- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Interest deduction on home equity loan/HELOC against rental property to buy 2 other rentals

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest deduction on home equity loan/HELOC against rental property to buy 2 other rentals

Hi all,

I have a multi-part question about mortgage interest on rental properties that I hope the community can help with.

Let's say I have a residential rental property (call this property 1) originally with no mortgage. I take out a home equity loan or HELOC (loan A) secured by property 1. I use 30% of loan A as down payment for another rental property (property 2), which is purchased with a mortgage (loan B). The other 70% of loan A is used as another down payment for a third property (property 3), which is also purchased with a mortgage (loan C). All 3 properties are actively rented out with zero personal use.

- Is the interest on loans A, B, and C all fully deductible as rental/investment expenses?

- If loan A were taken against my home instead of a rental property, is the mortgage interest on loan A still deductible as a rental/investment expense?

- Do I capitalize the loan expenses for loan A on a pro-rata basis between properties 2 and 3 (i.e. 30% toward the cost basis of prop. 2 and 70% toward prop. 3)?

Thank you all!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest deduction on home equity loan/HELOC against rental property to buy 2 other rentals

if the original HELOC is on property 1 the tracing rules Reg Section 1.163-8T(a)(3)

would say you allocate and deduct

if on your home see this link

https://www.taxcpe.com/blogs/news/tracing-rules-that-apply-for-deductibility-of-interest

the thing is that if the election specified isn't made then based on current law (this article was written before the rules for deductibility of HELOC were changed effective for the 2018 tax year) without the election none of the interest would be deductible since the funds weren't used on the residence.

see examples 2a and 2b the election is per reg sec 1.163-10T(o)(5)(i)

How to make the election

An election statement should be attached with the tax return in the year the debt is acquired. The tax code does not specify any specific format so simply attaching a note that states the intention will be sufficient. Here is an example:

Election Pursuant to Regulation 1.163-10T (o) (5) to Treat Debt as Not Secured by a Qualified Residence

20XX Form 1040

(Taxpayer's name) SSN XXX-XX-XXXX elects to treat $ amount of home equity indebtedness, the proceeds of which were used to purchase ........ (specify) as rental activity indebtedness.

The interest on this indebtedness for the tax year was $X, 000 and is being claimed on line 12 of the Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest deduction on home equity loan/HELOC against rental property to buy 2 other rentals

- Is the interest on loans A, B, and C all fully deductible as rental/investment expenses? Yes on Schedule E

- If loan A were taken against my home instead of a rental property, is the mortgage interest on loan A still deductible as a rental/investment expense? yes, but only on Schedule E. You can not deduct the interest on schedule A, even if you later sell the rental properties and maintain the debt.

- Do I capitalize the loanexpensesfor loan A on a pro-rata basis between properties 2 and 3 (i.e. 30% toward the cost basis of prop. 2 and 70% toward prop. 3)? Not sure what you mean by 'capitalize' the expenses. you simply report the interest expense on Schedule E. What loan expenses are you refering to?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest deduction on home equity loan/HELOC against rental property to buy 2 other rentals

In IRS Pub. 527 (2020; Residential Rental Property) under Expenses paid to obtain a mortgage, it states:

Certain expenses you pay to obtain a mortgage on your rental property can’t be deducted as interest. These expenses, which include mortgage commissions, abstract fees, and recording fees, are capital expenses that are part of your basis in the property.

I now also found in IRS Pub. 535 (2021; Business Expenses) under Expenses paid to obtain a mortgage:

Certain expenses you pay to obtain a mortgage cannot be deducted as interest. These expenses, which include mortgage commissions, abstract fees, and recording fees, are capital expenses. If the property mortgaged is business or income-producing property, you can amortize the costs over the life of the mortgage.

My third question is now: (1) do I amortize and deduct or do I capitalize and (2) if the latter, whether I can simply proportionally allocate these expenses to their respective cost bases.

@NCperson wrote:

- Is the interest on loans A, B, and C all fully deductible as rental/investment expenses? Yes on Schedule E

- If loan A were taken against my home instead of a rental property, is the mortgage interest on loan A still deductible as a rental/investment expense? yes, but only on Schedule E. You can not deduct the interest on schedule A, even if you later sell the rental properties and maintain the debt.

