- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: why after importing the 1099b with long term lose, my tax due didn't change

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

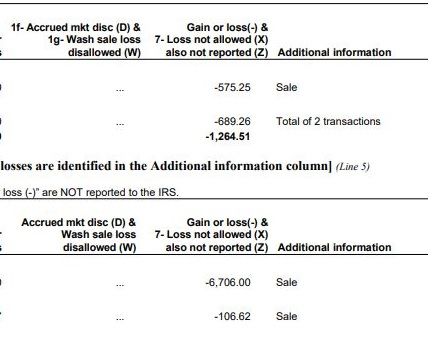

I imported the 1099 documents from my broker, I have long term losses, but not sure why my tax due amount didn't change at all after I imp

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

Have you already exceeded your $3,000 in capital losses?

IRS Topic No 409 Capital Gains and Losses states

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 21 of Schedule D (Form 1040).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

Let me guess ... you have self employment income reported on a Sch C right ???

The stock losses can only reduce FEDERAL taxes not the SE taxes which is probably what the balance due is comprised of. Switch to the FORMS mode and review the 1040, sch C & D and sch 1-3 carefully.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

Yes, I did have 1099-NEC income... Which part on 1040 and schedule C&D should I be looking at? Anyway it can be fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

There is no fixing it since it is NOT an error ... look at line 23 of the form 1040, line 31 of the Sch C, line 4 of sch 2 and line 12 of the sch SE.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

Thank you!

I have

1040 Line 23: $2178

SchC line 31: $16098

Sch2 Line 4: Nothing

Sch SE line2: 431

But what do those numbers mean? Why will those numbers make the long-term loss be ignored? I am sorry I am still not sure I understand this clearly...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

A Form 1099-B is issued to report the proceeds from your stocks and bonds transactions. The transactions will generate either a long term or short term capital gain or loss depends on how long the stocks are being held. The amount will be reported on line 7 of your Form 1040 along with a Schedule D and Form 8949.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

Thank you! So it is something that will be fixed by turbo tax late March right? If that is the case, i will just wait. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

Read the article. it says: "This article is intended to help customers impacted by the negative proceeds values issue that is preventing the e-file submission of tax returns."

Is this the same issue as mine? I am not ready to file the tax yet. My issue is that the tax due didn't change after the long term capital loss is entered. Are those two related?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

why after importing the 1099b with long term lose, my tax due didn't change

Yes, they are related. We are still working on it. See my post from above. Thank You for your patience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

angelinas2006

New Member

Fezziwig

Level 2

lzz1

New Member

krishnakurra

New Member

shubham-123

Level 2