- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State Level K1 (GA) - Am I entering this the right way on TurboTax?

Hello TurboTax Community,

Seeking your help in checking to see if I am entering my Georgia K1 on TurboTax correctly.

Quick background:

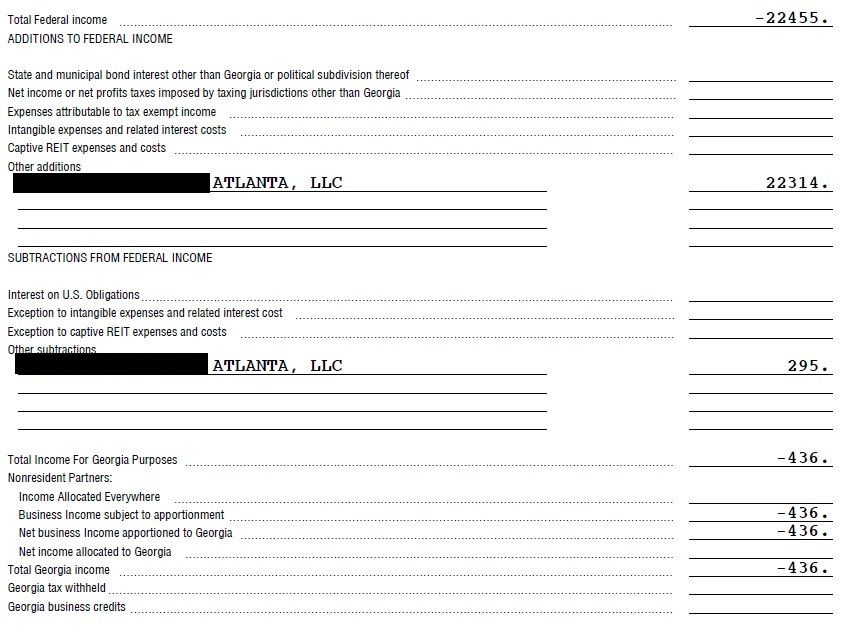

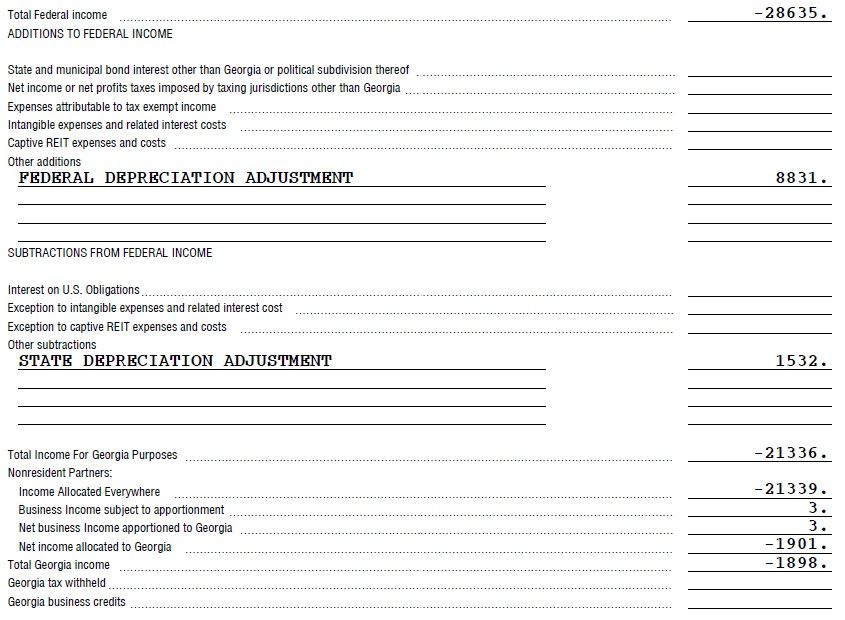

I am a limited partner in two real estate syndication funds that invest in multi-family apartments in Georgia. I received both GA K1s below. I am trying to enter the info on TT but wasn't sure if I am doing it correctly.

