- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Wash sale rule

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

So I sold my Vanguard S&P 500 ETF for a loss a week ago in my taxable (non-retirement) account . My separate retirement account is set to automatically invest a small amount every paycheck into Vanguards S&P 500 mutual fund. Even though it is automatic do I have to exclude the amount purchased within 30 days of the sale because of the wash rule?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

The fact that the purchase in your IRA is done automatically doesn't make any difference. A purchase is a purchase. The purchase being made automatically does not avoid the wash sale rule.

But there are two other questions here.

1. Is the S&P 500 mutual fund "substantially identical" to the S&P 500 ETF?

2. Does a purchase in your IRA make the sale in your taxable account a wash sale?

On the first question there is no clear IRS guidance, and experts may disagree. But there's good reason to consider them substantially identical, since they track the same index. If you compared the price movements of the two funds, you would not see any significant difference. Obviously the safe, conservative position is to consider them substantially identical.

For the second question, the rules are clear that purchasing substantially identical securities in your IRA does make the sale in your taxable account a wash sale. So you cannot deduct the loss on the portion of the fund that you sold that was replaced by the shares purchased in your IRA. What's worse is that you get no adjustment in your IRA for the disallowed loss, so you never get to deduct the loss. If the sale and purchase are both made in taxable accounts, the disallowed loss is added to the basis of the replacement shares. That means that when you eventually sell the replacement shares you get the benefit of the original loss. Your gain on the sale is reduced by the amount of the wash sale loss. But when the replacement purchase is in your IRA you never recover the disallowed loss from the wash sale.

In your specific situation, neither the purchase being made automatically, nor the purchase being in your IRA, avoids the wash sale rule. So the question comes down to whether the S&P 500 mutual fund is "substantially identical" to the S&P 500 ETF. The safe position is to consider them substantially identical and exclude that portion of the loss.

For an excellent, very detailed discussion of wash sales, see the following link.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@rjs @mas1998 - not an expert but one position is identified as a mutual fund and one is identified as an ETF... that in of itself may not be "substaintionally identical". in one case you are buying a basket of securities (mutual fund) and in the other the security you are buying is an ETF (which is technically not the basket of securities)

Last year I sold a mutual fund at a loss (at Vanguard) and then immediately purchased an ETF representing effectively the same basket of securities. In certain situations, Vanguard sells both a ETF version and a mutual fund version. Example: BND and VBLTX. This was in my non-qualified account. Vanguard did NOT report this as a wash-sale.

So if these are two Vanguard securities and one is a mutual fund and one is an ETF, it may not be 'substaintially identical'. What are the two ticker symbols?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@NCperson wrote:What are the two ticker symbols?

If the ticker symbols are VOO and VFIAX, I would be extremely cautious about taking the position that those two funds as not substantially identical; they hold almost exactly the same number of shares in exactly the same corporations.

The web site for VFIAX even states that the [fund] is "also available as an ETF".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

while in the end it is your tax return and you have responsibility for the result, what I am pointing out that Vanguard takes the position (at least in the specific example I offered and I suspect others mutal fund / ETF examples) that a mutual fund and a ETF are not subtaintailly identical and do not invoke wash sale reporting under the circumstance we are discussing.

Here is Fidelity's viewpoint. While they don't state unequivically that mutual funds and ETFs are not substantially identical, they make the case why they are not identical. We don't know how they operationalize this in their wash sale reporting; however, Vanguard does operationalize this viewpoint and doesn't report these situations as wash sale losses (again in at least the one example I provided but that means there are other examples).

https://www.fidelity.com/learning-center/investment-products/etf/tax-rules-for-losses-etfs

"It could also be argued that a sale of mutual fund shares at a loss, followed by the purchase of an ETF that is similar to the mutual fund, is outside the wash sale ban. The ETF price usually reflects the prices of the stocks it holds, whereas mutual funds shares tracking similar holdings may not have the same underlying value. In addition, there are different fees or other charges associated with mutual funds versus ETFs."

it would be worth calling Vanguard and ask about their wash sale reporting on the two funds in question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@NCperson wrote:

....what I am pointing out that Vanguard takes the position (at least in the specific example I offered....

