- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

@RobertB4444 These are not brokerage fees. These are Investment Expenses (for which there is a check box that says, "I paid sales expenses that aren't included in the sale proceeds reported on the form", allowing you to enter the Expense amount into the box).

These are not fees for managing an account. They are the Trust's expenses that "flow through" to the Shareholders.

I'm certainly not an expert and I'm having to learn as I go, but I think you're wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

Yes, and it is a big pain. Because I had several groups of GBTC purchased, I initially figured I would allocate expense on a per share basis per purchase group (since GBTC reports the expenses per share). SInce some expenses were "long term cap gains" and some were "short term," I tried to do one summary for each category, deleting all the individuals expense sales from TD Ameritrade. Each of those sales to pay expenses included a mix of long and short capital gains if I did it this way. When I tried to do the "summary" and it asked for date of purchase, I just put "Various". But while that was initially accepted, it produces an error when you run the error check. So I need to make up multiple breakdown expense sales for each sale? No, I don't think so. I will just make the assumption that just like stocks, you can decide what shares you sell (you often sell the oldest to make capital gains long term), and I will assume I am selling the BTC from my oldest purchase first to cover expenses. That way until I sell ALL of the BTC represented by the first purchase, I can keep it simple and once the expenses are a year out from that first purchase, all the expense sales will stay long term.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

This isn't deductible. It isn't a fee associated with the sale that they are talking about (eg, it isn't a transaction fee). It is an ongoing expense charged by Grayscale to manage the fund, and to pay their expenses, they sell off a few bitcoin every week. Your number of shares held doesn't change, but the number of bitcoin represented by your initial purchase" changes and the basis in your initial purchase is reduced by the $ of the expense sale as well. It makes sense but is just very complicated. I thought this would be an efficient and easy way to own BTC . It might be a good way since it sells at a big discount, but clearly just buying BTC and holding in a wallet is way easier and cleaner!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

No, unfortunately, they are not sales fees that aren't included. They are non-deductible management fees (according to GBTC they are management fees). The way Grayscale explains how to calculate everything makes sense but is very complicated and time consuming, especially if you have multiple lots purchased at different times when the cost for bitcoin was different.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

@davidcjonesvt Can you point me to where GBTC says they are management fees? In GBTC's 2021 Grantor Trust Tax Information letter, the second paragraph states, "Instead, the Trust's income and expenses 'flow through' to the Shareholders." The term "management fees" is nowhere in that document. Is it somewhere else?

Also, why would GBTC give you all that information about how to calculate expenses if it has no purpose? Why not just give you the necessary information to calculate the change to your Cost Basis and leave it at that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

Perhaps management fees are not the right word, but they are not sales fees either. According to the tax attorney I spoke with, these are the fees for holding/managing the bitcoin. They are not "sales fees" that we can use to directly offset the cost of our buying/selling. They are the fees charged to "hold" the bitcoin, sort of like the safety deposit fee that you might have to pay to store gold, I suppose. To state it more directly, these aren't fees to sell the bitcoin, they are the value of the bitcoin they sold to run/manage the trust.

The reason GBTC gives you all the information is that it is that effectively the IRS views the BTC they hold as the asset you purchased, not just the "stock" itself per se. So when they have to sell off BTC, you must report the capital gain (or loss) on that BTC that was sold. Their complicated tables give you a way to do that. They tell you the fractional share of bitcoin they were holding that were sold and the $ each of those were worth. You subtract that from the bitcoins you "controlled" when you bought GBTC (they tell you how to calculate that too). You adjust your basis on that initial purchase based on the capital gain/loss that you took, and you recalculate your ratio of remaining basis and remaining controlled bitcoin at the end of each year. That way, when you finally do sell all your shares, you can adjust the basis for the shares (initial purchase) so that you sale of the "stock" accurately reflects the gain/loss since some of the underlying assets have been sold off in between.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

@davidcjonesvt Thanks for the reply. I completely agree that these are not sales fees either. They are expenses. Everything in the GBTC letter refers to them as expenses. The word "fee" does not appear in the document. I'm sure that you trust your tax attorney, but if he is calling these expenses "fees for holding/managing the bitcoin", I would just ask for his justification for that, beyond just what he thinks or already has in his mind about it. Where does anything actually say "fees"? GBTC and crypto products in general are different animals.

I am not 100% sure that I am correct, but I'm trying to get there. I welcome any pushback or evidence you can give me that I am wrong. But I am not inclined to change my mind just because your tax attorney said so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

I can only go by what I am told, but if I also read what TDAmeritrade says (on my 1099):

"This transaction represents the sale of assets from a Widely Held Fixed Investment Trust (WHFIT). The cost basis allocation factor is the value of the assets sold divided by the total net asset value of the trust. If you know your cost of the assets sold, use that to determine your gain/loss. Otherwise, determine your cost basis by multiplying your adjusted cost basis by the cost basis allocation factor. For example, if your adjusted basis is $1,000 and the cost basis allocation factor is 0.005 your cost basis allocated to that sale is $1,000 * 0.005 or $5. If there are subsequent sales of trust assets, your adjusted cost basis for the next sale is $995. Sales are reported based on when and for how much the trust sold the asset. This may differ both in timing and amount from what is distributed. There are cases where the proceeds are used to pay expenses and there is no corresponding distribution. For more information refer to regulations section 1.671-5."