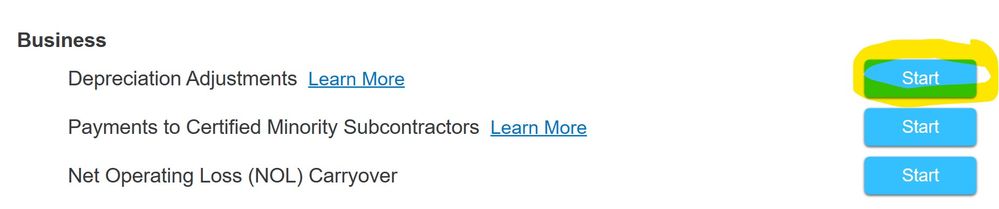

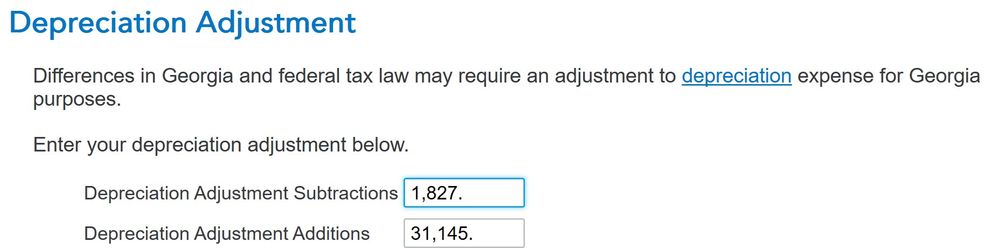

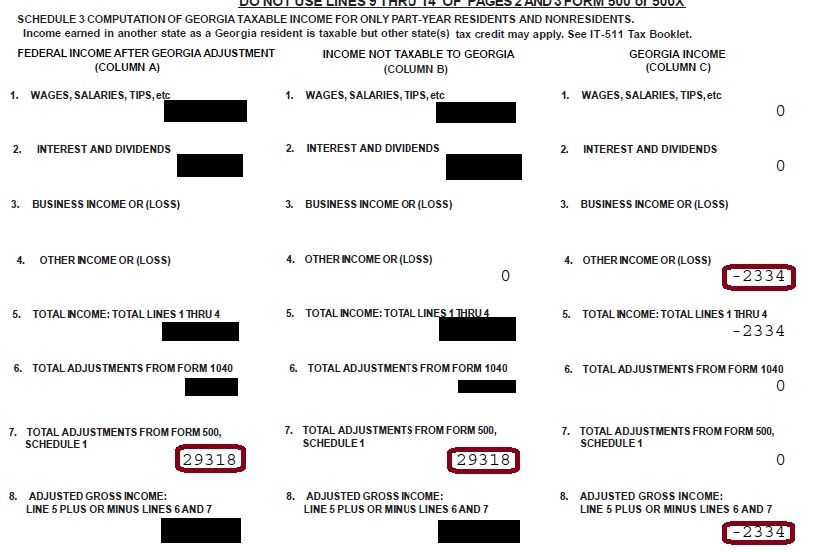

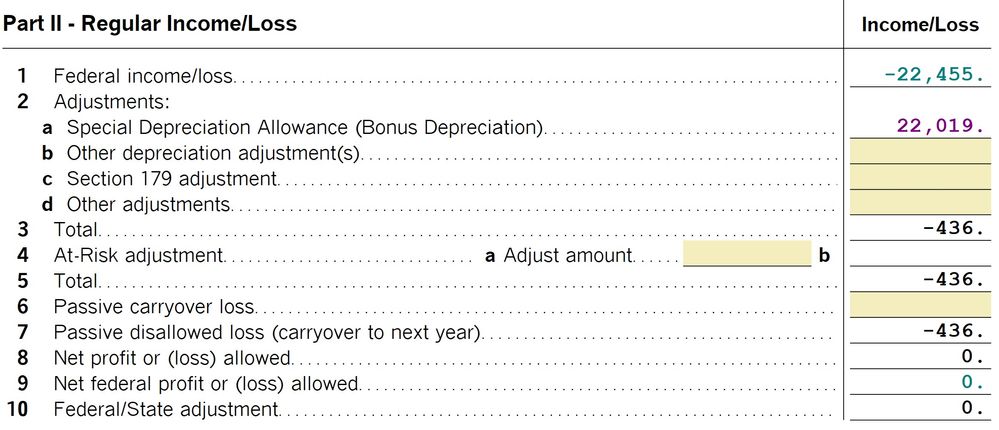

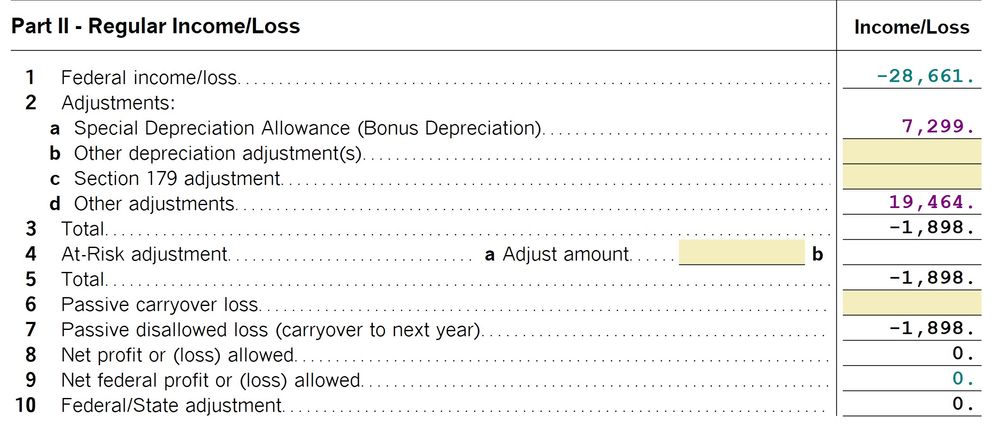

I tried playing with the depreciation adjustments (additions/subtractions) using the form below. But looks like it is adding it/subtracting it against my W2 federal income (Total Additions 8831+22314 = 31145; Total Subtraction1532+295=1827; Net adjustment = 29318). My understanding is that this should NOT be the case since I am just a limited partner. Passive loss cannot offset my W2 income and I don't materially participate.

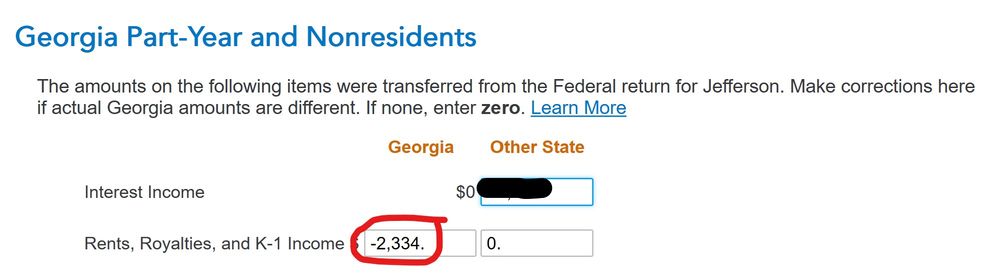

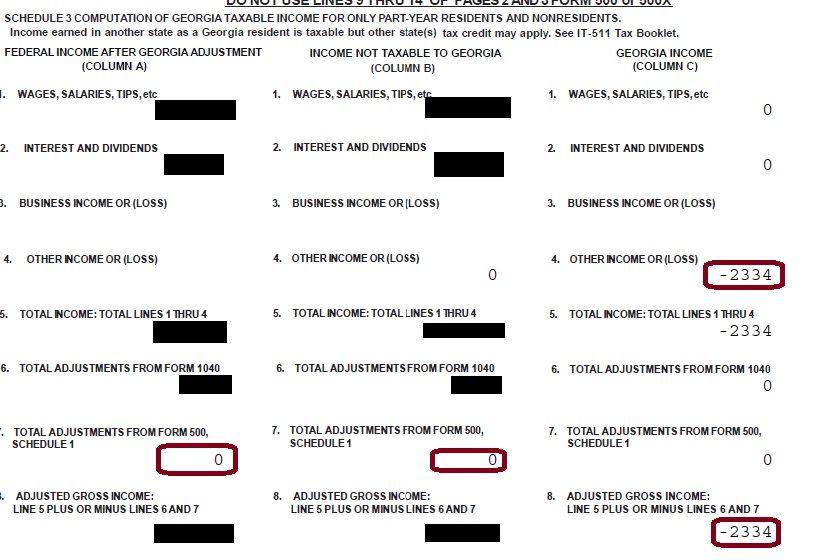

Do we really need to record these depreciation adjustments? I was thinking the adjustments on the K1s are just an FYI. What matters is the last line Total Georgia Income on the K1, which in this case is -436 and -1898 (totals to -2334). I recorded this amount using the form below and it appears in the Georgia Income column above.

I tried recording the adjustments in the GA K1 activity worksheet instead as shown below.

Then remove the adjustments on the earlier form so it won't add to my income.

Am I doing this correctly?

I am filing GA right now to record the loss (-2334) from the two K1s so that I can offset it against any gain in the future when we exit the deal.

Appreciate any feedback you can provide.

Thanks!