- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Nonresident North Carolina Income State Return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident North Carolina Income State Return

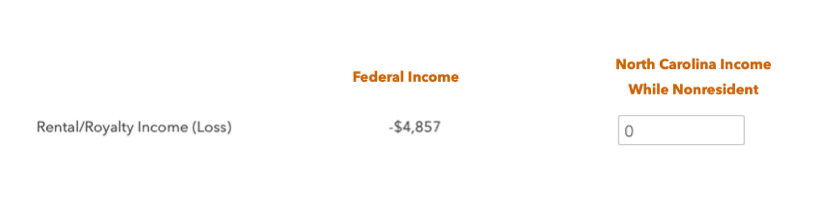

In my state tax return section, it asks to input the nonresident income for North Carolina. However, I have several rental properties, one of which is in North Carolina, and the sum income (loss) comes out to negative. If my property in North Carolina is profitable, should I put the profit/loss of that specific income for the NC home, or should I follow the Federal Income lump sum that TurboTax provides as reference? In that case, would North Carolina Income be equal to $0?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident North Carolina Income State Return

Yes, you are reporting only the net profit or loss for property that is located and situated in North Carolina (NV). The NC income begins with the federal adjusted gross income so if you had a profit on the NC property you should enter that as a positive amount in the NC box. If it was a net loss on that property then you should enter a negative figure (-300) as example.

The figure on the federal return is the net result of all profits and losses combined, for this reason you enter the actual amount for just that property as a nonresident in NC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tina484705

New Member

dmtcuz14

New Member

abarmot

Level 1

acb7b540bec1

New Member

med87-aol-com

New Member