- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Do I capitalize the loanexpensesfor loan A

Loan expenses are not capitalized/depreciated. For those expenses that qualify, it depends on what the expense was for, as to how it's handled.

- Expenses associated with acquisition of the property are added to the cost basis of the property. So they get capitalized and depreciated over time. Examples of this type of expense include title transfer fees paid at the courthouse to change the name on the deed from the seller's name, to the buyer's name. Since you took out a HELOC, you don't have any of these expenses, as the ownership of the property did not change.

- Expenses associated with acquisition of the loan are amortized and deducted (not depreciated) over the life of the loan. Examples would be loan application fees paid to the lender, as well as property survey fees *only* if required by the lender as a condition of loan approval. These costs are amortized and deducted over the life of the loan. These fees can only be claimed on the rental property used to secure the loan, and only if those fees actually qualify. (I'm not sure if they actually qualify or not.)

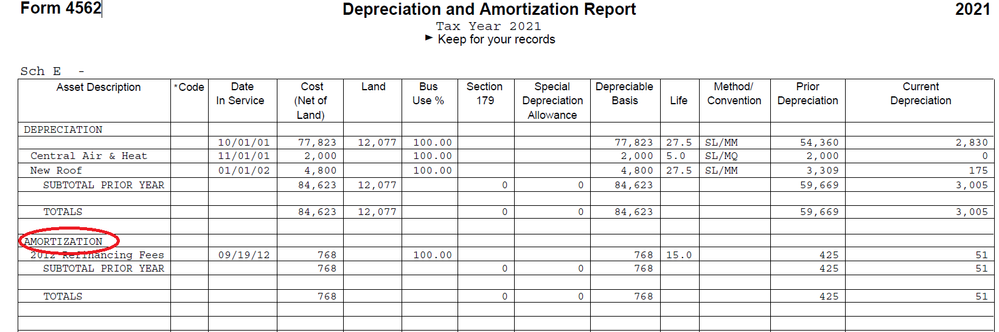

If entered correctly in the program, amortized costs will appear on the 4562 that prints in landscape format, titled "Depreciation and Amortization Report". They will be on that form below the depreciated assets, in a section called "Amortization". See example below: