- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Deducting Administrative costs for a decedent's Estate/Trust

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deducting Administrative costs for a decedent's Estate/Trust

Hi,

My father died last year and I am the successor trustee of his estate and Living Trust. I created an administrative trust to gather assets and manage the estate during the preparation of the 706 estate tax return, after which the Family/Bypass and Survivor Trusts were funded from the assets in the Administrative trust. I am filing the first and final 1041 for that trust. I would like to deduct the costs associated with the 706 preparation and understand that I need to file duplicate statements claim the 642(g) election to deduct these expenses on the income tax return (1041) rather than the estate tax return (706).

I'm using turbotax business for the 1041, but don't know what the 642(g) election statement should look like. Does anybody have an example of a 642(g) statement? I'm tempted to just create a document stating that I am claiming administration expenses of. the estate as an income tax deduction under IRC 642(g) and then list the expenses and purpose.

Also as a sanity check - are these deductions?

- Tax attorney fees for advice on 706 and estate issues

- 706 Tax preparation fees

- Appraisal of personal property fees for the 706 submission

- Appraisal of value of real property

(these amount to about $30K

any others?

Thanks,

Paul

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deducting Administrative costs for a decedent's Estate/Trust

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deducting Administrative costs for a decedent's Estate/Trust

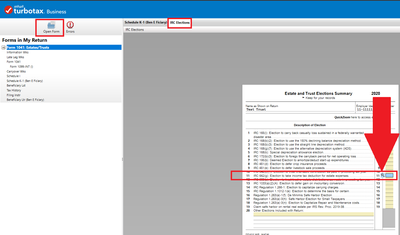

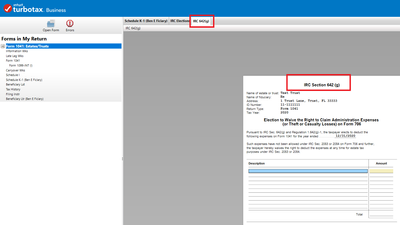

You can generate the 642(g) election easily in Forms Mode.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deducting Administrative costs for a decedent's Estate/Trust

That looks VERY promising however I can't find anything like that in forms mode. How do I get the IRC Elections summary to activate?

PAul

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deducting Administrative costs for a decedent's Estate/Trust

Click the Open Forms icon in Forms Mode, scroll down to Elections Summary in the forms list, and open the summary form.

Put your cursor in the box to the right of the election and click the magnifying glass icon, which should open the election form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deducting Administrative costs for a decedent's Estate/Trust

Thank you!

I found the elections and got to the correct forms. You have been incredibly helpful.

Paul

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jandrwall_mke

Level 2

ptspringer

Level 2

BenH

Level 2

Mindapater

New Member