- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Replacing HVAC in Rental, but still depreciating HVAC from 10 years ago

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Replacing HVAC in Rental, but still depreciating HVAC from 10 years ago

Hello, I replaced the HVAC in my rental property in 2023, but I'm still depreciating the previous HVAC (as a separate item from the property itself) that was replaced 10 years ago. I know how to enter the new HVAC as a depreciated item (for 27.5 years). My question is what do I do about the previous HVAC? Do I keep depreciating, since I did not get to depreciate the entire amount (whoever came up with 27.5 as a "usable life" for HVAC must have been on some good stuff)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Replacing HVAC in Rental, but still depreciating HVAC from 10 years ago

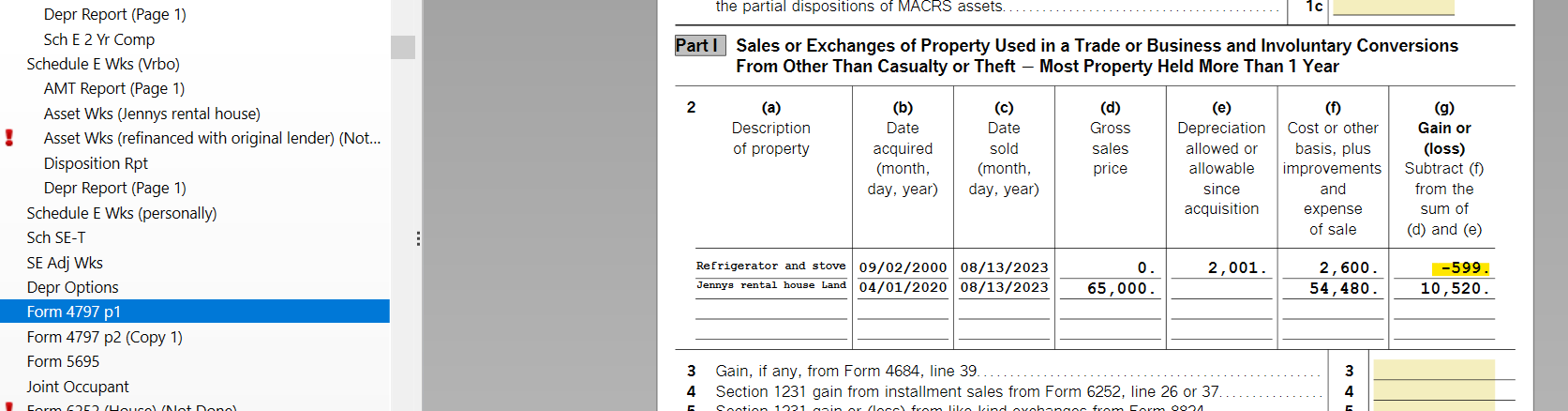

Follow these steps to recoup the remainder:

- Go to your summary asset screen

- Select the retired HVAC unit

- You will want to mark that you disposed of the asset.

- Confirm prior depreciation

- Special handling? select No

- Sale information, enter sales price $0, unless you sold it for more

- This will allow you to take the rest of the amount now.

- You will see the loss on the asset worksheet, and the disposition report the most clearly. For tax purposes, he Form 4797 will show the report.

Here is an example from a fake return using appliances.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Replacing HVAC in Rental, but still depreciating HVAC from 10 years ago

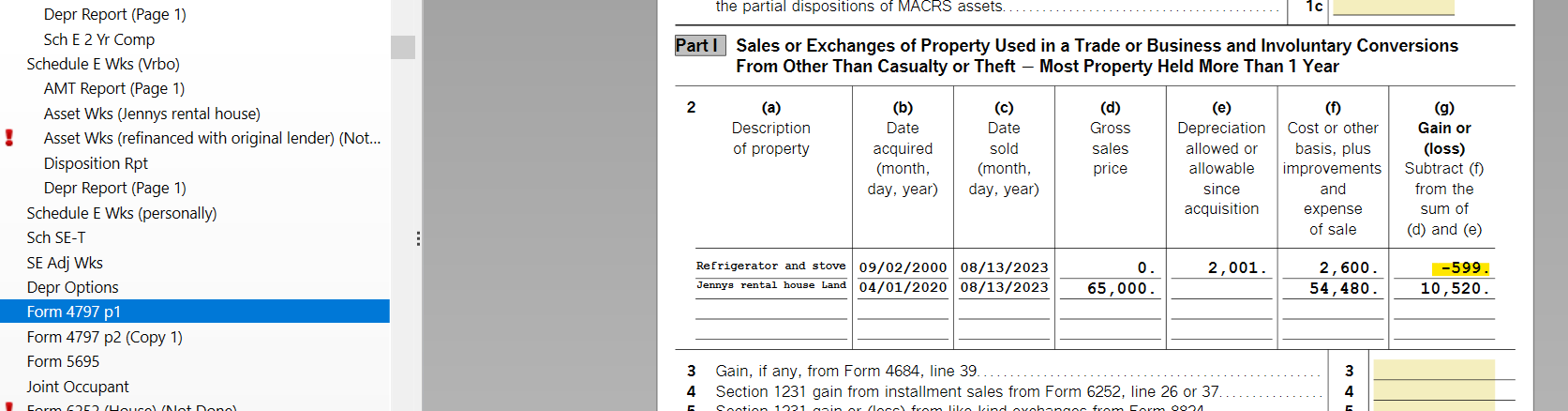

Follow these steps to recoup the remainder:

- Go to your summary asset screen

- Select the retired HVAC unit

- You will want to mark that you disposed of the asset.

- Confirm prior depreciation

- Special handling? select No

- Sale information, enter sales price $0, unless you sold it for more

- This will allow you to take the rest of the amount now.

- You will see the loss on the asset worksheet, and the disposition report the most clearly. For tax purposes, he Form 4797 will show the report.

Here is an example from a fake return using appliances.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PeehPooh17

New Member

mitlm1

Level 2

Roseleena

Level 1

eric_d_flaim

New Member

erikgandhi

New Member