- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Does the building value of $184,161 include the value of land or only the depreciable value of the building?

Is $184,161 only the building or does it also include the value of appliances and improvements that may have a different useful life?

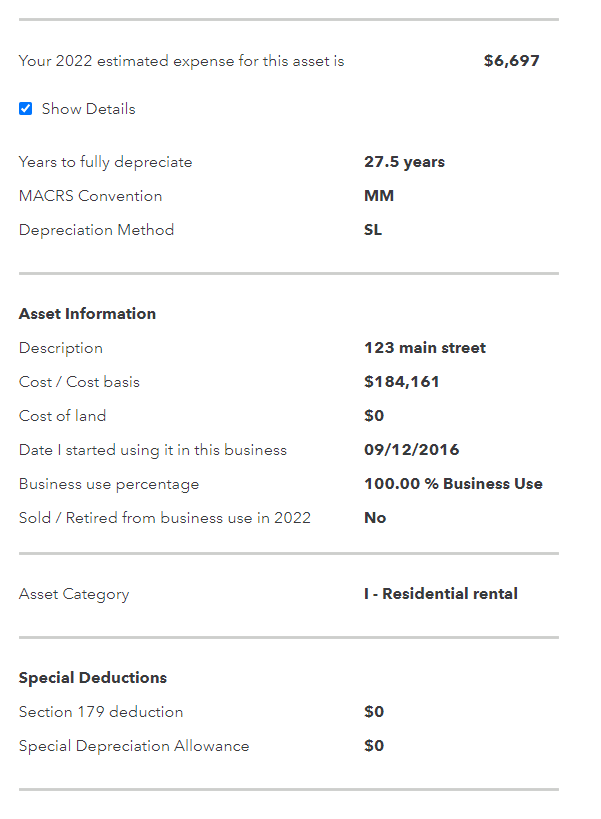

Assuming 100% business use and claiming $0 for land value, TurboTax Premier Online reports $6,697 for current expense and $35,438 in depreciation taken in prior years. See here.

We must be using different assumptions when computing our calculations.

Once the correct depreciation has been determined, you should report the correct prior depreciation at the screen Confirm Your Prior Depreciation.

[Edited 3/14/2023 | 12:48 pm PST]

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 14, 2023

5:56 AM