- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

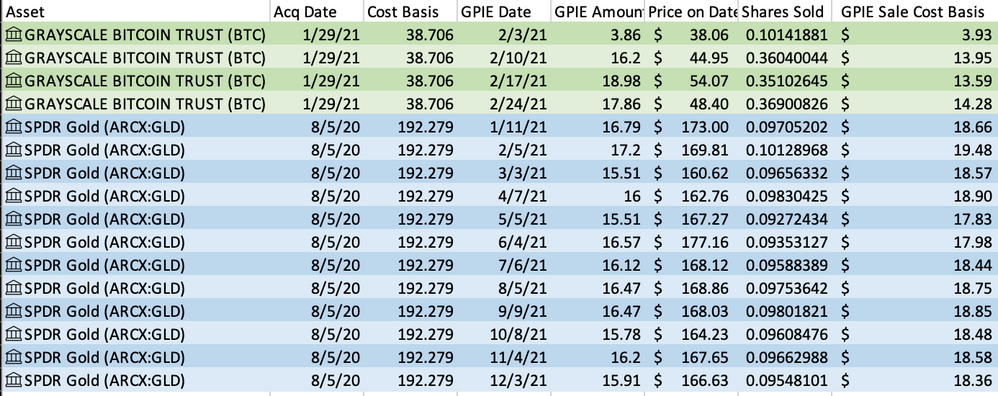

Create an excel spreadsheet like this

Columns:

(1)Asset

(2)Acquisition Date

(3)Cost/share at Acq

(4)GPIE Date

(5)GPIE Amount

(6)Price on GPIE Date

(7)Shares Sold

(8)GPIE Cost Basis

1: The stock symbol

2: The date you acquired some of that stock (must be sufficient to cover the GPIE sale, or else use next date forward); specific date is the first date if using first-in, first-out accounting, change as needed

3: The price/share (cost basis) that corresponds to the date in #2

4 and 5: Date and amount of GPIE sale from your 1099B form

6: Enter this formula: =STOCKHISTORY(A2,D2,D2,0,0,1)

A2 and D2 should refer to the stock symbol and GPIE date for that row and match the column orders I put here

7: Enter this formula: =E2/F2

(GPIE amount / Price on that day)

8: Enter this formula: =G2*C2

(Effective shares sold * Cost basis for all shares in the lot used to sell them)

Fill that spreadsheet with all the GPIE sales from your 1099B; don't worry about the Cost Basis Factor if you use this method; that's only needed if you can't figure this method out.

Take the values from columns 2 and 8 for each GPIE sale, using them to manually edit the "needs review" entries in TurboTax; helps to click "status" twice in the TurboTax table to sort all "needs review" to top.

Voila! Cost basis complete.