- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Using TurboTax to report sale of rental property instead of a CPA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TurboTax to report sale of rental property instead of a CPA?

Is the general consensus that TurboTax is capable of reporting the sale of a rental property? Or is it necessary to hire a CPA? What would a CPA do for me that TurboTax would not?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Using TurboTax to report sale of rental property instead of a CPA?

Yes, TurboTax is fully capable of reporting the sale of a rental property. Here are some tips that may be useful.

The selling price should be prorated for each asset then entered for each asset when you indicate they were sold or disposed of. You will not lose the remaining depreciation because you will use the remaining basis against the selling price to determine gain or loss.

To figure out the selling price for each asset:

- Take the current basis of each asset against the total combined basis of all of your assets to figure out the sales price for each one; OR

- Determine a fair market value for each asset against the total value of all assets to figure out the sale price for each one.

Use the original cost of each asset listed on depreciation, add those together then divide each one by the combined total to find the percentage of the cost for each asset. Use that percentage times the sales price and sales expenses to find the selling price/sales expenses for each asset. (Choices would also be fair market value on the date of the sale or adjusted basis on the date of the sale, which is cost less depreciation.)

Example: Original Cost (of each asset on your depreciation schedule)

$10,000 Land = 13.33%

$50,000 House = 66.67%

$15,000 Improvements = 20%

$75,000 Total = 100%

Multiply each percentage times the sales price/sales expenses to arrive at each individual sales price/sales expense.

I hope this example provides clarification to enter your sale. If you have not used TurboTax, enter each asset exactly as it appears on your prior year return.

You need to dispose of the property by telling TurboTax how and when it was disposed of. Follow the instructions below.

- Click on Wages & Expenses

- Scroll to Rental properties and royalties, click Edit/Add or Start/Revisit

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Do you want to go directly to your asset summary?, click Yes and Continue

- Click Edit to the right of each asset to be disposed of/sold

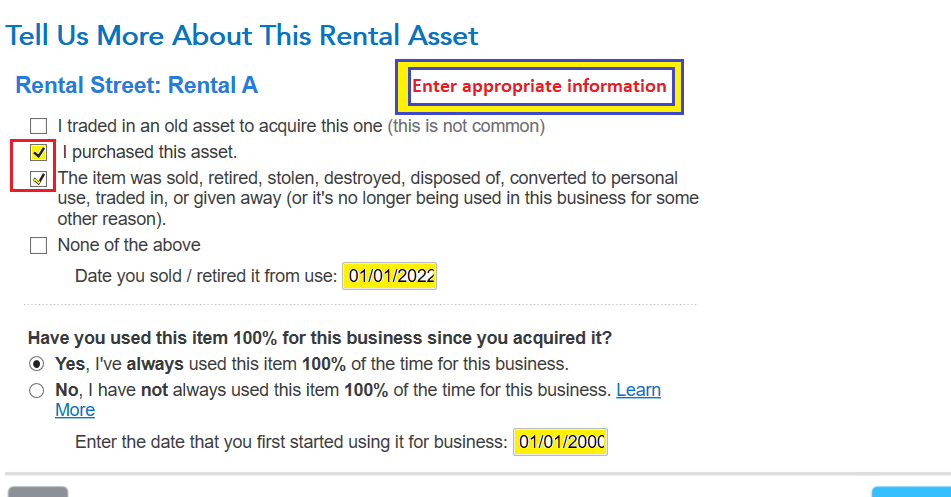

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold……. And continue to answer the questions

You might also review information here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

dkbrad

New Member

William--Riley

New Member

Idealsol

New Member

bill Pohl

Returning Member