- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sale of Rental Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

I sold my rental property and trying to walk through TurboTax to dispose the asset. I've already entered in the rental income, taxes and expenses for the property as normal, but I'm confused as to what to put in the

- Asset Sales Price

- Asset Sales Expense

- Land Sales Price

- Land Sales Expense

I believe that if I look at the sellers column of my closing statement, I should get the values stated. Please confirm that my understanding is correct. I believe:

Asset Sales Price should be:

-) Sale Price of Property

Asset Sales Expense should be:

-) Seller paid closing costs per contract

-) Title - Deed Preparation Fee

-) Title - Settlement/Closing Fee

-) Title - Seller Wire Payoff Fee

-) Real Estate Commission - Buyer's Realtor

NOT included in the sales expense should be the Lender: Payoff of First Mortgage Loan

Finally I should leave Land Sales Price and Land Sales Expense empty as there was no additional land in the sale... just the house.

Thanks in advance for your time

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

You almost had it. Unless you have a situation where you paid only for a building with no land attachment, you do it correctly. However, most real estate includes land. When you initially set up the asset, you should have subtracted the land value. It may have been 10% of the cost or 75% of the cost. Land values vary depending on location and the house itself might not have been worth much.

When you sell, there is also an allocation between building and land. The land % of the sales price may have increased or decreased over the years.

You would allocated the sales price to the percentage of the land as appropriate.

Closing costs (Title fees, real estate commissions, documentary stamps, credit report costs, costs of an abstract, transfer taxes, home inspection, flood certificate, attorney fees, etc.), instead of being deductible, reduce the sales price of the property.

NOT included in the sales expense should be the Lender: Payoff of First Mortgage Loan-YES

- Title fees

- real estate commissions

- documentary stamps

- credit report costs

- costs of an abstract

- transfer taxes

- home inspection

- flood certificate

- attorney fees, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

You almost had it. Unless you have a situation where you paid only for a building with no land attachment, you do it correctly. However, most real estate includes land. When you initially set up the asset, you should have subtracted the land value. It may have been 10% of the cost or 75% of the cost. Land values vary depending on location and the house itself might not have been worth much.

When you sell, there is also an allocation between building and land. The land % of the sales price may have increased or decreased over the years.

You would allocated the sales price to the percentage of the land as appropriate.

Closing costs (Title fees, real estate commissions, documentary stamps, credit report costs, costs of an abstract, transfer taxes, home inspection, flood certificate, attorney fees, etc.), instead of being deductible, reduce the sales price of the property.

NOT included in the sales expense should be the Lender: Payoff of First Mortgage Loan-YES

- Title fees

- real estate commissions

- documentary stamps

- credit report costs

- costs of an abstract

- transfer taxes

- home inspection

- flood certificate

- attorney fees, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

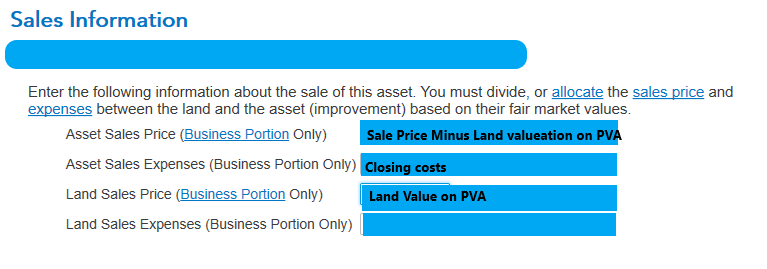

Thanks Coleen,

When I set it up in Turbo tax, It did have the land separate from the asset. I checked the land value in PVA and it has not changed (In PVA at least) since I purchased it. According to your message I should subtract that land value from the sale value.

As for your comment about closing costs, I should put that on the Asset Sales Expenses line:

Please verify this is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

You are correct!

If you have assets other than the house itself (new roof, new deck, improvements, etc.) you will have to apportion the total sales price among the house, land, and any assets that may have been entered separately (for example new roof, new appliances, improvements).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

I'm not sure I follow your answer to ndegroff about the Lender:

Specifically:

Are you saying that payoff of the first mortgage IS or IS NOT to be included in the Sales Expense of the Property?

Also are all the other items listed below that (Title Fees, Real Estate Commissions, etc.) NOT to be included in Sales Expense of the Property? If not, where are they accounted for, as they certainly reduce the income from the sale of the property?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

You do not include anything related to mortgage in the sales information. It is completely unrelated to the sale in regards to the calculation of gain or loss. The other closing costs listed are added to the basis of the property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Hi,

I'm in a very similar situation. I do have other assets associated with my property that have been fully depreciated after 1 year using the Special Depreciation Allowance.

My question is, how do I determine the sales price and sales cost to these assets (washer, dryer, fridge etc)? Can I assign $1 in sales price and cost to these assets and reduce my total sales price and expenses from the total?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Make the sale price zero. Everything was included in the sales price you received for the house.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Irene, i had some improvements made to my rental and have been depreciating the costs ($25,000). I sold the property last year for $192,500. are you saying i need to allocate the costs somehow between the improvement cost and the remainder?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Hello,

I am confused as to where I would list the capital improvements on the screen shown(asset sales price, expense, land sales, land expense)? I had new appliances(installed 3 years before sale of property) & new carpet(installed 1 month before sale of property). Do I also list these on this screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Appliances should have been either expensed or depreciated when you purchased them. They are not part of the home sale as they are not an improvement to the home itself.

If you listed the appliances as assets and depreciated them, then you would need to sell them separately (you can allocate a portion of the home sale that is for the appliances) and list your cost for the appliances when you mark them as sold.

To separately report and sell the appliances you would go back to your rental property, click the pencil next to the property, then scroll down and click add expense or asset. You will then walk through the steps to list and sell the appliances as assets.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

So, the new flooring that was installed a month prior to the sale Does that go on the depreciation screen or the screen that pertains to the sale price and closing fees? Thank you so much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

Add the cost of the flooring to the basis of the property. You would not take any (even 1 month) depreciation on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

So adding flooring expense to the basis would be accomplished on the screen that pertains to the sale. The same screen the closing expenses are added? Do I have to appropriate the % between the land or building? or just the building?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property

@dwpcep You would assign the flooring 100% to the building, none to the land.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

rhalexda

Returning Member

huntinad

Level 1

frankdigiu

Level 1

knownoise

Returning Member

Ashleej828

New Member