- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Unable to enter Passive Losses from Prior Years for rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

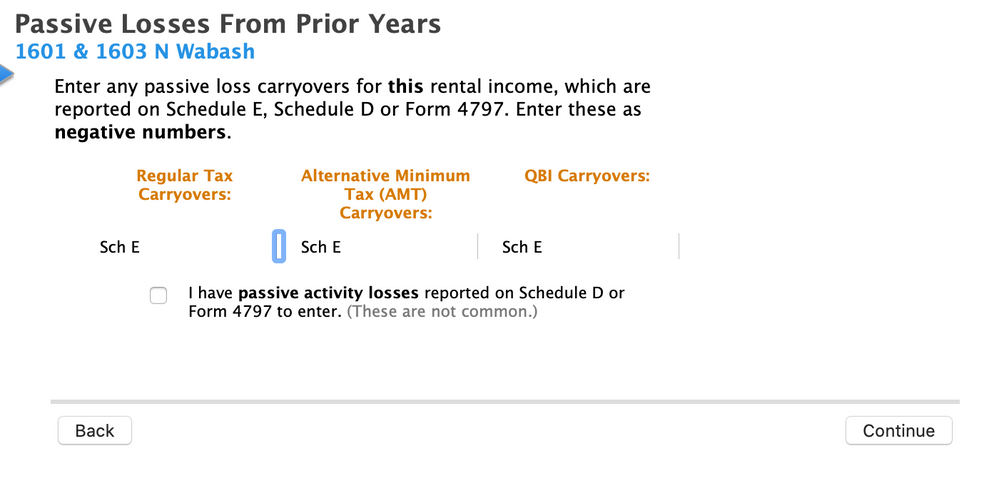

Unable to enter Passive Losses from Prior Years for rental property

See screen shot. TT is NOT allowing me to enter an amount of passive losses for prior years on the rental property. Is this a bug or am I doing something wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

If you used TurboTax last year, your Passive Carryover Losses for your Rental Property should already be entered for you.

Check Form 8582.

If not, here's how to enter Passive Loss Carryovers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

I have the same issue. The program will not let you physically enter it per the screen shot. The posted link is not the solution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

I downloaded prior years taxes which did not transfer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

You need to enter is as a negative amount, did you put a negative sign before the number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

this does not work!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

I have exactly the same image on my screen. Nothing goes in and nothing from last years Turbo Tax will carry over...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

As of March 24, 2020 I have exactly the same problem. Any solution yet? It's quite frustrating trying to determine the programming logic on my own. This should be straightforward, but it's not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unable to enter Passive Losses from Prior Years for rental property

If you converted the property from a rental to personal use in 2018 or before, and are converting it back to rental property in 2019, from my limited testing the program is incapable of dealing with this correctly. Not only on passive loss carry overs, but on prior depreciation already taken too.

Your new 2019 in service date is the problem. The program "thinks" this is the first time ever you have converted the property from personal use to rental property. Therefore from the program's perspective it's absolutely impossible for you to have anything to carry forward from a prior year.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

JMB011

New Member

taxquestion222

Returning Member

MellowStudent

Level 1

AS80

Returning Member

saalves2424

New Member