- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- State Level K1 (GA) - Am I entering this the right way on TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Level K1 (GA) - Am I entering this the right way on TurboTax?

Hello TurboTax Community,

Seeking your help in checking to see if I am entering my Georgia K1 on TurboTax correctly.

Quick background:

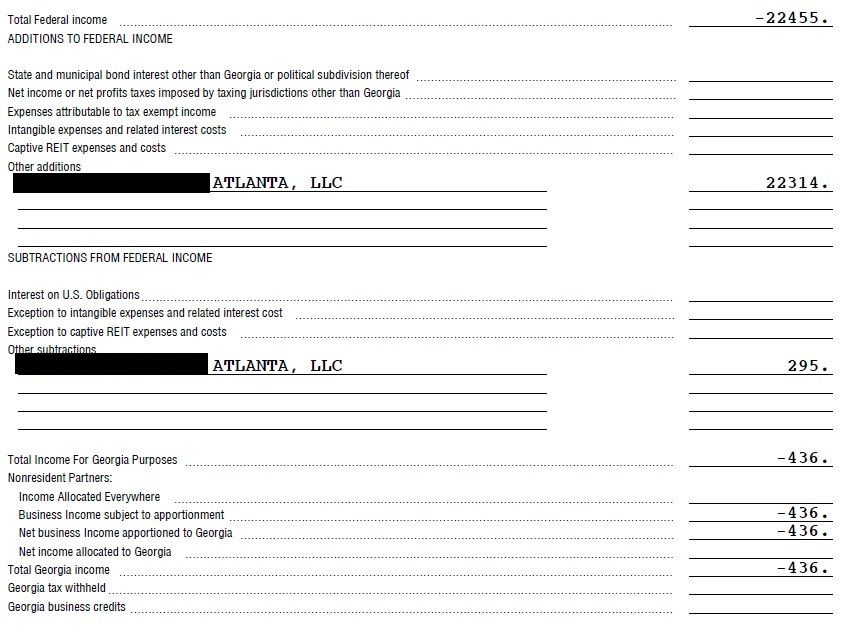

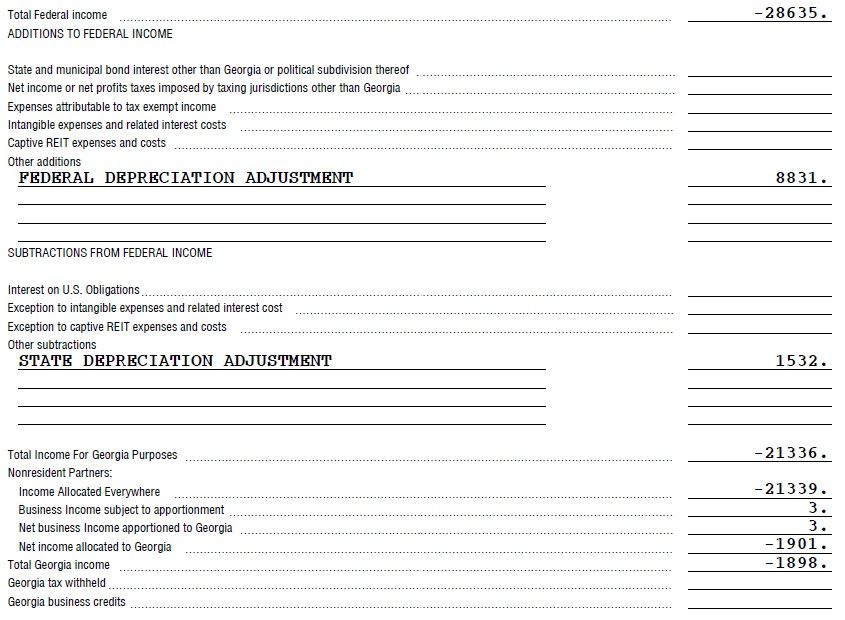

I am a limited partner in two real estate syndication funds that invest in multi-family apartments in Georgia. I received both GA K1s below. I am trying to enter the info on TT but wasn't sure if I am doing it correctly.

