- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Depreciation of rental property major improvements - Federal Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation of rental property major improvements - Federal Return

I have a single family home I have been renting for 20+ years. During 2019, I have made three 'major improvements' to this house (new flooring, new windows, and new plumbing worth $6.2K, $8.8K, $8.5K resp.).

When I added these to my existing depreciation list, the end result is that it's going to be depreciated in 5 years, which as far as I can tell in IRS documentation is way too fast/short.... In addition, I don't think I'm eligible under Section 179, which would be even faster, so I'm wondering if I'm missing something...

The path I took to add these 3 projects (one at a time as they have different service dates), is as follows:

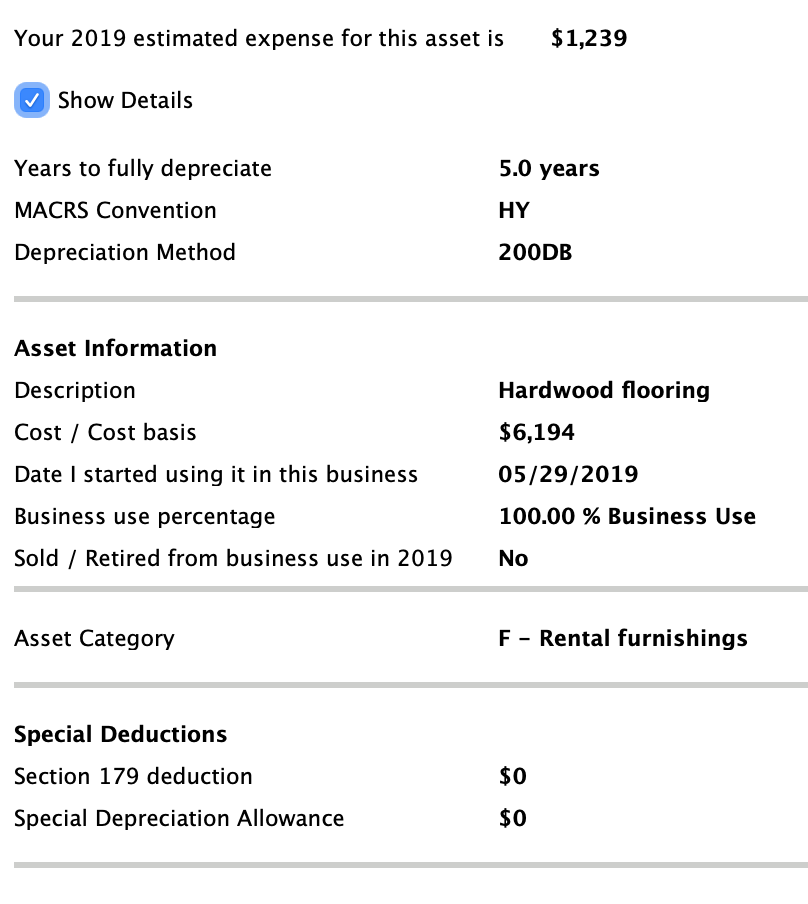

Rental Real Estate Property >> Appliances, carpet, furniture >> Name/Amount/Date >> Purchased asset NEW & 100% business use & date >> OPTION: I'll spread the deduction over several years >> it then gives me 2019 expense amount, which is 1/5 of total value...attached is the 'show details' screenshot which confirms it's only 5 years....

Any thoughts/hints? I didn't find anything about this in FAQ's but maybe am looking in the wrong place.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation of rental property major improvements - Federal Return

You have just classified things wrong in the wrong asset class, is all. Easy to fix.

new flooring,

If it's carpet, then it's classified correctly and gets depreciated over 5 years. But for anything else (hardwood, tile, etc.) it should be classified as "Residential Rental Real Estate" and it will be depreciated over 27.5 years.

new windows, and new plumbing

There is absolutely no question that these become "A physical part of" the rental structure. So they should be classified as "Residential Rental Real Estate" and they will be depreciated over 27.5 years. If you want, (and I recommend it) if the windows and plumbing were placed "in service" on the date date, then you can combine windows and plumbing into a single asset item.

If you put carpet in, that's something that generally doesn't last long and it's easy to rip up and replace. The "real" life expectancy of a descent carpet is 10 years. But the IRS classifies that with appliances for 5 years. I could see that for a rental property, because in general a renter doesn't take care of the property like they would if they owned it.

Now if the flooring is not carpet, and if all three improvements were place in service on the same date, you can actually combine all three into a single asset entry and depreciate the total $23.5K over 27.5 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation of rental property major improvements - Federal Return

Thank you @Carl for your detailed answer! Exactly what I needed...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mjtax20

Returning Member

c0ach269

Returning Member

SB2013

Level 2

Idealsol

New Member

SB2013

Level 2