- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

Hi,

I sold my rental property in august 2023. Tenants moved out on 6.15.23. A new roof for $9K went on house on 4.20.23. Current owed taxes per TT for sale of home is about $110K. When I add the $9k roof into the depreciable assets list, the tax amount doesn't change at all. I would expect a decrease of around $2k in taxes. Shouldn't my cost basis be changing. I assumed TT would make this calculation automatically.

I am clearly missing something here.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

Your sales price is zero. You did not charge a separate fee. No special handling, not part of main home. That is the only thing I see. You want to go through all of your assets and dispose of them as sold for zero. You may have appliances or other things that were all sold with the house. They all sold for zero. You will get a deduction for the remainder of the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

Was the new roof included as an asset that was sold in August of 2023? Or was the new roof simply reported as an asset?

You would allocate the selling price over the two assets, the residential property and the roof. (We ignore the cost of land for purposes of this example.)

For instance, you purchased the property for $100,000, the new roof cost $10,000 and you sold the rental property for $220,000. Was the $220,000 selling price allocated over the two assets?

Basis Selling price

Rental property $100,000 $200,000

New roof $ 10,000 $ 20,000

$110,000 $220,000

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

James,

thnx for the reply.

question: how do assess the selling cost of the roof? I paid 9k in 4/23. do I assign an arbitrary amount to its resale value?

Regards,

Will

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

It would be reasonable to assign a sale price equal to the cost of the roof since you purchased it recently, so it's probably worth about what you paid for it. You set the roof up as an asset in TurboTax, so go to the asset summary and edit the entry. Indicate that you sold it and TurboTax will ask you what the sale price is, which is $9,000 in this case evidently. Reduce the sale price you entered for the house by that much so you have the correct sales price overall.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

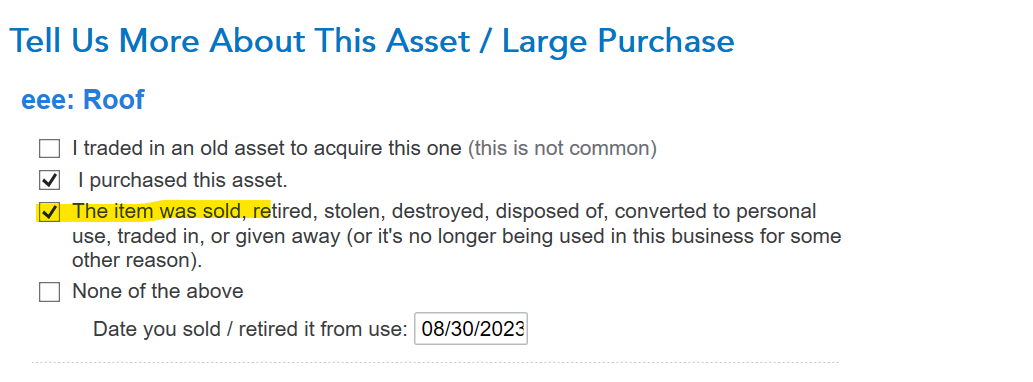

Hey Thomas, the for the reply. I get that first screen, but follow up screens dont give me a sales price option. It's a logic tree so fairly quickly I could be off on a wrong path. I'll attach my successive screens....

Am I wrong in assuming, that, given my being in the 20% tax bracket for 2023, I should see a roughly $1.5-2k in tax reduction when adding roof, as this roof was a business expense for the sale of the house? Whatever I do, nothing reduces my tax amount; with or without roof asset reporting, my tax amount stays roughly the same. I am clearly missing something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

Your sales price is zero. You did not charge a separate fee. No special handling, not part of main home. That is the only thing I see. You want to go through all of your assets and dispose of them as sold for zero. You may have appliances or other things that were all sold with the house. They all sold for zero. You will get a deduction for the remainder of the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why doesn't adding the new roof as depreciable asset affect taxable amount on rental sale?

That seemed to do the trick! thats for the advice.

Will

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

SB2013

Level 2

syounie

Returning Member

alvin4

New Member

melillojf65

New Member