- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Manual Entry of Capital Loss Carryover and QBI Passive Loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Manual Entry of Capital Loss Carryover and QBI Passive Loss

Running into a strange issue with TT this year, where it's asking me to manually calculate and input data that I suspect it should be calculating itself. This comes up in the "Review" at the end of the process. There's little to no instruction on where/how to get these numbers. Here the requests:

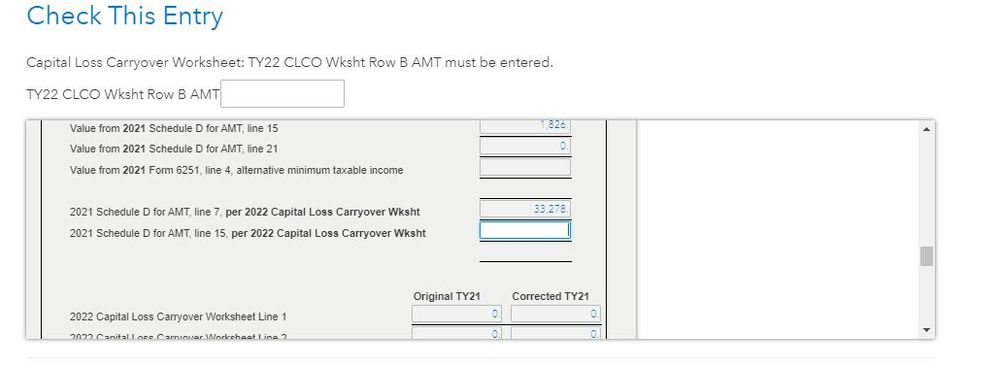

- Capital Loss Carryover Worksheet: TY2022 CLCO Wksht Row B AMT must be entered

- I had capital losses in 2022 that will carryover to 2023, but NO losses in 2021. So I do not see a capital loss carryover sheet on my 2022 return, as nothing was carried over from the previous year. There is reference to it in lines 6 and 14 of Schedule D, but those fields are blank.

- Also no mention of AMT on any of my previous returns

- Do I just enter zero in TT? If not, where do I find this number?

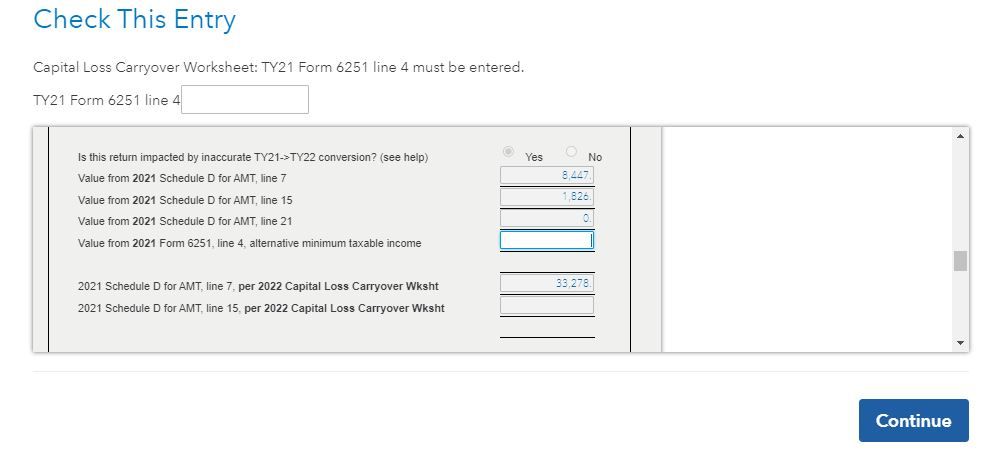

- Capital Loss Carryover Worksheet: TY2021 Form 6251 line 4 must be entered

- Again, I had no capital losses in 2021. I did in 2022, and that should carryover to 2023

- I do not have Form 6251 in my 2021 (or 2022) tax returns.

- Again, no mention of AMT on either

- Is this value also zero? If not, where do I find it?

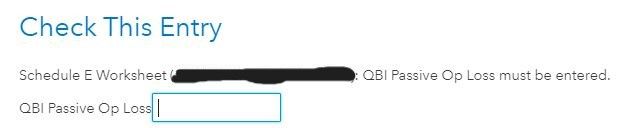

- Schedule E Worksheet (*Rental Property*): QBI Passive Op Loss must be entered

- Background: This is for a rental property that has significant bonus depreciation carrying over from previous year.

- What tax year? 2022? Current year? There is no indication.

- Is this the net income without the loss carryover? It will not allow a positive number.

- QBI is not mentioned anywhere on Schedule E. It doesn't seem to let me plug in my QBI operating loss

A google search seems to suggest the first two are related to correcting a TT bug in previous years. However, I can't pull numbers from forms I don't have. There is no "help" or "additional info" link. I snipped the prompts below, as there is also a smart form displayed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Manual Entry of Capital Loss Carryover and QBI Passive Loss

1. AMT will equal the same capital loss carryover since you had no form 6251 in your return.

2. No capital loss and no carryovers means zero is the entry

3. There isn't enough information for me to be sure the program is verifying your QBI carryover but that is my expectation based on your scenario. You will want to view your tax forms and double check that is the missing spot.

If you have not yet paid, you will need to in order to see all forms and worksheets.

To see your forms:

- In desktop, switch to Forms Mode.

- For online, see How do I preview my TurboTax Online return before filing?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Bill413

Level 2

latefiler5

Level 1

embedded_guy

Level 3

krazewmn10

New Member

lllbby

Level 2