- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

That is always a tricky question. But the bottom line is you should be able to expense those kind of expenses though you may need to make an election for a de-minimis safe harbor.

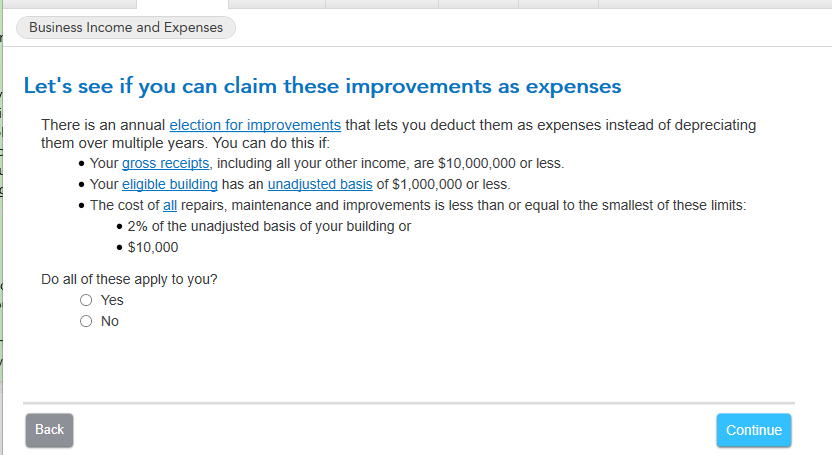

When you do through the TT rental property interview, under the assets/depreciation section, you will be asked about small improvements or total improvements < $10k/2% of your basis, and if you qualify TT will make the election for you. E.g. if you say you have depreciable improvements > $2.5k you will get this screen:

For background info see these references

https://www.nolo.com/legal-encyclopedia/tips-maximizing-repair-deductions.html

which says in part (repairs are deductible, improvements must be depreciated).

What is the Difference Between a Repair and an Improvement?

Here's the basic rule from the IRS: An expense is for an improvement if it:

- makes a long-term asset much better then it was before

- restores it to operating condition, or

- adapts it to a new use.

In contrast, expenses you incur that don't result in a betterment, restoration, or adaptation are currently deductible repairs.

There is also a "de-minimis safe harbor" that you probably qualify for. details:

https://www.nolo.com/legal-encyclopedia/small-taxpayer-safe-harbor-for-repairs-improvements.html

this describes the safe harbors

**Mark the post that answers your question by clicking on "Mark as Best Answer"