The specific example you offered, BND and VBLTX, is inapposite for the purpose of this thread. Those two funds are not even in the same asset class; one is an intermediate-term bond fund while the other is a long-term bond fund. As such, they are clearly not "substantially identical".

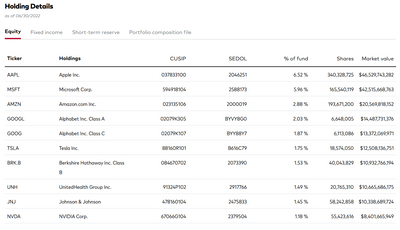

Below are screenshots from Vanguard's SP500 Index fund ETF and mutual fund. Good luck determining which is which based on the top ten holdings (which are identical to the share all the way through the funds).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@NCperson wrote: "it would be worth calling Vanguard and ask about their wash sale reporting on the two funds in question."

Amen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@NCperson wrote:

what I am pointing out that Vanguard takes the position . . . that a mutual fund and a ETF are not subtaintailly identical

. . .

it would be worth calling Vanguard and ask about their wash sale reporting on the two funds in question.

The IRS has the final word, not Vanguard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

Take a look at the language in the Fidelity statement "...it could be argued..."

Fidelity is correct. It could be, but that won't be on Fidelity's dime.

As has been noted, should you win the audit lottery, an agent, their manager, their technical group manager, etc. could take a different position. This will involve your time, professional fees, etc. to argue your position; and maybe not even prevail.

Is it worth the risk?

Notice Schwab dabbles in this area, but aren't as aggressive in their comment:

ETFs and mutual funds present investors a different set of challenges. Switching from one ETF to an identical ETF offered by another company could trigger a wash-sale. There are ways around this problem. For instance, an investor holding an ETF indexed to the S&P 500 at a loss might consider switching to an ETF or mutual fund that is indexed to a different set of securities, such as the Russell 1000 or Dow Jones Industrial Average.

I agree you need to be cautious in the mix of the fund. These cases will always be determined on each specific set of facts and circumstances.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@Rick19744 wrote:Notice Schwab dabbles in this area, but aren't as aggressive.....

Yes, exactly, and note how Vanguard's "surrogate fund list" carefully avoids swapping from one fund/etf into another based on the same index (or profile), even if broad-based.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

you may want to read this thread

note that one line in the key takeaways says

Mutual funds are actively managed, and ETFs are passively managed investment options.

while lower in the thread

In 2008, the Securities and Exchange Commission (SEC) streamlined its approval process for ETFs, which for the first time allowed for actively managed ETFs.

how they are managed is something that the IRS could take into consideration in determining whether the two securities are substantially identical.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@Mike9241 wrote:note that one line in the key takeaways says

Mutual funds are actively managed, and ETFs are passively managed investment options.

As a blanket statement, it is overly broad and therefore erroneous.

There are mutual funds that are also passively managed, such as most all of those that track (try to replicate) an established index.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@Mike9241 wrote:

how they are managed is something that the IRS could take into consideration in determining whether the two securities are substantially identical.

The OP's question in this thread involves an S&P 500 mutual fund and an S&P 500 ETF. They are both passively managed. So that would be a factor in favor of considering them to be substantially identical.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

Go to Vanguard website and do a detailed Realized Gains report.

You will know immediately if Vanguard is recording a Wash Sale.

And yes, IRS will accept the Vanguard 1099-B report.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash sale rule

@fanfare wrote:

Go to Vanguard website and do a detailed Realized Gains report.

You will know immediately if Vanguard is recording a Wash Sale.

Are you certain about that?

Read the original post, carefully. It was stated that the ETF was sold for a loss in a regular, taxable, account and the mutual fund was purchased in a separate retirement account.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cparke3

Level 4

Nicki9

Level 1

starkyfubbs

Level 4

starkyfubbs

Level 4

Nicki9

Level 1