- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Depreciation on rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation on rental

I have a rental property that I started renting out on 9/12/2016. The building value is 184,161. For years 2017 - 2020 I took a $6,747 depreciation deduction every year. For 2021 I got my taxes done by a CPA. For some reason the CPA came up with a depreciation deduction of $4,604 for 2021 and a value of 27,574 for prior years depreciation. For 2022 I'm entering a total of 27,574+4604 = 32,178 as my prior year depreciation in TT. TT shows me that I can take a depreciation deduction of only $2,341 for 2022. How's that possible when in the years from 2017 - 2020 I took a depreciation deduction of $6,747/year? How can I rectify this in TT by entering what I think is the correct depreciation amount of 6,747 for 2022? Or is my depreciation amount something else for 2022?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation on rental

Does the building value of $184,161 include the value of land or only the depreciable value of the building?

Is $184,161 only the building or does it also include the value of appliances and improvements that may have a different useful life?

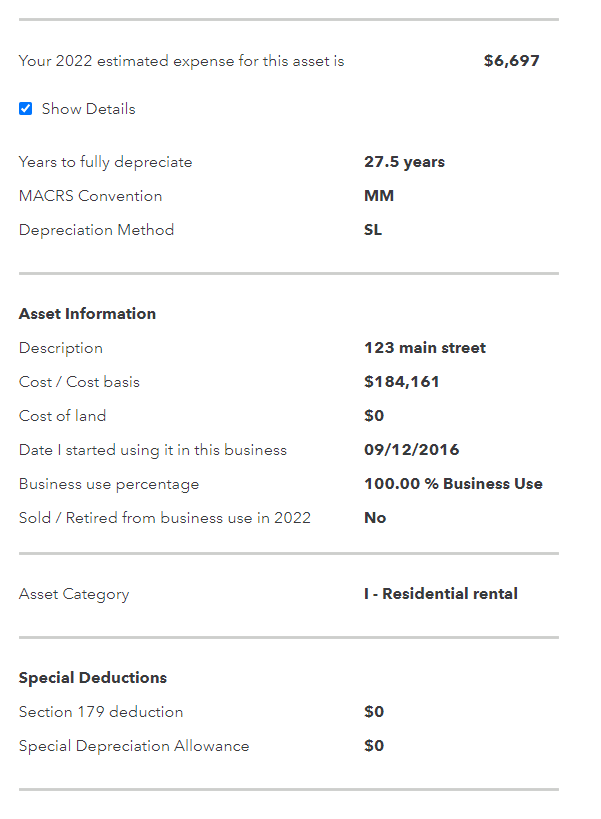

Assuming 100% business use and claiming $0 for land value, TurboTax Premier Online reports $6,697 for current expense and $35,438 in depreciation taken in prior years. See here.

We must be using different assumptions when computing our calculations.

Once the correct depreciation has been determined, you should report the correct prior depreciation at the screen Confirm Your Prior Depreciation.

[Edited 3/14/2023 | 12:48 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation on rental

@JamesG1 I agree with your calculation of prior depreciation based on your assumption that the entire $184,161 is depreciable real property.

However, you indicate that the OP should report "$27,574 + $4,604 = $32,178 at the screen Confirm Your Prior Depreciation".

I believe the OP should report the correct amount of depreciation ($35,438) for prior years that you calculated.

This is due to the fact the depreciation is based on allowed or allowable.

The only way to correct the difference would be to complete a form 3115 to benefit from the incorrect depreciation determined in prior years.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation on rental

Hello JamesG1,

Thanks for your reponse.

I am not able to see the picture you attached very well. The 184,161 is the building value and doesn't include any land value or claiming any land value. The property is used for business 100% of the time. How did you compute $35,438 as depreciation for prior years? If I take 6747 for each of the 5 years, then the depreciation amount should be 33,735 not 35,438 as you indicated.

A second confusion I have is in the year 2017 I bought a refrigerator for 944 that I marked it under special depreciation but the following year I marked it's depreciation value as 0. Then in 2019 I bought a water heater for 1558 which I again depreciated this time through section 179 but the following year in 2020 I marked it's depreciation as 0. Do I need to rectify my prior years depreciation based on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation on rental

Hello Rick,

Thanks for your response. Not sure what OP stands for. I'm not sure how you or James are getting 35438 as prior year depreciation. Also how do I file the form 3115 to rectify my situation? I'm assuming that I select 35,438 as my prior year depreciation but in form 3115 I show the actual depreciation amount of 32,178 that I have taken so far to fix for the difference between 35,438 and 32,178.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation on rental

Here is the meat & potatoes answer for you- If you have a problem backing into prior depreciation, inquire with prior CPA is a must. Ask for depreciation workpapers. Amend if you don’t agree.

If you agree with him, amend your own work. If you don’t agree with him, amend his work. Present a uniform front going forward.

You asked: how can you rectify what you think is the correct depreciation? Amend, if necessary.

The absence of the land value is the second most concerning aspect of your quandary. The first concern is while the CPA was different from you and why no years were amended upon this professional’s advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation on rental

- Residential property or commercial/business property?

- Long term rental or short term rental? Has it been that way the entire time?

- Is the property in the United States?

- Before 2021, were you using TurboTax? Or were you preparing your tax returns some other way?

- When you enter the $184,161 are you ALSO entering the land value?

- $184,161 divided by 27.5 years is $6697. I wondering how you get $6747.

- Did you claim depreciation in 2016? If so, how much?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

obeteta

New Member

samT5

New Member

bruced63

New Member

jasonmark1993

New Member

user483784620

New Member