- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- How do I make turbotax online deduct my military income from the AGI for Ohio return when I was not stationed in Ohio?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I make turbotax online deduct my military income from the AGI for Ohio return when I was not stationed in Ohio?

I'm a Ohio resident that is Active Duty military but am not stationed in Ohio. Per the tax.ohio.gov I should be able to deduct my income because it was earned while not stationed in Ohio. I have gone through he my info section multiple times verifying I haven't messed anything about saying I'm military. I can not figure out how to make turbotax give me the option to select that what am I missing?

Additional information if it helps filing jointly and spouse is a resident of another state.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I make turbotax online deduct my military income from the AGI for Ohio return when I was not stationed in Ohio?

I figured it out! After uploading your W-2 you must select the check box that says "Active military duty." If that box is not checked the prompt will not come up when doing the state taxes.

I hope this helps anyone else out. Took a while for me to find that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I make turbotax online deduct my military income from the AGI for Ohio return when I was not stationed in Ohio?

I figured it out! After uploading your W-2 you must select the check box that says "Active military duty." If that box is not checked the prompt will not come up when doing the state taxes.

I hope this helps anyone else out. Took a while for me to find that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I make turbotax online deduct my military income from the AGI for Ohio return when I was not stationed in Ohio?

^ But how does that deduct the nontaxable income from the reported income which was taxed but included BAH and BAS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I make turbotax online deduct my military income from the AGI for Ohio return when I was not stationed in Ohio?

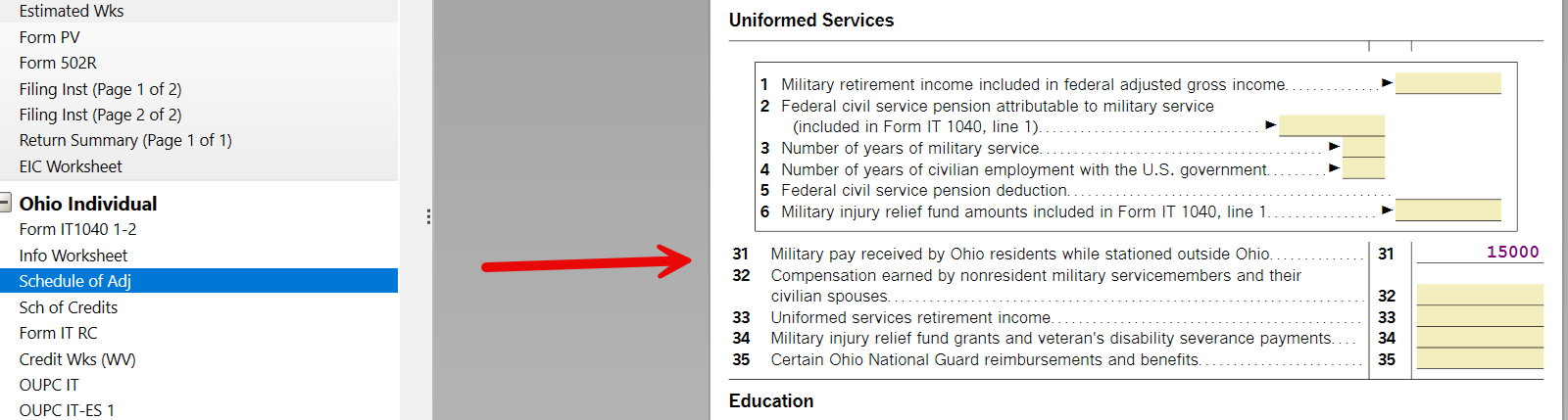

It removes all the income. If you are stationed outside OH, there is no taxable income for military pay. The adjustments form is accessed by going through Ohio to Here's the Income that Ohio handles differently. Be sure you have military marked in the personal information screen and where stationed outside of OH to qualify for the deduction.

See Military FAQs for Ohio.

Thank you for your service.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

drildrill23

Returning Member

smfwalker

Level 2

Anobikit

New Member

Taxfused

New Member

hilo12

New Member