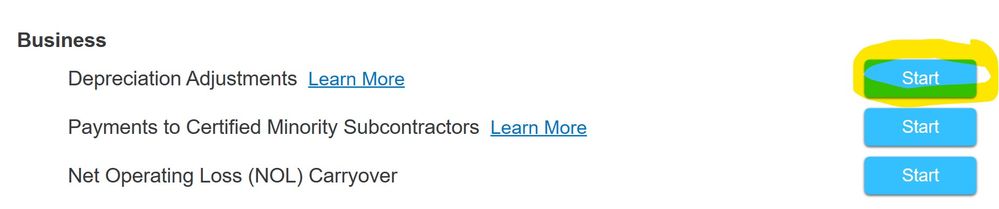

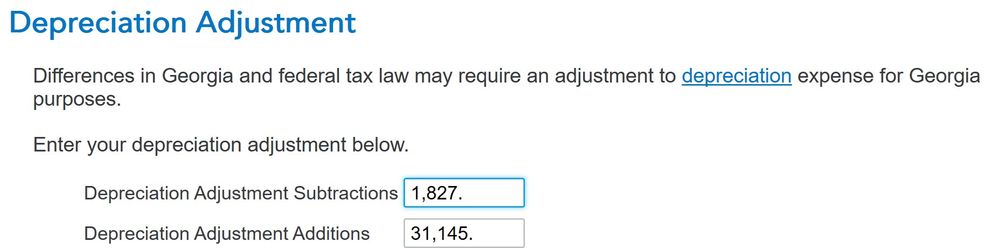

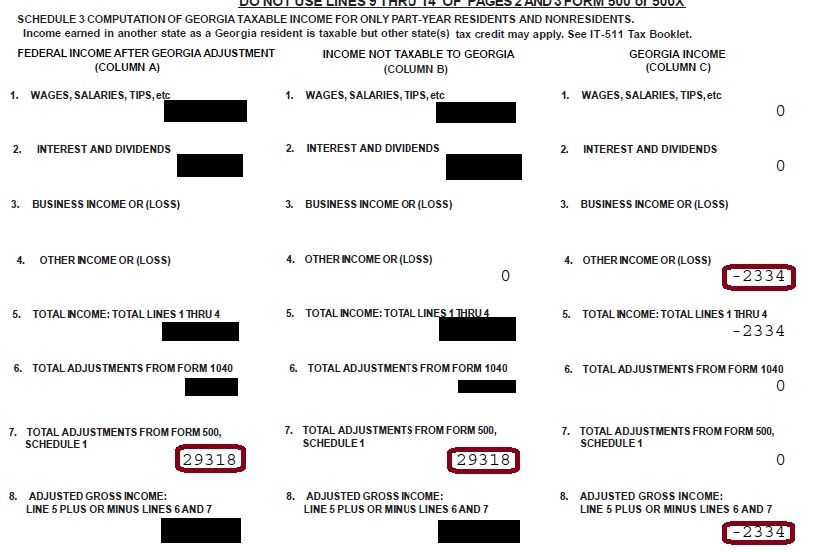

I tried playing with the depreciation adjustments (additions/subtractions) using the form below. But looks like it is adding it/subtracting it against my W2 federal income (Total Additions 8831+22314 = 31145; Total Subtraction1532+295=1827; Net adjustment = 29318). My understanding is that this should NOT be the case since I am just a limited partner. Passive loss cannot offset my W2 income and I don't materially participate.

