- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sold one of two rental properties that have always been deeded together

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold one of two rental properties that have always been deeded together

Hello,

I have held two structures in an LLC since 2008 and they have always been deeded together (there have always been two addresses but for real estate purposes with the county it was on one deed, so one property tax, etc.); therefore, I reported the rents, expenses, taxes, depreciation, etc. as one entry on my taxes (noting that it was two structures that were deeded together). In September 2021, we had the property surveyed to divide the properties and sold one of the structures and land to the tenant (seller-financed). The land was divided in about a 60%/40% split with the 60% piece of land and the house that it contained being sold. How is the best way to reflect this on my 2021 taxes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold one of two rental properties that have always been deeded together

It depends. If the two properties are equal in size and square feet as well as land, then you could split the cost, and depreciation in half for the one sold. Then enter then as two separate properties on your 2021 tax return.

This would allow you to sell only one of them while continuing to show the rental property you still own. However, if the rentals are not equal, but disproportionately sized then you must default to using the square feet and/or property tax assessed values to determine the percentage to use for the cost basis of each rental home/land. Once this is completed you are ready to separate the properties in your tax return, then proceed to report the sale of the one property.

The selling price should be prorated for each asset then entered for each asset when you indicate they were sold or disposed of. You will not lose the remaining depreciation because you will use the remaining basis against the selling price to determine gain or loss.

To figure out the selling price for each asset:

- Take the current basis of each asset against the total combined basis of all of your assets to figure out the sales price for each one;

Use the original cost of each asset listed on depreciation, add those together then divide each one by the combined total to find the percentage of the cost for each asset. Use that percentage times the sales price and sales expenses to find the selling price/sales expenses for each asset.

Example: Original Cost (of each asset on your depreciation schedule)

$10,000 Land = 13.33%

$50,000 House = 66.67%

$15,000 Improvements = 20%

$75,000 Total = 100%

Multiply each percentage times the sales price/sales expenses to arrive at each individual sales price/sales expense.

Once you indicate the property is sold then the sales information screen will populate for you to enter the sales price both for land and building as well as the sales expenses.

- Start with the Federal tab

- Click on Income and Expenses

- Under Your income and expenses, scroll down to

- Rental properties and royalties, click Edit/Add

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Click Edit to the right of the assets to be disposed

