- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Rental property conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

I converted my rental property to personal use Nov 1 of 2021 and TT comes up with a different number for allowable depreciation expense on my sch E work page than what I would expect 303/364 of 12 months of SL depreciation. TT applies a "vacation home loss limitation", but I cannot find where this is calculated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

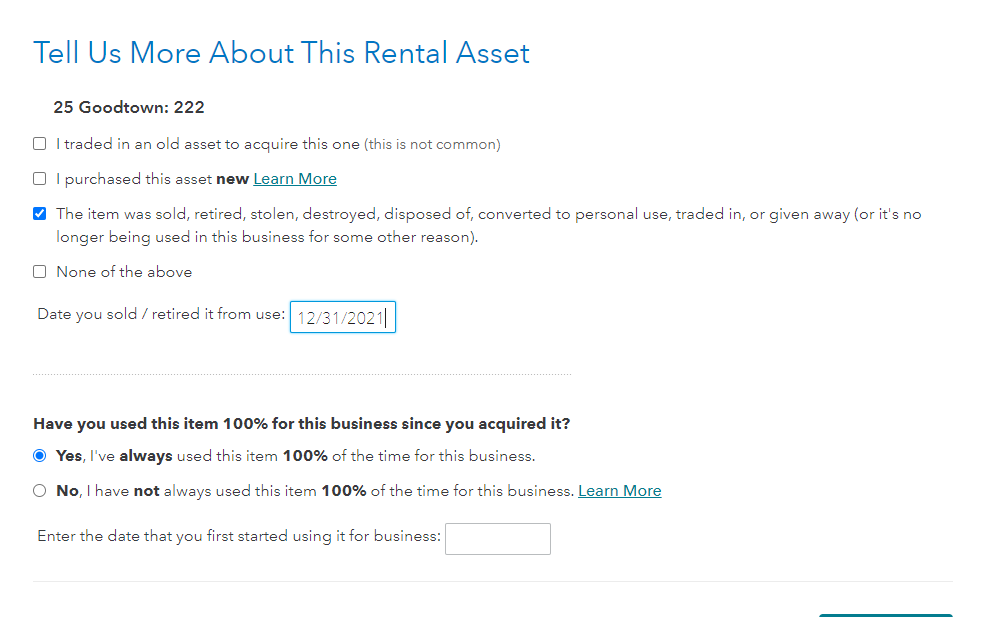

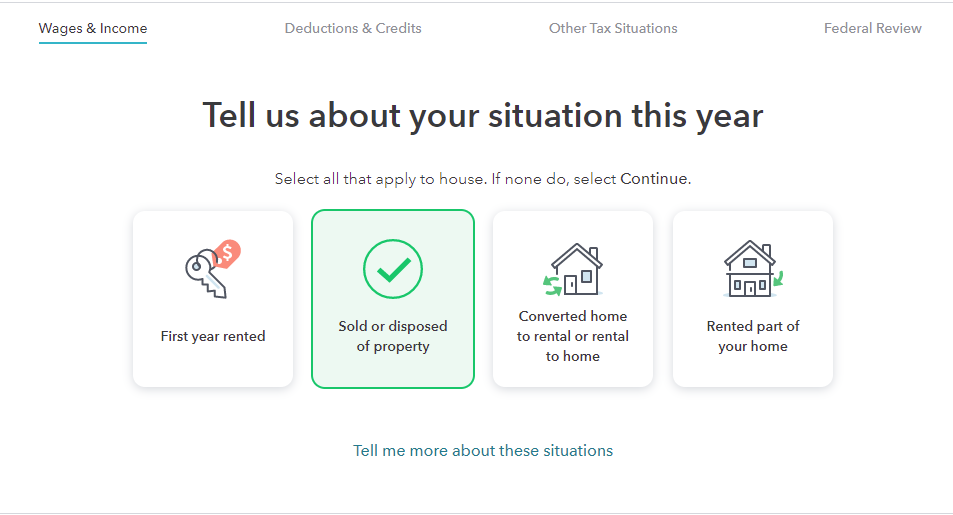

Make sure that you have indicated the conversion and that you have answered the following questions correctly. The first screenshot shows the conversion and the date. The second offers an option for the conversion.