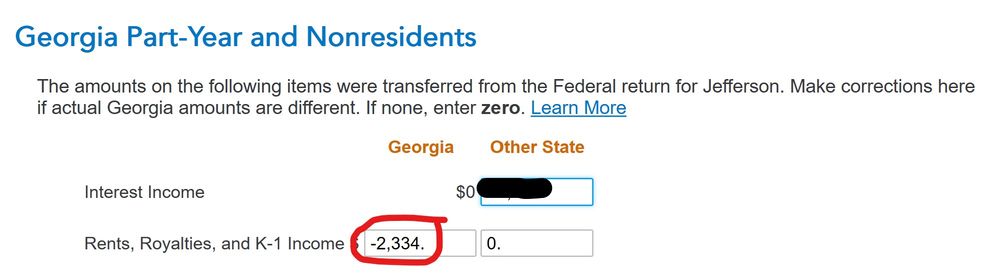

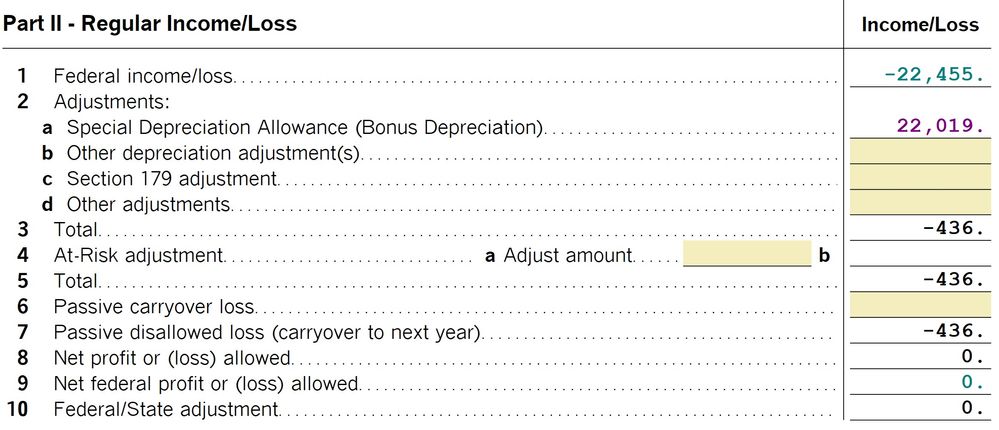

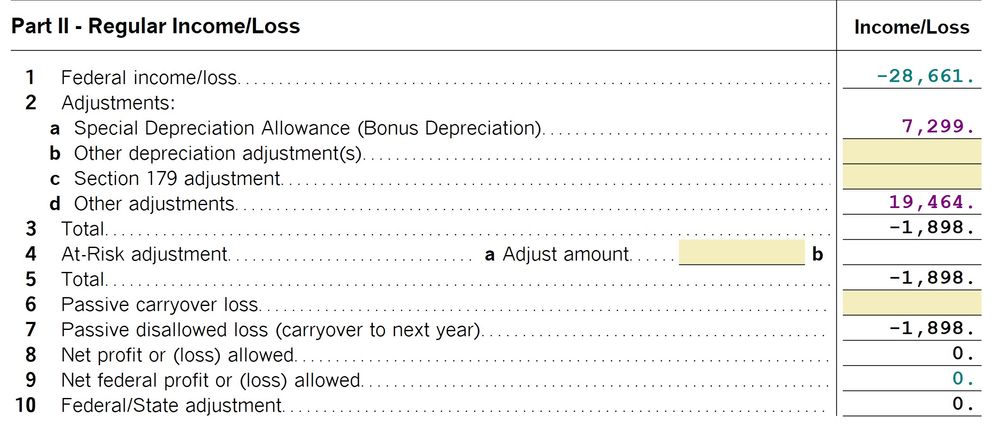

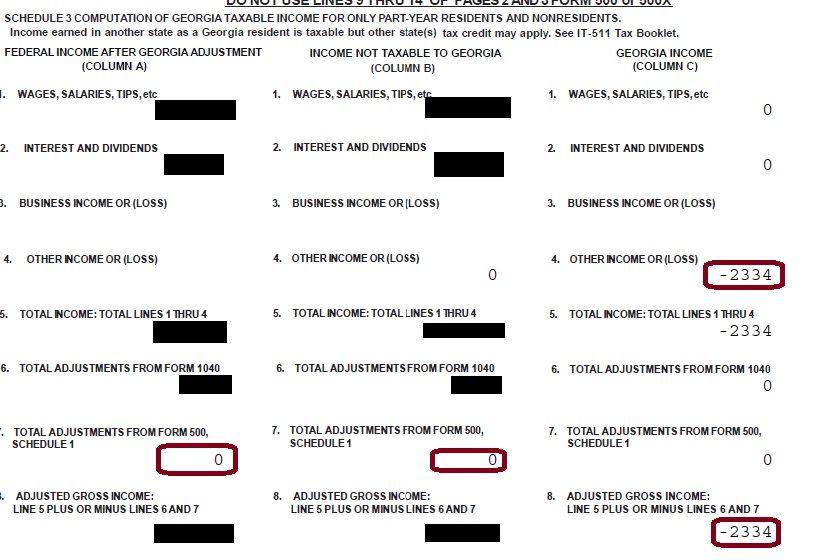

Do we really need to record these depreciation adjustments? I was thinking the adjustments on the K1s are just an FYI. What matters is the last line Total Georgia Income on the K1, which in this case is -436 and -1898 (totals to -2334). I recorded this amount using the form below and it appears in the Georgia Income column above.

I tried recording the adjustments in the GA K1 activity worksheet instead as shown below.

Then remove the adjustments on the earlier form so it won't add to my income.

Am I doing this correctly?

I am filing GA right now to record the loss (-2334) from the two K1s so that I can offset it against any gain in the future when we exit the deal.

Appreciate any feedback you can provide.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Level K1 (GA) - Am I entering this the right way on TurboTax?

The bottom line is the only information that you really need for Georgia since the depreciation adjustment is just how you get there and the state already has a copy of the K1 for matching against your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Level K1 (GA) - Am I entering this the right way on TurboTax?

Hello TurboTax Community,

Appreciate any help/guidance you can provide on this topic.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Level K1 (GA) - Am I entering this the right way on TurboTax?

The bottom line is the only information that you really need for Georgia since the depreciation adjustment is just how you get there and the state already has a copy of the K1 for matching against your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Level K1 (GA) - Am I entering this the right way on TurboTax?

Thanks @RobertB4444!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

brad-dunphy

New Member

Irasaco

Level 2

npcollins13

New Member

jcd8852

New Member

RonnieC14

New Member