- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Taxes on Rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

We have condo that we converted from a primary residence to rental property in 2013.

We never had any positive cash flow. We could never deduct passive losses because our income was too high. We have $42,000 in accumulated passive losses.

Assuming a purchase price of $205,000 and sales price of $260,000, what would our tax liability be (factoring depreciation)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

We never had any positive cash flow.

That's common "on paper" at tax filing time. Typically, when you add up the deductions of property taxes, mortgage interest and insurance along with the depreciation you're required to take, those four items alone almost always exceed the total rental income for the year. Add to that the other deductible rental expenses (repairs, maintenance, etc.) and you're practically guaranteed to show a loss "on paper" at tax filing time.

We could never deduct passive losses because our income was too high. We have $42,000 in accumulated passive losses.

Again, not uncommon.

Assuming a purchase price of $205,000 and sales price of $260,000, what would our tax liability be (factoring depreciation)?

You're asking a question with no definitive answer. It depends on to many other factors to numerous to list here. For example, your total income from all sources for the entire tax year. Basically, your tax liability on the rental is your cost basis, minus depreciation, and subtract that total from your sales price. While that will get you close to your taxable gain, keep in mind that recaptured depreciation is taxed as ordinary income anywhere from 0% to a maximum of 25%, depending on your overall AGI. The gain on the sale will be taxed at capital gains tax rates which again, is dependent on your overall AGI.

Typically, if you put 20% of your total gain aside for taxes, you'll be fine. If your total income after the sale will be more than $160k then you might want to put 25% of your gain aside. Keep in mind this is for federal taxes. If your state taxes personal income then you'll probably want to allow extra for state taxes too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

The passive losses that have been accumulating will be released in the year of sale and will be an expense on the Sch E line 18 which will basically balance off the depreciation recapture.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

Thank you. When you say "balance off," do you mean deduct from? I have read in various places that you can deduct your passive losses when you sell the property, but I am never sure what they are being deducted from. Concretely, I estimate my total depreciation over 10 years to be about $75,000, would my passive losses ($42,000) be subtracted from that to calculate my depreciation recapure, or would it be deducted from the sales price prior to calculate my capital gains?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

@PaulEman wrote:

I estimate my total depreciation over 10 years to be about $75,000, would my passive losses ($42,000) be subtracted from that to calculate my depreciation recapture.....

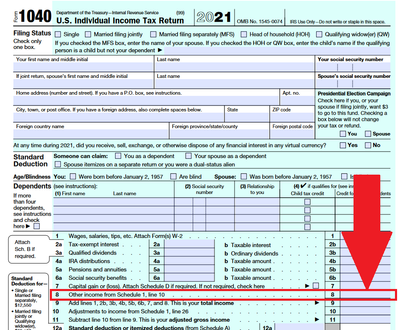

It is not necessarily a dollar-for-dollar deduction solely from your recapture amount. The ($42,000) gets entered on Schedule 1 and then appears on Line 8 of your 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

On the return you will have the passive loss on the Sch E which will show a loss on the Sch E and then the depreciation recapture will show as positive income on the form 4797 so they do not directly negate each other on the same form but they do offset each other overall.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxes on Rental property

Thank you!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

huntinad

Level 1

tiffanilyons82

New Member

knownoise

Returning Member

mpiseter

New Member

Ashleej828

New Member