- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation of rental property major improvements - Federal Return

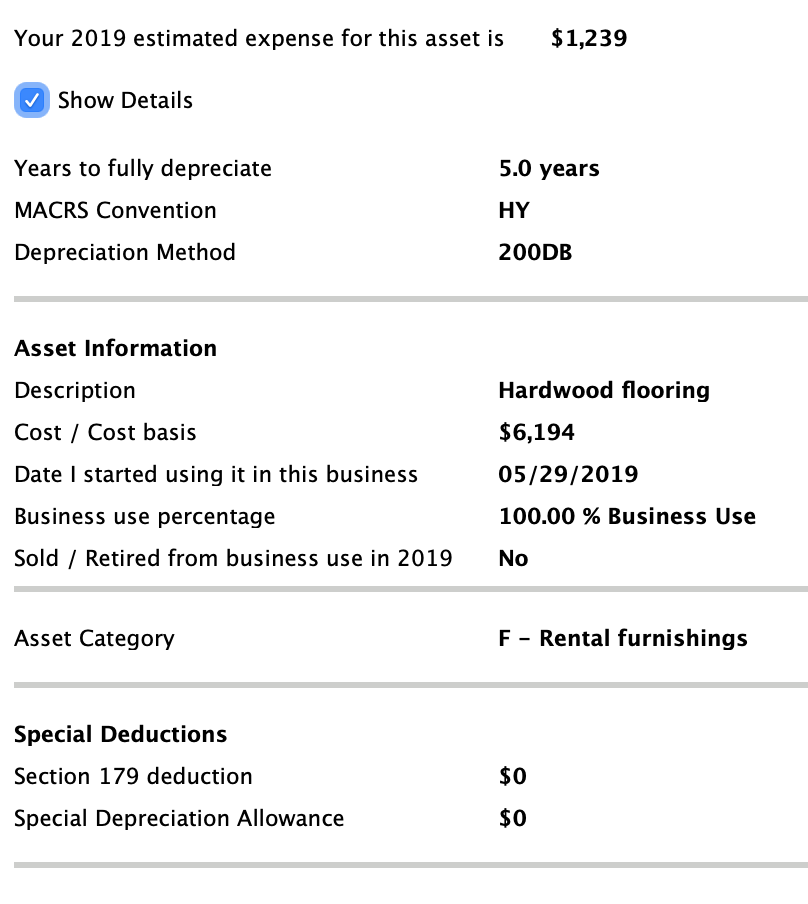

I have a single family home I have been renting for 20+ years. During 2019, I have made three 'major improvements' to this house (new flooring, new windows, and new plumbing worth $6.2K, $8.8K, $8.5K resp.).

When I added these to my existing depreciation list, the end result is that it's going to be depreciated in 5 years, which as far as I can tell in IRS documentation is way too fast/short.... In addition, I don't think I'm eligible under Section 179, which would be even faster, so I'm wondering if I'm missing something...

The path I took to add these 3 projects (one at a time as they have different service dates), is as follows:

Rental Real Estate Property >> Appliances, carpet, furniture >> Name/Amount/Date >> Purchased asset NEW & 100% business use & date >> OPTION: I'll spread the deduction over several years >> it then gives me 2019 expense amount, which is 1/5 of total value...attached is the 'show details' screenshot which confirms it's only 5 years....

Any thoughts/hints? I didn't find anything about this in FAQ's but maybe am looking in the wrong place.

Thanks!