- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

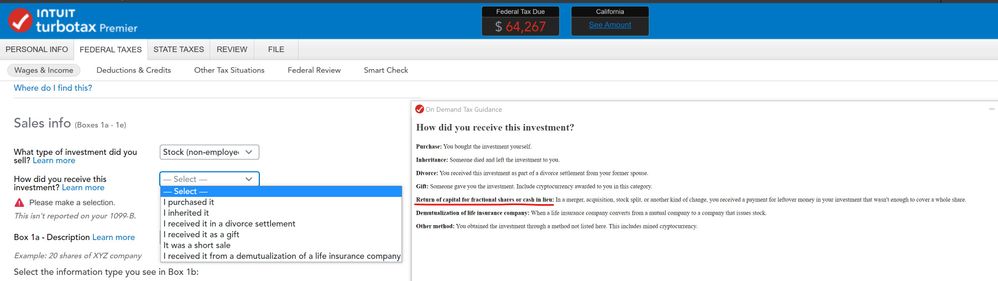

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

I had small amount of spin off stock that were sold by broker TD ameritrade due to very small amount.

On the tax return report, the turbotax asked me " how did u receive this investment,"

The learn more highlights told me to choose "Return of capital for fractional shares or cash in lieu: " However, the software did not include this choice in its droplist.

I can not proceed it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

THIS IS AN OBVIOUS BUG PLS FIX IT TURBOTAX! IT'S UNBELIEVABLE!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

You can select that you purchased the stock. The instructions below will help you with cost basis.

How to Report Cash in Lieu of Fractional Shares

- The IRS considers cash for a fractional share to be money received as the result of a stock sale.

- This transaction must be reported on IRS tax form Schedule D Capital Gains and Losses.

- The date of the sale (when cash was received) and the date of the original stock purchase is needed to complete the tax form.

Tax Basis Example: Assume a shareholder has an aggregate $100 basis in 50 shares of ABC stock ($2 per share), and the fair market value of one share of ABC stock is $66.65. Following the ABC Merger, the shareholder should have an aggregate $100 basis in 64.1 shares of ABC stock (50 shares x 1.2820, or $1.56 per share), and should be treated as having sold 0.1 shares of ABC stock with a tax basis of $0.156 ($1.56 x 0.1 shares) for $6.67 ($66.65 per share fair market value x 0.1 fractional shares).

Once you have your information you will complete the entry in TurboTax using the following steps.

- Open (continue) your return if it isn't already open.

- In TurboTax, search (upper right) > Type 1099B (include dash) Press enter > then select the Jump to link

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2021?

- If you see Here's the info we have for these investment sales, select Add More Sales.

- Answer NO to Did you get a 1099-B or brokerage statement for these sales?

- Follow the instructions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

I am having the same problem. Dang. What now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

I spoke a rep from turbotax and she said she could not provide any suggestion for this content but would report this bug to the technical support. Not sure if the turbotax will fix the bug. It is an obvious mistake by omitting the choice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

The bug in the instruction part. Your answer was about to find the 1099B for input, which did not address the question!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

I have this issue too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

You received cash in lieu of fractional shares. Getting your tax return to correctly report the transaction is what matters. Above @DianeW gave the correct instructions for how to report this income.

One team writes the learn more stuff while another team programs the computer. Our job is to get your return done, with everything in the right place.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

If you want to get the job done correctly, add cash in lieu to the drop down menu! Haven't you noticed your customers have been crying out loud for you to fix this problem for a few years now? Get your writers and programmers together to fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

the answer given no how to determine the cost basis of a "cash in lieu" is unworkable. I have no information of what was the original stock. There are no details in my 1099B that show that transaction. You need to come up with a better answer. This is a really big bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

In this country, most representatives just keep repeating what they are told of by some brief training program. It's very hard to reach some person who really knows what problem it is, much less how to fix it. That said, many customer service calls don't solve the problem but frustrate customers more. This happens across the board. I think this country really has some deep problem. I would put blame on our educational system. But anyways, this is life.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

unable to choose " Return of capital for fractional shares or cash in lieu: " on spinoff stocks

Amounts received for "cash in lieu" is almost always a small insignificant amount. There are two practical ways that you can deal with it. 1. Use a cost basis of zero and realize a capital gain for the amount of the cash in lieu. 2. Use a cash basis equal to the amount of the cash in lieu, which will result in no gain or loss. I have been told, but haven't verified, that when you receive cash in lieu, that 100% of the cost basis of the surrendered shares is applied to the whole shares of the new stock you received, which leaves the fractional shares for which you receive cash in lieu with a zero basis. Either way, the IRS isn't going to question it. I've been using a zero cost basis, it may not be the correct basis, but it's not incorrect to use it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sts_66

Level 2

sts_66

Level 2

sandysl010999

Returning Member

sandysl010999

Returning Member

tizianadipucchio

New Member