This really is highly suggestive that you are required to be adjusting your basis and treating each sale to cover expenses as a capital gain/loss based on the relative price of the underlying assets. So if you want to separate into long- and short-term capital gains, doing it the way GBTC suggests (and not just using the cost basis factor, since you have specific details) allows for that. TDAmeritrade is not suggesting you can just add the whole sale cost to your basis as would have happened with the commission for buying/selling a stock or option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

I am not sure if I replied to this or not, but they are not sales expenses (eg, so the checkbox doesn't apply). That is, they are not expenses related to the sale of the asset. The asset (BTC) is being sold to cover expenses. In another reply, I put in what TDAmeritrade says about it, and TDA seems to say that we should be using the sales to adjust our basis and treat like capital gains/losses too. I am not an expert, but when the tax attorney says it, TDAmeritrade suggests it, and then Grayscale describes the process, that is how I will do it, painful though it might be. But to each their own! I am not a tax attorney/expert myself, but I have been doing my own somewhat involved taxes for over 35 years, FWIW. LOL.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

I found some more information. This is from the LPL financial website. If you do a search and look for "Widely Held Fixed Investment Trust" you should find a link to a pdf on their website that is the "2013 Widely Held Fixed Investment Trust Guide". I have bolded some of the text from the guide below.

I just found I can post the link so you can read the whole thing if you want: Widely Held Fixed Investment Trust Guide

If take that link and add "[product key removed].pdf" to the end, you can read the document.

Commodity Trusts

A commodity trust represents interest in a trust that holds precious metals such as gold, silver, etc. Commodity trusts do not pay cash distributions. However, assets of the trust (such as gold, silver, etc.) are sold to cover expenses. LPL Financial will report proceeds for these sales and offsetting expenses. Some common commodity trusts are SPDR Gold Trust ETF (Ticker: GLD) and Ishares Silver Trust ETF (Ticker: SLV).

[Note that GBTC is just like these other commodity trusts, except it holds BTC.]

An excerpt from GLD’s prospectus on page 30 states:

United States Federal Tax Consequences

When the Trust sells gold, for example to pay expenses, a Shareholder generally will recognize gain or loss in an amount equal to the difference between (1) the Shareholder’s pro rata share of the amount realized by the Trust upon the sale and (2) the Shareholder’s tax basis for its pro rata share of the gold that was sold, which gain or loss will generally be long-term or short-term capital gain or loss, depending upon whether the Shareholder has held its Shares for more than one year. A Shareholder’s tax basis for its share of any gold sold by the Trust generally will be determined by multiplying the Shareholder’s total basis for its share of all of the gold held in the Trust immediately prior to the sale, by a fraction the numerator of which is the amount of gold sold, and the denominator of which is the total amount of the gold held in the Trust immediately prior to the sale. After any such sale, a Shareholder’s tax basis for its pro rata share of the gold remaining in the Trust will be equal to its tax basis for its share of the total amount of the gold held in the Trust immediately prior to the sale, less the portion of such basis allocable to its share of the gold that was sold.

---------------------------

So based on what I read above, this sales to pay expenses are indeed capital gains/losses, not sales expenses, etc.

My main question now is whether, since I bought several lots of GBTC at different times, I can choose which from which lot I can "sell" the underlying bitcoin assets for the expenses in order to take them all from one particular lot, making it far simpler (and getting me to long term capital gains sooner).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

@davidcjonesvt I don't know. I thought I had this figured out and now my head is spinning again. Your statement, "...but they are not sales expenses (eg, so the checkbox doesn't apply). That is, they are not expenses related to the sale of the asset" makes a lot of sense to me when I really think about what you are saying. Sometimes the simplest explanation is the best.

I was relying on the GBTC Letter in paragraph 2 that states, "Instead, the Trust's income and expenses 'flow through' to the Shareholders", and paragraph 3 that states, "Shareholders generally will be treated, for U.S. federal income tax purposes, as if they directly owned a pro rata share of the underlying assets held in the Trust. Shareholders also will be treated as if they directly received their respective pro rata shares of the Trust’s income and proceeds, and directly incurred their pro rata share of the Trust’s expenses."

But your statement makes those points moot, I think.

So if you go back to Page 2 of this thread and read Employee Tax Expert DawnC's post about the Common Adjustments, can I assume that you completely disagree with her post?

It is maddening that there isn't a clear definitive answer to this question anywhere. The answer should be clearly spelled out in the Grayscale letter but no one wants to be seen as giving tax advice. I'm selling all my GBTC at the end of the year (hopefully after the SEC does the right thing and approves the ETF and the discount to NAV goes away), and I hope to never think about GBTC again after next tax season.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

Yes, I completely disagree. You haven't sold any "shares" of GBTC yet. Now maybe when you do sell the GBTC, you will check that box to alter the purchase basis because you have been actually selling the underlying asset (fractionally) all along (eg, you do need to alter the basis—I am just not sure that box would need to be checked because again, it isn't due to selling fees). If you look at what I posted above and check this link, I think you will see that these must be treated like capital gains.

