- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- I HAVE A MILITARY 1099-R THAT I NEED TO ENTER. I HAVE TRIED ALL THE CHOICES BUT THEY ARE NOT CORRECT. WHICH CHOICE DO I USE TO ENTER IT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

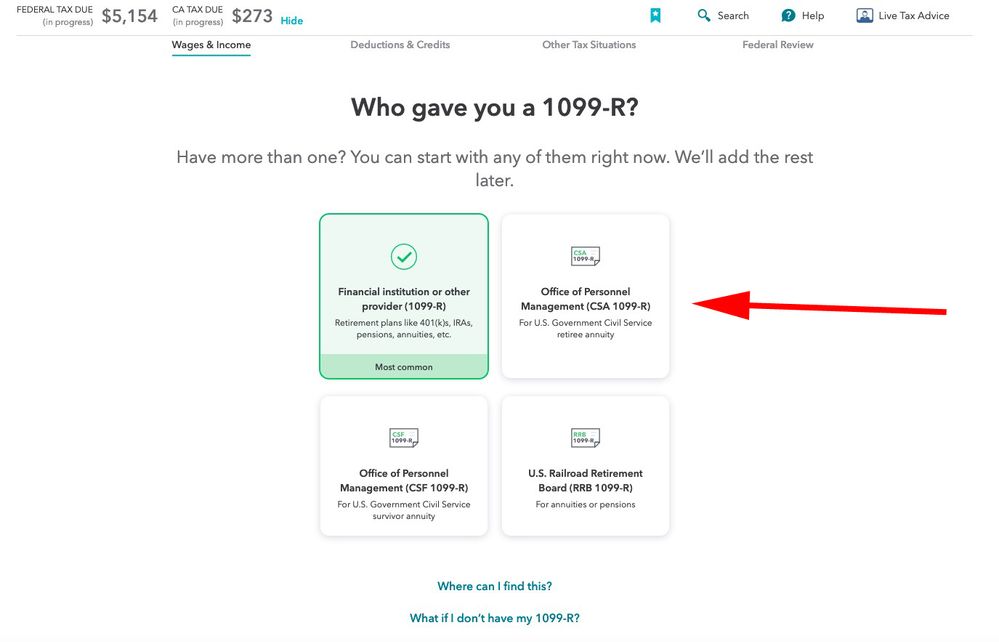

I HAVE A MILITARY 1099-R THAT I NEED TO ENTER. I HAVE TRIED ALL THE CHOICES BUT THEY ARE NOT CORRECT. WHICH CHOICE DO I USE TO ENTER IT?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I HAVE A MILITARY 1099-R THAT I NEED TO ENTER. I HAVE TRIED ALL THE CHOICES BUT THEY ARE NOT CORRECT. WHICH CHOICE DO I USE TO ENTER IT?

If it is a CSA-1099-R from OPM then choose that type.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I HAVE A MILITARY 1099-R THAT I NEED TO ENTER. I HAVE TRIED ALL THE CHOICES BUT THEY ARE NOT CORRECT. WHICH CHOICE DO I USE TO ENTER IT?

But #1 if it was from DFAS...then it's a regular 1099-R.

BUT #2: Some 1099-R forms from DFAS had a FEIN issued without the proper number (too short). The proper FEIN has a "2" at the end....it should have been:

34-0727612

__________________________________

Also, if you turned age 59.5 at any time during 2020 there was an occasional issue with making entries in the software...they might have fixed it by now...they might not have. IF you did turn 59.5 in 2020 and are having issues with some penalty...post back, and we can instruct you about a fairly simple workaround...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I HAVE A MILITARY 1099-R THAT I NEED TO ENTER. I HAVE TRIED ALL THE CHOICES BUT THEY ARE NOT CORRECT. WHICH CHOICE DO I USE TO ENTER IT?

Also, for military retirement it's a non-qualified plan. That matters.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ualdriver

Level 3

Stllwtrs

Level 2

c-mbrooks

New Member

bgerry

Level 1

MikeO4

New Member