- Do I capitalize the loanexpensesfor loan A on a pro-rata basis between properties 2 and 3 (i.e. 30% toward the cost basis of prop. 2 and 70% toward prop. 3)? Not sure what you mean by 'capitalize' the expenses. you simply report the interest expense on Schedule E. What loan expenses are you refering to?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest deduction on home equity loan/HELOC against rental property to buy 2 other rentals

So to summarize, the answer to (1) is yes, and the answer to (2) is "yes and requires an irrevocable election to be made". Is that right?

Secondly, do you have a sense for question (3)? "NCperson" discussed it in a separate response, and I clarified the question in response.

Thank you!

@Mike9241 wrote:if the original HELOC is on property 1 the tracing rules Reg Section 1.163-8T(a)(3)

would say you allocate and deduct

if on your home see this link

https://www.taxcpe.com/blogs/news/tracing-rules-that-apply-for-deductibility-of-interest

the thing is that if the election specified isn't made then based on current law (this article was written before the rules for deductibility of HELOC were changed effective for the 2018 tax year) without the election none of the interest would be deductible since the funds weren't used on the residence.

see examples 2a and 2b the election is per reg sec 1.163-10T(o)(5)(i)

How to make the election

An election statement should be attached with the tax return in the year the debt is acquired. The tax code does not specify any specific format so simply attaching a note that states the intention will be sufficient. Here is an example:Election Pursuant to Regulation 1.163-10T (o) (5) to Treat Debt as Not Secured by a Qualified Residence

20XX Form 1040

(Taxpayer's name) SSN XXX-XX-XXXX elects to treat $ amount of home equity indebtedness, the proceeds of which were used to purchase ........ (specify) as rental activity indebtedness.

The interest on this indebtedness for the tax year was $X, 000 and is being claimed on line 12 of the Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interest deduction on home equity loan/HELOC against rental property to buy 2 other rentals

Do I capitalize the loanexpensesfor loan A

Loan expenses are not capitalized/depreciated. For those expenses that qualify, it depends on what the expense was for, as to how it's handled.

- Expenses associated with acquisition of the property are added to the cost basis of the property. So they get capitalized and depreciated over time. Examples of this type of expense include title transfer fees paid at the courthouse to change the name on the deed from the seller's name, to the buyer's name. Since you took out a HELOC, you don't have any of these expenses, as the ownership of the property did not change.

- Expenses associated with acquisition of the loan are amortized and deducted (not depreciated) over the life of the loan. Examples would be loan application fees paid to the lender, as well as property survey fees *only* if required by the lender as a condition of loan approval. These costs are amortized and deducted over the life of the loan. These fees can only be claimed on the rental property used to secure the loan, and only if those fees actually qualify. (I'm not sure if they actually qualify or not.)

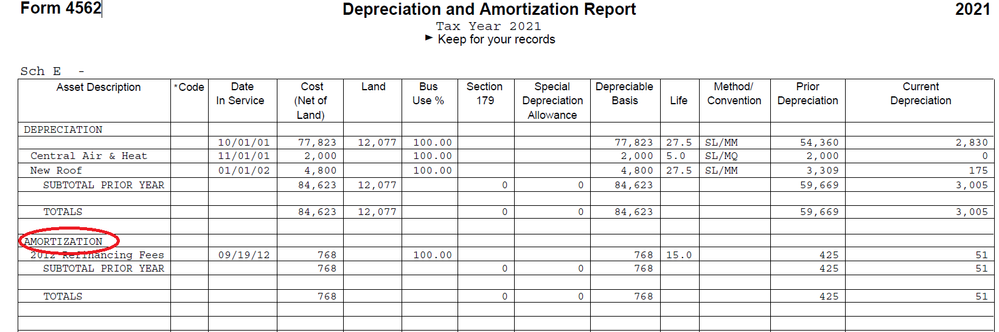

If entered correctly in the program, amortized costs will appear on the 4562 that prints in landscape format, titled "Depreciation and Amortization Report". They will be on that form below the depreciated assets, in a section called "Amortization". See example below:

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mbdowty

New Member

tiffanilyons82

New Member

maylh

New Member

frankdigiu

Level 1

knownoise

Returning Member