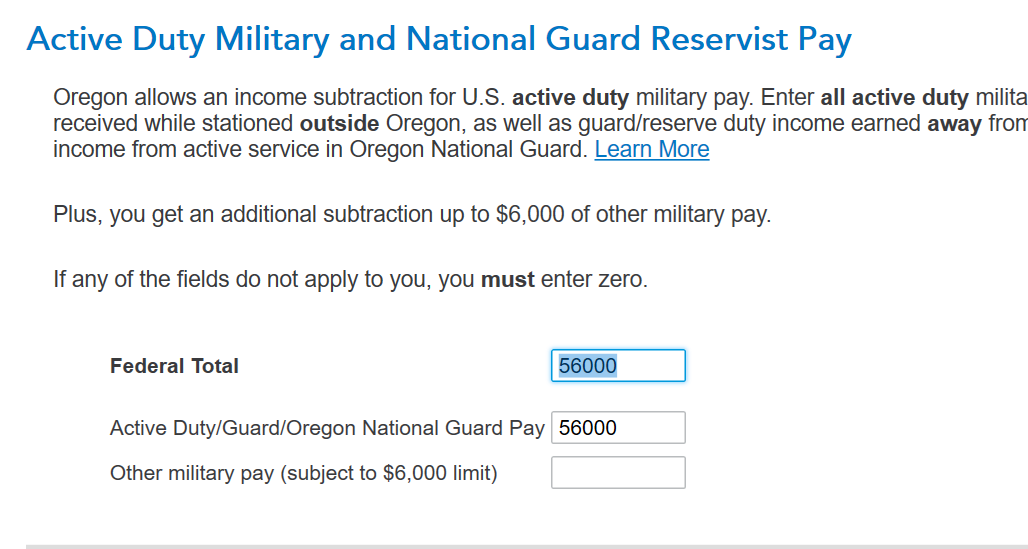

If you fit these parameters, you may exclude your military pay. When you begin preparing your Oregon return, there will be a screen that appears like the screenshot I have included below. Once you put in the military pay into the screen, this should exclude your Oregon income. If you paid withholding tax to Oregon, that entire amount should be refunded back to you.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 22, 2024

5:27 PM

432 Views