- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TurboTax mistakenly shows one of my rental properties as NONPASSIVE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Hi. I am filing my 2021 tax using TurboTax Home & Business 2021. TurboTax is mistakenly showing one of my rental properties as NONPASSIVE instead of PASSIVE on the California FTB 3801 worksheet, thus that property is not being shown on the Passive Activity Loss Limitations form (Form 8582) and I am losing out the allowed loss from this property.

The few other rental properties that I own are correctly showing as PASSIVE on the California FTB 3801 worksheet and are being shown on the Passive Activity Loss Limitations form (Form 8582).

Any idea how to correct that? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Take a look at the number of days rented and the number of personal use days. If the number of personal use days is greater than 14 or 10% of the days rented at fair rental value, then the activity is deemed to be non-passive.

You will need to review these entries in the Federal rentals section of your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Hi. This property was rented 100% of the time with zero personal use days, just like my other few rental properties. For some reason this property is the only one that says NONPASSIVE, while the other ones say PASSIVE. Any idea why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

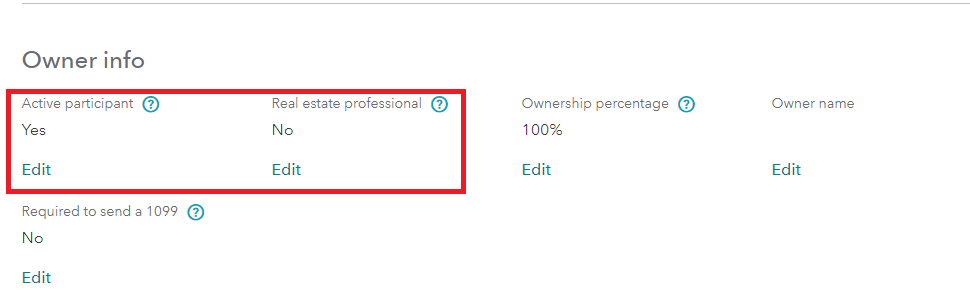

Yes. Look at the property information to see how you answered your questions. You should say yes to 'Active Participation' and No to 'Real Estate Professional'

- Search (upper right) > rentals > Click the Jump to... Link > Edit beside your rental activity > Edit beside Rental Property Info

- Or if using TurboTax CD/Download Edit beside Property Profile

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Hi. Yes that is what I have: Yes to Active Participant and No to Real Estate Professional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

You seem to have entered everything accurately. You may have a computer loop and need to clear you cookies, history, cache' an reboot. This can clear up any computer loops.

Cookies are small files that temporarily store data on your computer. We use them to personalize your experience so you see information you already entered and not items that are irrelevant or repetitive.

On rare occasions, they may make your browser think you already did something that you still need to do. To fix that, you'll need to delete (clear) the cookies from your browser.

Each browser has a slightly different method for deleting cookies. Choose the browser you're using:

- Internet Explorer

- Mozilla Firefox

- Google Chrome

- Safari

- Safari for iOS (mobile devices)

If this does not work, you may have to delete and re-enter this property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Did you accidently mark it as a rental of "land" or as a "self rental"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

I am using the Desktop version, not the online version, so I am pretty sure the issue is not because of the browser's cookies / history / cache.

If there is a solution I would rather not deleting and re-entering this property, as I have years of past carryovers and data on this property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Nope I did not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Go into the "Forms" and look at the "Schedule E Wks" for that property

Compare the top of that worksheet (with the check boxes, number of rental/personal days etc) with one of the other "Schedule E Wks" for a different property. Is there anything different between the two? If so, what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

The top of "Schedule E Wks" for that property is exactly the same as "Schedule E Wks" for the other properties:

. 365 days rented

. 0 days of personal use

. C Active Participation

. H Complete taxable disposition

. No for I thru M

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

@man21 wrote:. H Complete taxable disposition

So you sold this property? That releases the passive losses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax mistakenly shows one of my rental properties as NONPASSIVE

Yes this is one of the 3 properties I sold in 2021, but this is the only one that says NONPASSIVE on the California FTB 3801 worksheet and is not being shown on the Passive Activity Loss Limitations form (Form 8582). The other 2 that I sold in 2021 say PASSIVE on the California FTB 3801 worksheet and is being shown on the Passive Activity Loss Limitations form (Form 8582).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DallasHoosFan

New Member

RuffyK

Level 2

Edward Torgersen

Level 1

Charles414

Level 2

Stephen-H-AuYeung

New Member