- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Sale of rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

Thanks so much for your detailed info. Diane. I am unable to find the section to fill in the land cost in the rental property under the sale of asset section. All I could find was the sale price and sales expense for the rental property. Please advise! Thanks again!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of rental property

You should sell the land outside of the rental asset using the instructions provided and placed here. It does not need to be entered in the rental asset since it may not be included there.

The instructions for selling the land outside of the rental asset for the rental home can be done as follows:

- Wages & Income at the top

- Scroll down to Other Business Situations

- Select Sale of Business Property

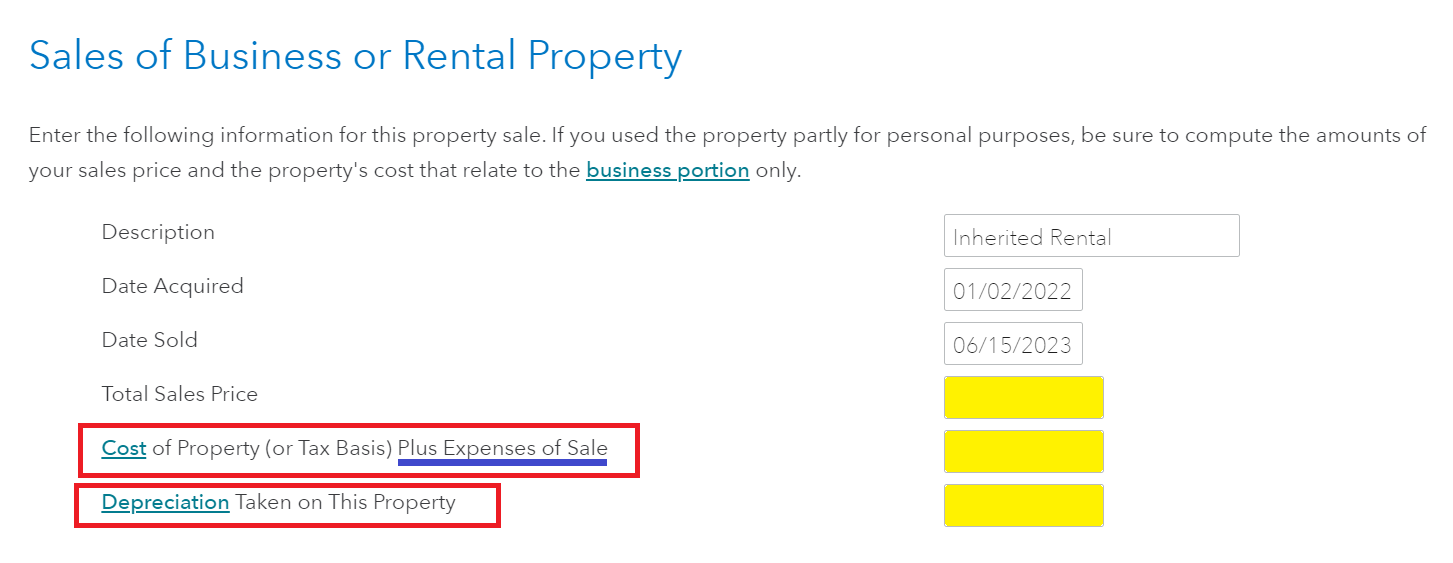

- Select Sales of business or rental property that you haven't already reported.

- Answer 'Yes' to Do all of the following apply...?

- Enter your sales information, do not make an entry for depreciation (no zeros)

- Cost of land ($150,000),

- Sales Price/Sales Expenses for Land portion only

- Use the land cost divided by the total cost of the property to arrive at the percentage for sales price/expenses attributable to the land. This assumes you used a prorated amount for the sale of the building asset.

- Date acquired and date sold

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

William--Riley

New Member