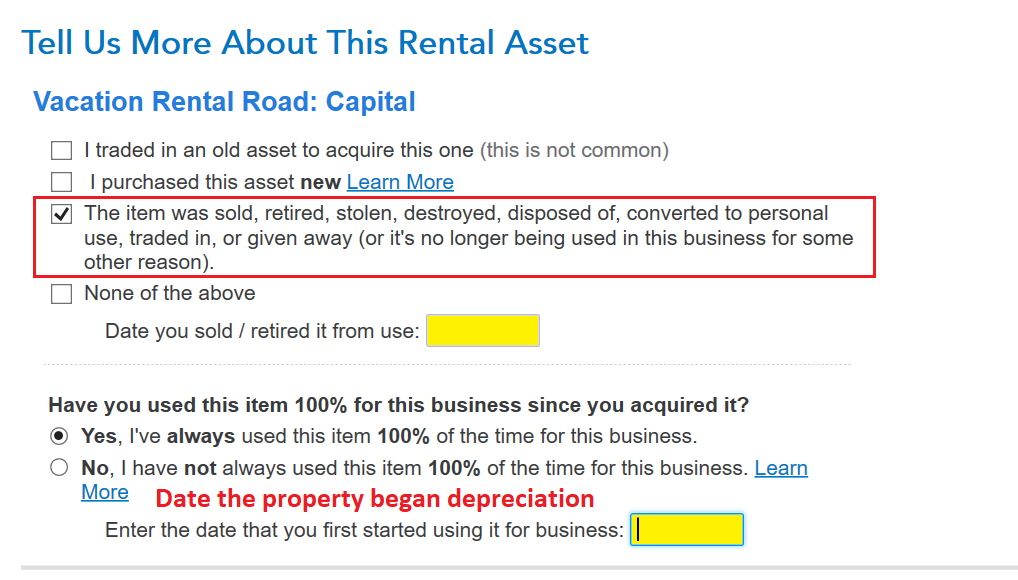

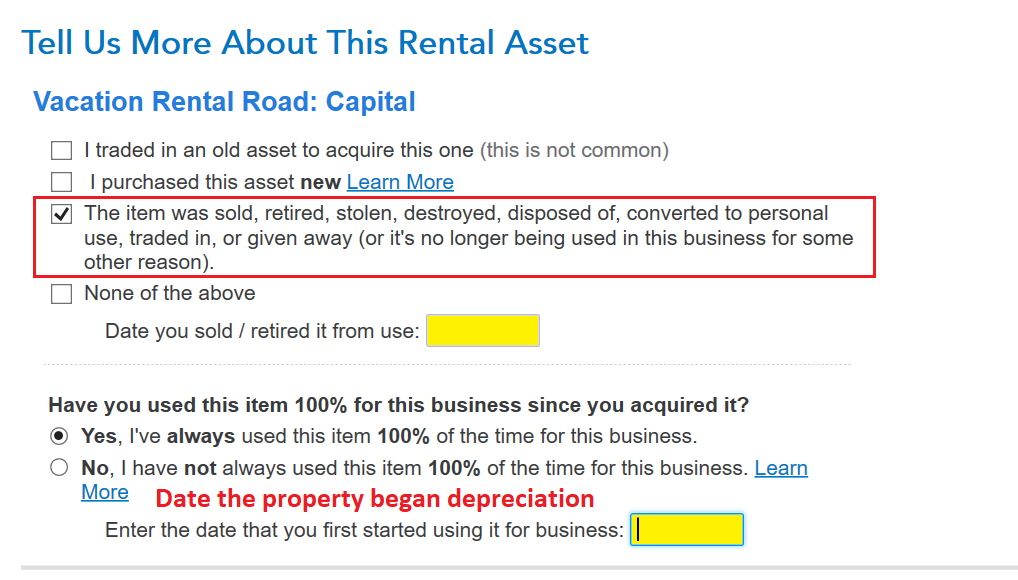

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold……. and continue to answer the questions

- And continue to answer the questions

- See the screen images below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold one of two rental properties that have always been deeded together

The fact that these were on the same deed is irrelevant. They are two buildings, rented to two different tenants, each with its own income and expenses. How did you depreciate this? Only one depreciation for two buildings?

You may need to see a professional who can sort this out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold one of two rental properties that have always been deeded together

There was one entry as an asset so it was depreciated together. As far as income and expenses I did separate out the income and expenses that were to each rental but the depreciation was as one deeded property. When we purchased it as one property, there was only an appraisal and value done for them jointly. I wondered if I could split the depreciation that has been taken so far between them now and separate them on my taxes this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold one of two rental properties that have always been deeded together

It depends. If the two properties are equal in size and square feet as well as land, then you could split the cost, and depreciation in half for the one sold. Then enter then as two separate properties on your 2021 tax return.

This would allow you to sell only one of them while continuing to show the rental property you still own. However, if the rentals are not equal, but disproportionately sized then you must default to using the square feet and/or property tax assessed values to determine the percentage to use for the cost basis of each rental home/land. Once this is completed you are ready to separate the properties in your tax return, then proceed to report the sale of the one property.

The selling price should be prorated for each asset then entered for each asset when you indicate they were sold or disposed of. You will not lose the remaining depreciation because you will use the remaining basis against the selling price to determine gain or loss.

To figure out the selling price for each asset:

- Take the current basis of each asset against the total combined basis of all of your assets to figure out the sales price for each one;

Use the original cost of each asset listed on depreciation, add those together then divide each one by the combined total to find the percentage of the cost for each asset. Use that percentage times the sales price and sales expenses to find the selling price/sales expenses for each asset.

Example: Original Cost (of each asset on your depreciation schedule)

$10,000 Land = 13.33%

$50,000 House = 66.67%

$15,000 Improvements = 20%

$75,000 Total = 100%

Multiply each percentage times the sales price/sales expenses to arrive at each individual sales price/sales expense.

Once you indicate the property is sold then the sales information screen will populate for you to enter the sales price both for land and building as well as the sales expenses.

- Start with the Federal tab

- Click on Income and Expenses

- Under Your income and expenses, scroll down to

- Rental properties and royalties, click Edit/Add

- Do you want to review your rental?, click Yes

- Under Rent and Royalty Summary, click Edit

- Click Update to the right of Assets/Depreciation.

- Click Edit to the right of the assets to be disposed

- Go through several screens until you get to Tell Us More About This Rental Asset

- Click on This item was sold……. and continue to answer the questions

- And continue to answer the questions

- See the screen images below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold one of two rental properties that have always been deeded together

@DianeW777 Many thanks for that very thorough explanation!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mjtax20

Returning Member

misschristian0711

New Member

janetcbryant

New Member

noodles8843

Level 1

IslandMan1

New Member