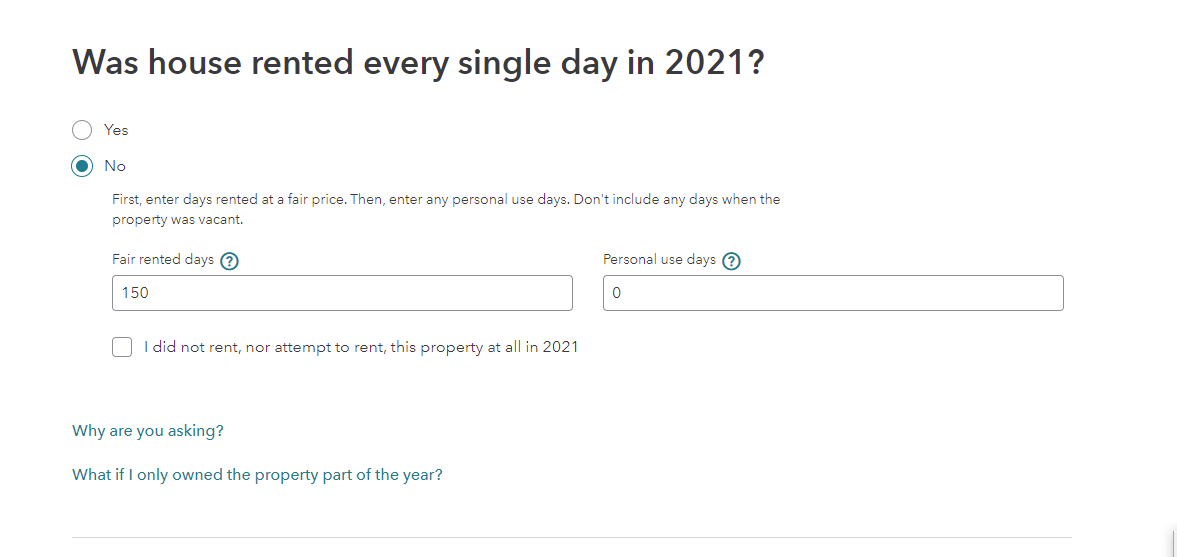

In this last screen, enter zero personal days.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

If you did not have a vacation home, you entered something wrong. You need to indicate that you converted to personal use. Once you do that, it ceases to be rental property. There is no comingled useage.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

I converted my rental property to personal use Nov 1 of 2021 and TT comes up with a different number for allowable depreciation expense on my sch E work page than what I would expect 303/364 of 12 months of SL depreciation.

303/364 is the wrong math. When it comes to the IRS, if it's easy you did it wrong. That's now how depreciation works. For rental property, the mid-month convention is used. See IRS Publication 946 and use the worksheet on page 37. For line 6 of the worksheet, Table A-6 on page 72 applies.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

Maybe this is clearer:

Converted property to personal use Nov 1, 2021

Schedule E Wks

Column A, 12 months calculated depreciation $14,747

Column C (reported on Schedule E) $1,165

Column D (vacation Home Loss Limitation) $13,582

My question is, where is column D calculated in TT and why is it not based on days of use like all other schedule E expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

TT and I guess the IRS seem to conflate vacation home and personal use as one and the same in regard to schedule E depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

For starters, there is no Column D on the SCH E. But maybe it's because you accidentally skipped column B? Or more than likely you're referring to one of the worksheets.

Work through the property profile section again. Two or 3 screens in it asks "What Type of Rental Is This?"

More than likely, you have incorrectly selected the option for "vacation or short term".

Then on the next screen, "Do any of these situations apply to this property?" you should only have two things selected.

- 2021 was the first year I rented this property

- I converted this property from personal use to a rental in 2021

For "Was this property rented for all of 2021?" Select YES. I'll say it again so there's no doubt I did not mess up. Say *Y*E*S* this property 'WAS" rented for all of 2021.

Later when asked, for days rented select "THE WHOLE YEAR and if asked, days of personal use is "ZERO". It's asking for days of personal use *AFTER* you converted it to a rental. What you used it for before you converted it to a rental does not count for anything, anywhere on your tax return. Ever.

The program will "know" when to start depreciation based on the fact that you physically entered an in service date of 11/1/2021

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

I think I clearly stated I was referring to Schedule E Wks (worksheet) when referencing column D

The property has been a long-term rental purchased in 2011 and retired from service 11/1/2021.

My question still is unanswered, why is TT imposing a vacation home loss limitation (column D Sch E Wks line 18A) and where in TT is this loss limitation number calculated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

Make sure that you have indicated the conversion and that you have answered the following questions correctly. The first screenshot shows the conversion and the date. The second offers an option for the conversion.

In this last screen, enter zero personal days.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property conversion

I found my error and I suspect it is a common one for those with a like situation. I had entered the 61 days after conversion as personal days use when it should have been o days (as you pointed out). Thanks for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

ramseym

New Member

DallasHoosFan

New Member

eric6688

Level 2

alvin4

New Member