- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Correctly inputing a 1099-MISC - Box 3 Other Income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correctly inputing a 1099-MISC - Box 3 Other Income

I receive a 1099-MISC from my financial institution for reimbursement of a branded credit card fee ($695). Turbo tax keeps wanting to include this on a schedule C. This reimbursement is not part of any self-employment or any work at all. It's just a fee reimbursement. How should this be entered correctly into TurboTax. Thank you,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Correctly inputing a 1099-MISC - Box 3 Other Income

This can be entered using the following steps. Be sure to delete the 1099-MISC if you do have an entry for that now.

Please follow the instructions below to report Other Income:

- Sign into your TurboTax return

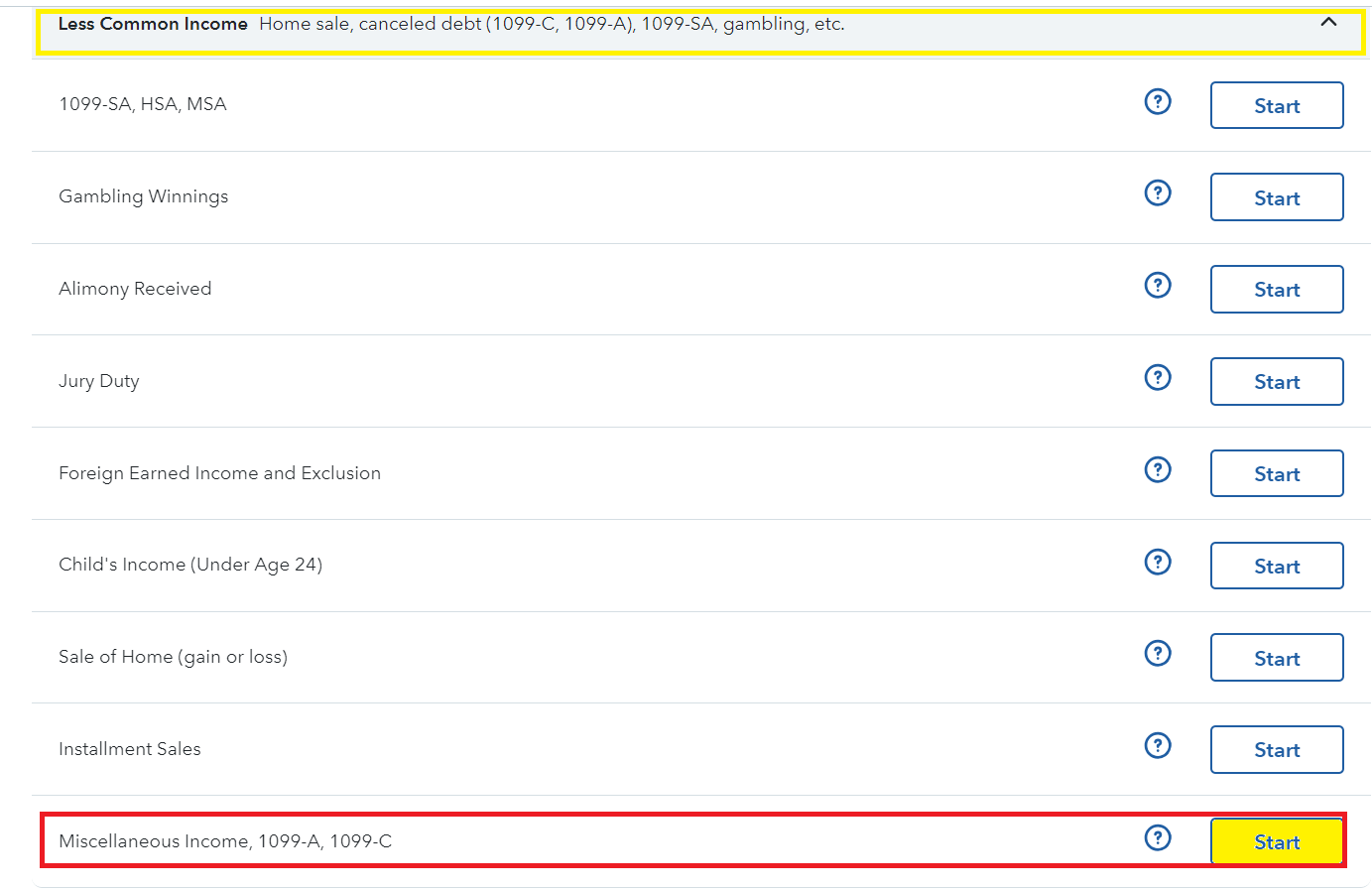

- Click on Wages and Income and scroll down to Less Common Income

- Go to the last selection, Miscellaneous Income and click Start

- Go to the last option, Other reportable income and click Start

- When it asks, "Any other reportable income?" > yes and then type in a description and the amount to report it on your tax return.

- TurboTax Online and TurboTax CD/Download will use the same procedure

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

brandner-jm

New Member

SoftwareIssue

Returning Member

mlkramer125

New Member

taxqn24

Level 1

JVY

New Member