- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Schedule E less than 14 days

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Hello,

I rented my personal home (I lived in .362 days), but rented to a business for 13 days in 2023. The business issued me a 1099-MISC for the rental income. I have entered the 1099-MISC in TurboTax as rental income and it created a Schedule E for me. Since this is a rental of my personal home for less than 15 days, the IRS pub 527 says not to report the income and to not complete a Schedule E. However, I feel I must report the 1099-MISC income. Most advice I have seen in similar situations it to complete the Schedule E, but to back out the income with a statement such as "AUGUSTA EXEMPTION 280A(G)". TurboTax though will not let me enter the "days rented at fair rental value" as 13 and "days of personal use" as 362. Either the days rented needs to be greater than 15 or the personal use needs to be less than the days rented. How do I correct this error?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

You could enter it as miscellaneous income and then make an immediate offsetting entry for the same amount (negative entry). Use the minus sign for the latter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Yes, I can negate the income to $0, but it forces me to state the rental days are >15 or if I keep the rental days at 13 (which is actual), then my personal days must be less than that amount (which is not true).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Remove the Sch E that you are working on completely then enter the income another way ... do NOT enter it in the 1099-misc section ... that is only taking you down a black hole.

- Down the left side of the screen, click Federal.

- In the center of the screen, click Income & expenses.

- On the screen Your income and expenses, scroll all the way down to the last section, Less Common Income.

- Click the Start or Update button for the last topic, Miscellaneous Income, 1099-A, 1099-C.

- On the next screen, Let's Work on Any Miscellaneous Income, scroll down and click the Start or Update button for the topic: Income from renting out personal property.

- Enter the rent received in both boxes for both the income and expenses ... this will put the income on line 8l and the expenses on line 24b on the Sch 1.

- On the next screen click Done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Ok, thank you. I actually thought about that too, but my only question is that Income from renting out personal property says it is not for rental real estate. You think that is still OK? Will the IRS flag my return because they do not see the 1099-MISC rental income on a Schedule E?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

No, you are not required to report rental income from real estate if the days rented is less than 15 days. This will not flag your tax return for the IRS. Keep the 1099-MISC in your tax file with any documentation showing you did not rent for more days in 2023. You have it if you need it later should there be questions.

- Used as a home but rented less than 15 days. If you use a dwelling unit as a home and you rent it less than 15 days during the year, its primary function isn’t considered to be rental and it shouldn’t be reported on Schedule E (Form 1040). You aren’t required to report the rental income and rental expenses from this activity. Any expenses related to the home, such as mortgage interest, property taxes, and any qualified casualty loss, will be reported as normally allowed on Schedule A (Form 1040).

- IRS Publication 527

You are confused about 'Personal Property' versus 'personal use'. Personal use can occur in either personal property or real property. There is a big difference in tax lingo, see the definition below.

- Personal Property = Any property that is not real property which is real estate - residential or nonresidential. This includes everything that is not real property, examples would be a bicycle, a lawn mower, equipment, etc.

- Real Property - Land, buildings and their structural components.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

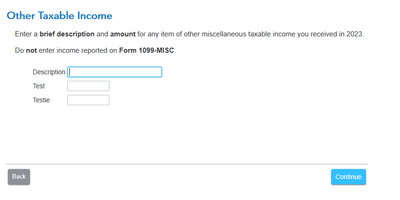

You can type anything you want as a description (e.g., income from rental less than 15 days or Section 280A(g) income).

[I think you can safely disregard the warning re 1099-MISC]

An alternative would be to not report the income at all. If you are ever contacted by the IRS, a simple explanation is available to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Since a 1099 should not have been issued this is the only clean way to report the income yet negate it as well. If the IRS was ever to question it then you can explain it then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Thanks for all the advice. I understand this is an unusual situation where is it clear I do not have to report the income (Pub 527), but I have received a 1099-MISC for that income. I feel like NOT reporting it will immediately draw a reaction and question from the IRS. Yes, I do have a valid explanation, but would rather not even get the inquiry. So, I will report the income so it doesn't look like I am ignoring it. The question is the best way. It can either be with a Schedule E and just say my rental days are 365 (or 13) and personal days 0 and net the Schedule E to $0 with an explanation of using the Augusta Exemption 280A(g) or putting it in miscellaneous income with a description explaining why it is not on Schedule E. I think since the 1099-MISC uses box 1 (Rents) my best bet would be to use the Schedule E and net it to zero. The only thing inaccurate is having the personal days as 0. I still may be questioned, but it would likely not be as automatic as not including the income as Pub 527 suggests. Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Do what you feel comfortable doing. If the IRS questions it later then you have your explanation ready.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Ok Critter, I didn't see your last response before sending mine. Maybe you are right. If the $ amount in box 1 (Rents) does not automatically mean real property but would also be used to report personal property rental, then maybe that is the best solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E less than 14 days

Either one, @shafer92:

Box 1. Report rents from real estate on Schedule E (Form 1040). However, report rents on Schedule C (Form 1040) if you provided significant services to the tenant, sold real estate as a business, or rented personal property as a business.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

hopiegirl

New Member

annienni2011-gma

New Member

talinb78

New Member

joelrose909

New Member

lrobertsgandy

New Member