- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: No. Line 21 of Schedule E is the current year Income or L...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

After finding Unallowed losses, Form 8582, Worksheet 6, Column b to enter into Schedule E

passive activity losses on line G, Schedule E Suspended Loss,

Now Turbo Tax Premier 2019 asks for At Risk Operating Loss, so how to calculate that number ?

There is no mortgage on either rental property.

There have been extensive repair costs.

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

An "At Risk Loss" would occur if you had a loss on the property and you were not "At Risk" up to the amount of the loss. To be at risk, it means that your basis in the properly is less than the losses the properly is generating.

You basis is basically what you invested in the rental activity, plus any income you reported on your tax return over the years, less losses that you deducted.

So, you would have to do a basis calculation to determine what your at risk loss is. It would be the amount of your basis, if it was negative.

Here is an article on how to calculate basis:

https://taxmap.irs.gov/taxmap2016/pubs/p541-006.htm

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

where would I find the AMT Carryover from the previous year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

Do I enter this number as a negative or a positive?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

What happens if you don’t enter anything ?

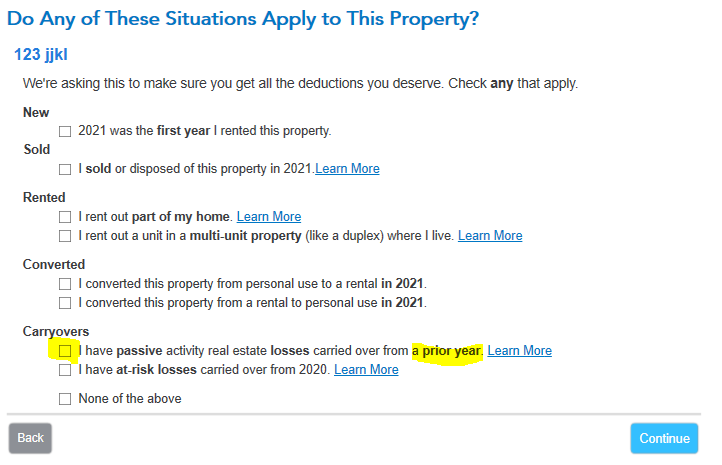

In prior years, my husband has been doing our returns assuming TurboTax is carrying forward this information and automatically entering it where it needs to be. During the interview on TT2021, it asks if any of these situations apply: second from the last I believe was passive losses , which we did have according to the definition and explanation. The next screen wants me to enter something under “Regular tax” : is this current year PAL from schedule E (loss or profit). And than PAL carry overs from prior years as the last entry im that box which I can take from the federal form for PAL correct?

If so, why isn’t this information populated automatically or is it?

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

Yes, you need Form 8582 from your 2020 tax return to enter your passive loss carryover. If the box is blank then TurboTax is not entering the carryover for you. Be sure to enter the amount from Part VII, page 2 Form 8582.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

So, is this requirement to enter in your passive loss carryovers new in this section? Form 8995 carries over the passive losses from year to year and accumulates correctly.

Does this mean I have to go back and amend all of my returns? How does NOT entering this information here affect my tax liability, because again, it shows up in From 8995.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

@pyropinup If your passive loss carryover is correct then you have no need to go back and amend prior year returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

Hi Robert... just to make sure I understand correctly, are you saying that if the passive losses carryover correctly in Form 8995, that I don't have to click the button that was in the post from MJMann ( the one just prior to my post) and enter it there?

Thank you for your guidance.

Jeanne

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

Hello -

This is what I have on Form 8582, worksheet 5 (2020):

Name of activity | Form/schedule line number| a) loss |b) ratio | c) unallowed loss

xyz | E ln 22 | $15045 | .5616 | $6896

How do I enter this $6896 as unallowed loss?

in the interview, TT is asking for "Regular Tax carryover".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

Hello -

This is what I have on Form 8582, worksheet 5 (2020):

Name of activity | Form/schedule line number| a) loss |b) ratio | c) unallowed loss

xyz | E ln 22 | $15045 | .5616 | $6896

How do I enter this $6896 as unallowed loss?

in the interview, TT is asking for "Regular Tax carryover".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

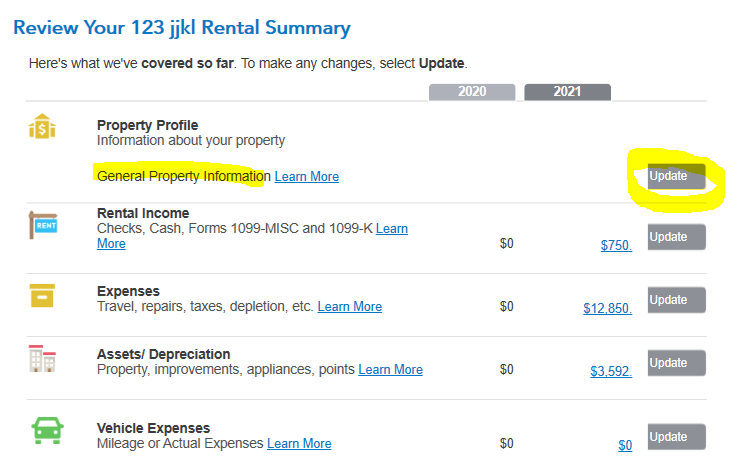

In the rental interview, go to property profile. Select the carryover and enter the information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

On what line number of form 8582 do I find that amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

Pg. 8582 Part 1- 1b

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line number do I fine the passive loss carryover for rental property on the Schedule E?

Would it be 8582 Part1 1b + 1c ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sarmis

New Member

abarmot

Level 1

dinesh_grad

New Member

user17555332003

New Member

DavidRaz

Returning Member