- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where do i enter the details of sale of rental property?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the details of sale of rental property?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the details of sale of rental property?

To enter the sales and depreciation information, Edit each rental asset.

- Type rentals in the search bar and click on Jump to rentals.

- On the Your 2020 rentals and royalties summary screen, edit the rental.

- On the Here's XXX rental property info screen, scroll down to Improvements, furnishing, and other assets and Edit.

- On the Your improvements, furnishings, and other assets screen, select an asset and click on the pencil icon on the right side.

- On the Do you want to go directly to your asset summary? screen, select Yes, I want to go to my asset summary.

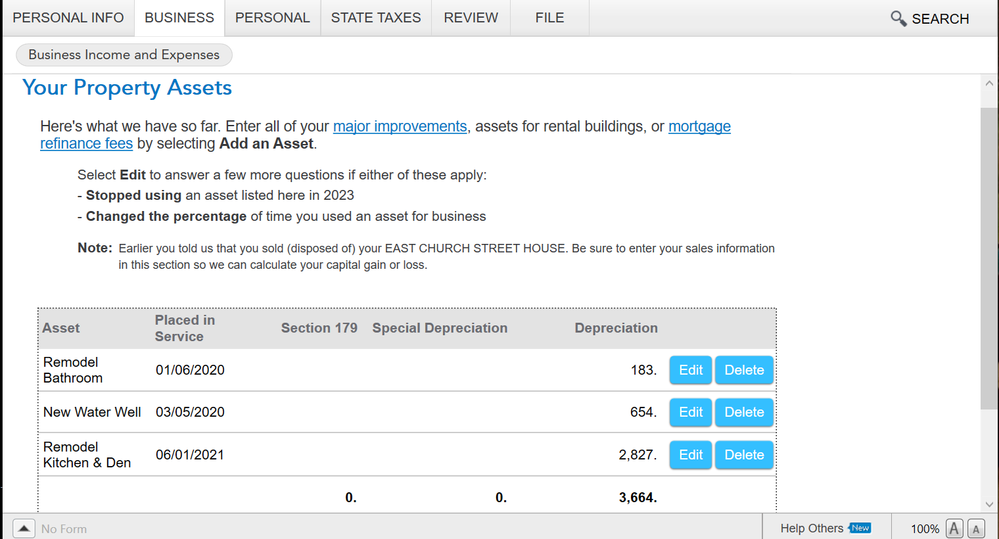

- On the Your Property Assets screen, Edit the asset.

- On the Describe This Asset screen, select an asset category and continue.

- On the Tell Us a Little More About Your Rental Asset screen, select the category and Continue.

- On the Tell Us About This Rental Asset screen, confirm the information and Continue.

- On the Tell Us More About This Renal Asset screen, select The item was sold, retired, stolen, destroyed, disposed of, converted to personal use, traded in, or given away and enter the date sold.

- Answer the next question on the page and Continue.

- Continue with the onscreen interview. On the Enter Asset Sale Information screen, enter the Sales Price and Sales Expenses.

- Continue with the onscreen interview until complete.

- Repeat this process for each asset.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the details of sale of rental property?

These steps are just for the rental improvements in my file, I don't have the actual rental property itself as one of these assets in Schedule E, as the house itself is not depreciated. Do I mark each of these improvements as sold and then add the undepreciated amounts to my cost basis? Do I go to Sale of Business Property and input the rental property sale details there?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the details of sale of rental property?

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2020". Select it. After you select the "I sold or otherwise disposed of this property in 2020" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even if it's zero. Then you MUST work through the "Sale of Property/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1 on some assets. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1 on some assets.

Basically, when working through an asset you select the option for "I stopped using this asset in 2020" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the details of sale of rental property?

Thanks, I have done all these steps, but as I mentioned the assets are only my improvements to the rental property over the years. Not the property itself. So should I input the property cost basis as one of these rental property assets, then close it out as part of the sale? I also had closing costs and have no idea where to input those.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the details of sale of rental property?

Exactly my question now. How did you do it ? Did you zero out those improvements listed as assets and add that to the cost basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter the details of sale of rental property?

You do need to add the basis of the rental property in TurboTax if not already there, and then report the sale of it. You will take the sale proceeds and allocate them to the assets sold, which includes the real estate, improvements, land and furniture and fixtures. Typically, you assume the sales proceeds are equal to the cost basis of all of the assets accept for the house itself unless there is an agreement with the buyer that states otherwise. When you are done, you will typically have a gain and the portion of the gain that is equal to depreciation taken over the years will be taxed as ordinary income up to a maximum of 25% federal tax, and the rest of the gain will be taxed at capital gain rates.

Also, you need to consider depreciation in the cost basis of the property excluding the land. The IRS requires you to reduce the original cost basis by the applicable depreciation to arrive at the adjusted cost basis for calculating gain or loss on sale. It doesn't matter if you didn't deduct the depreciation, you must include it in the basis calculation. If you were entitled to depreciation but didn't deduct it over the years, you can make an adjustment for that in the year of sale and deduct it.

You have two choices in determining how you can claim depreciation that you failed to report in previous years. You can file an amended return for the effected years if allowed (you can only go back three years for this) or you can file IRS Form 3115 that will allow you to apply for a change in accounting method. If you file form 3115, you can report the missed depreciation in the current tax year.

If you decide to file Form 3115, be mindful that you can’t use this method for making a late section 179 expensing election, or to change the date an asset was placed into service, or to change the designated use of an asset.

On form 3115, you need to complete the entries on page 8 "Schedule E - Change in Depreciation or Amortization". In part I(a), the DNC code is "7", used to note a change in depreciation method from an impermissible method. You will need to complete the "Information for All Requests" on pages 1 to 3.

You can only prepare Form 3115 in the desktop version of TurboTax. You can find the form by entering the form number in the "Open Forms" box you will find in the Forms Menu. Here is a link to an article that you may find helpful: Reclaim depreciation missed in previous years .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

alvin4

New Member