- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Nonresident North Carolina Income State Return

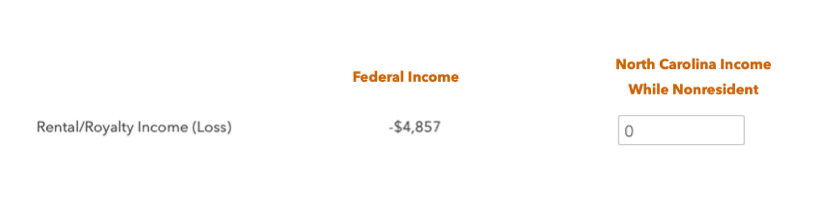

In my state tax return section, it asks to input the nonresident income for North Carolina. However, I have several rental properties, one of which is in North Carolina, and the sum income (loss) comes out to negative. If my property in North Carolina is profitable, should I put the profit/loss of that specific income for the NC home, or should I follow the Federal Income lump sum that TurboTax provides as reference? In that case, would North Carolina Income be equal to $0?

Topics:

February 13, 2024

10:42 AM