- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

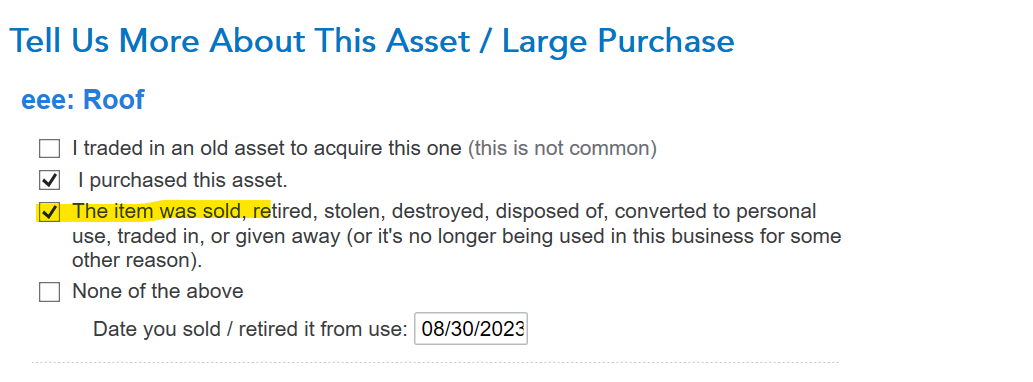

It would be reasonable to assign a sale price equal to the cost of the roof since you purchased it recently, so it's probably worth about what you paid for it. You set the roof up as an asset in TurboTax, so go to the asset summary and edit the entry. Indicate that you sold it and TurboTax will ask you what the sale price is, which is $9,000 in this case evidently. Reduce the sale price you entered for the house by that much so you have the correct sales price overall.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 22, 2024

12:47 PM