- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sold rental property and I need help with figuring out the numbers and how to enter them into basic turbotax. This is holding up my taxes from going through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold rental property and I need help with figuring out the numbers and how to enter them into basic turbotax. This is holding up my taxes from going through.

Hi -

I sold my rental property on March 1, 2019. I have questions on how to exactly enter the information on BASIC turbotax.

I sold rental condo for $335,000.

Expenses for sell were $33,198.

It have been too long to claim the "lived in there,"

Original Purchase Price $180,000 (not sure on closing costs from then), Land said $70,000. not sure why when it's a condo.

Depreciation $34,500,

No improvements,

When sold rental, I did make a gain on the property.

Also, I'm a single mom, low income.

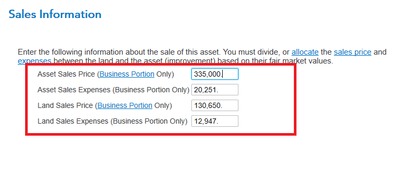

1st - I'm in the rental sales information section, it only says the following. Please tell me what numbers exactly to put here on basic Turbotax based on what I have told you.

Asset Sales Price

Asset Sales Expenses

Land Sales Price

Land Sales

Please give me the exact number (not words) to tell me what to do.

I did pay $11,156.00 in Withholding: Franchise Tax Board at the time of closing. I have a CA forms 593 and 593-V. Do I have to attach this too? or is it done?

I have form 1099-S proceeds from real estate transactions ($335,000.00). Attach this or done?

2nd - Do I have to anything else, like Capital Gains,

I have never sold a rental property before.

Thank you so much!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold rental property and I need help with figuring out the numbers and how to enter them into basic turbotax. This is holding up my taxes from going through.

@msmarci2 You stated that you have never sold a rental property before, taxes were withheld, and your return is now past due so you need professional income tax preparation and guidance.

With the foregoing caveat, I would enter the figures presented as shown in the screenshot below. Those entries are based upon percentages of land value to asset value when you purchased the property. Again, please seek professional guidance for your situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold rental property and I need help with figuring out the numbers and how to enter them into basic turbotax. This is holding up my taxes from going through.

This is not hard. In fact, your situation is the absolute easiest ans simplest there is.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold rental property and I need help with figuring out the numbers and how to enter them into basic turbotax. This is holding up my taxes from going through.

@msmarci2 You stated that you have never sold a rental property before, taxes were withheld, and your return is now past due so you need professional income tax preparation and guidance.

With the foregoing caveat, I would enter the figures presented as shown in the screenshot below. Those entries are based upon percentages of land value to asset value when you purchased the property. Again, please seek professional guidance for your situation.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zeishinkoku2020

Level 2

green2ski

Level 2

AS80

New Member

packfan444

New Member

redmoose

New Member