- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Recapture depreciation on sale of rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

I sold my rental of 8 years in 2023. I enter the information on the business section "sale of business property". But, TurboTax doesn't automatically recapture the depreciation of $32K that I claimed over the 8 years. It did everything else correctly by calculating my capital gain. Can someone walk me through the process, with screenshot if possible.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

If the property was still classified as a rental when you sold it, then you should report the sale in the SCH E section of the program. Only then will depreciation recapture be automatic.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2023". Select it. After you select the "I sold or otherwise disposed of this property in 2023" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even if it's zero. Then you MUST work through the "Sale of Property/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1 on some assets. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1 on some assets.

Basically, when working through an asset you select the option for "I stopped using this asset in 2023" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

I don't qualify for a live it. This property has always been a rental property. I follow the below video and it deduct the depreciation from the cost basis and treat it as a capital gain, which I don't think is accurate.

How To Calculate Gain | Sale of Rental Property | TurboTax (youtube.com)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

@TaxInCal wrote:it deduct the depreciation from the cost basis and treat it as a capital gain, which I don't think is accurate.

Why do you think it is not accurate? That sounds right to me.

The gain due to depreciation is a Capital Gain, but it is a special kind of Capital Gain that is taxed at ordinary tax rates, up to 25%. That gain due to depreciation should show up on line 19 of Schedule D.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

First remove the sale entry in Sale of Business Property. Please use and follow the steps below to let TurboTax know you have sold all of the assets for your rental property.

Use the original cost of each asset listed on depreciation, add those together then divide each one by the combined total to find the percentage of the cost for each asset. Use that percentage times the sales price and sales expenses to find the selling price/sales expenses for each asset. (Choices would also be fair market value on the date of the sale or adjusted basis on the date of the sale, which is cost less depreciation.)

Example: Original Cost (of each asset on your depreciation schedule)

$10,000 Land = 13.33%

$50,000 House = 66.67%

$15,000 Improvements = 20%

$75,000 Total = 100%

Multiply each percentage times the sales price/sales expenses to arrive at each individual sales price/sales expense.

I hope this example provides clarification to enter your sale. If you have not used TurboTax, enter each asset exactly as it appears on your prior year return.

You need to dispose of the property by telling TurboTax how and when it was disposed of (sold). Follow the instructions below.

- Click on Wages & Expenses

- Scroll to Rental properties and royalties, click Edit/Add or Start/Revisit

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Do you want to go directly to your asset summary?, click Yes and Continue

- Click Edit to the right of each asset to be disposed of/sold

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold……. And continue to answer the questions

@LEE58380

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

@TaxInCal wrote:I enter the information on the business section "sale of business property".

Let's back up. Why are you reporting it in the "Sale of Business Property" section rather than in the rental section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

I did what you list again and still same results. I think it is the same steps as the you tube video that I provided a link to above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

It may help if you give us numbers: What was the purchase price (and cost of any improvements)? What was the amount of depreciation? What was the selling price? Was it always 100% rental? Did you use TurboTax last and and it is carried forward the previous year's rental information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

This property has always been 100% rental property and I've used TurboTax since owning this rental, so all information has been carried forward year after year.

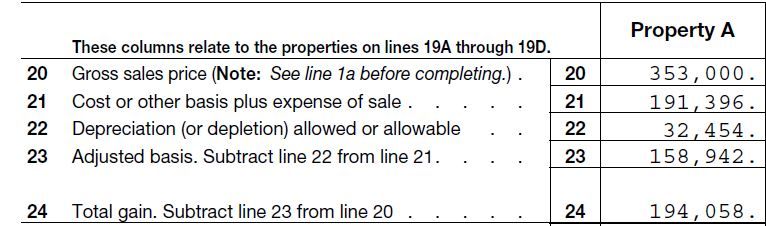

Here is a screenshot of Form 4797 part III

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

The $194,000 gain look correct. Are you SURE the $32,000-ish is not on line 19 of Schedule D? You don't have any numbers (besides zero) on lines 25, 26a, 27, 28 or 29 of 4797, right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

Correct, nothing on line 25, 26a, 27, 28 or 29 of 4797.

Line 19 on schedule D is blank. No value on that line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recapture depreciation on sale of rental

Wow, you have me stumped.

Unfortunately, I suspect you'll need to have a TurboTax employee look at a sanitized diagnostic copy of your tax return to try to figure out why it isn't showing up correctly. MAYBE one will show up here, but I suspect you'll need to call Customer Support.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

alvin4

New Member

melillojf65

New Member

iqayyum68

New Member

user17524531726

Level 1