Widely Held Fixed Investment Trust Guide

Note the link won't work because the system keeps removing the pdf document from the link. Just google it as I described above. Sigh...it isn't really a product in the link!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

@davidcjonesvt Okay, so maybe I misread one of your earlier posts, but we might be talking about two different things here. I had 47 (combined) sales of GBTC and ETHE last year. I still have 2 lots of GBTC that I will sell this year. Are you saying that for those 47 sales, you think I CAN check that box and enter the expense amount and alter the purchase basis in addition to changing the Cost Basis based on the calculations in Steps 1-4 of the GBTC Letter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

The way the 2013 WHFIT guide reads, each of the small "sales" are treated as capital gains/losses that you declare as such when they happen. You pay the tax on them as such, because IRS counts what you own as the BTC not the shares of stock. In the background, because you have sold off some of your initial bitcoin, there is less bitcoin left when you finally sell the shares of GBTC that covers your bitcoin. You actually reduce the actual initial basis (cost) by the amount of initial $ cost that was covered by all the sales along the way. So if you bought 10 sh of GBTC for $10 each (so total $100) that, based on BTC price, represented 20 BTC (I know this isn't close to accurate, it's just for illustration), you basically paid $5 per controlled bitcoin. Then along the way, Grayscale sold off 0.5 BTC for expenses, that would have reduced your initial cost basis to $97.50 (because when they sold that 0.5 BTC for some amount of money, you would have declared a capital gain/loss based on the price they sold it for compared to the $2.5 it cost you based on your initial purchase). When you finally sell the 10 sh of Grayscale, you get to (should) adjust the initial cost from $100 to $97.50. This has the unfortunate effect that any gain you have at the sale is increased by $2.50 (or loss decreased by $2.50), but you have already accounted for the gain/loss on that initial $2.50 in BTC back when it was sold for the expenses. That is my take.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099 lists "Gross proceeds investment expense" and this is being listed as sales profits. How can this be fixed?

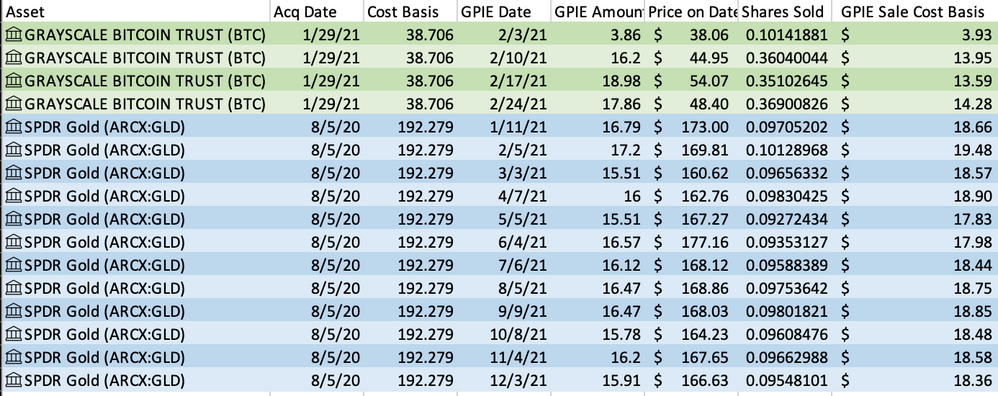

Create an excel spreadsheet like this

Columns:

(1)Asset

(2)Acquisition Date

(3)Cost/share at Acq

(4)GPIE Date

(5)GPIE Amount

(6)Price on GPIE Date

(7)Shares Sold

(8)GPIE Cost Basis

1: The stock symbol

2: The date you acquired some of that stock (must be sufficient to cover the GPIE sale, or else use next date forward); specific date is the first date if using first-in, first-out accounting, change as needed

3: The price/share (cost basis) that corresponds to the date in #2

4 and 5: Date and amount of GPIE sale from your 1099B form

6: Enter this formula: =STOCKHISTORY(A2,D2,D2,0,0,1)

A2 and D2 should refer to the stock symbol and GPIE date for that row and match the column orders I put here

7: Enter this formula: =E2/F2

(GPIE amount / Price on that day)

8: Enter this formula: =G2*C2

(Effective shares sold * Cost basis for all shares in the lot used to sell them)

Fill that spreadsheet with all the GPIE sales from your 1099B; don't worry about the Cost Basis Factor if you use this method; that's only needed if you can't figure this method out.

Take the values from columns 2 and 8 for each GPIE sale, using them to manually edit the "needs review" entries in TurboTax; helps to click "status" twice in the TurboTax table to sort all "needs review" to top.

Voila! Cost basis complete.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AliChalo

New Member

bruced63

New Member

latefiler5

Level 1

skibum11

Returning Member

shirleyzeng

Returning Member