- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property

I have questions about my property rental, The property depreciation is 30 years over, can I redo the property depreciation again on different value.?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property

What do you mean "is 30 years over?"

Do you mean you have fully depreciated the property? I.e. For residential realty it has been more than 27.5 yrs since it was put into service?

If so, you cannot start it "over again." You could however start depreciating improvements to the property starting with the date they go into service (e.g. remodels, etc.).

Depreciation is done item of property by item of property. So the building itself is one thing. Rental appliances (fridge, dishwasher, etc.) are each a different thing with a different time period (life) for depreciation. It is typical to have a bunch of assets associated with a rental/business property that are depreciated over different time periods and are at different points. The asset history reports keep all the detail for you. (You enter each asset in TT and it keeps track of the depreciation over the years).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property

Yes, the property fully depreciation for 27.5 years. Can I deduct onetime expense small items like buy "porcelain tile for bathroom" etc..instead do depreciation?

Thanks for your help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental property

That is always a tricky question. But the bottom line is you should be able to expense those kind of expenses though you may need to make an election for a de-minimis safe harbor.

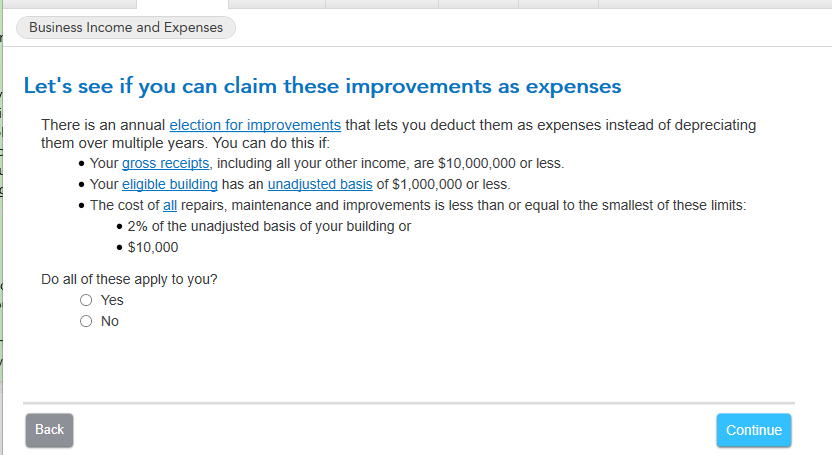

When you do through the TT rental property interview, under the assets/depreciation section, you will be asked about small improvements or total improvements < $10k/2% of your basis, and if you qualify TT will make the election for you. E.g. if you say you have depreciable improvements > $2.5k you will get this screen:

For background info see these references

https://www.nolo.com/legal-encyclopedia/tips-maximizing-repair-deductions.html

which says in part (repairs are deductible, improvements must be depreciated).

What is the Difference Between a Repair and an Improvement?

Here's the basic rule from the IRS: An expense is for an improvement if it:

- makes a long-term asset much better then it was before

- restores it to operating condition, or

- adapts it to a new use.

In contrast, expenses you incur that don't result in a betterment, restoration, or adaptation are currently deductible repairs.

There is also a "de-minimis safe harbor" that you probably qualify for. details:

https://www.nolo.com/legal-encyclopedia/small-taxpayer-safe-harbor-for-repairs-improvements.html

this describes the safe harbors

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Brownsa00

New Member

Lee_shore

New Member

ddaannyyd1986

New Member

user17674466895

New Member

user17674020775

New Member