- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Manual Entry of Capital Loss Carryover and QBI Passive Loss

Running into a strange issue with TT this year, where it's asking me to manually calculate and input data that I suspect it should be calculating itself. This comes up in the "Review" at the end of the process. There's little to no instruction on where/how to get these numbers. Here the requests:

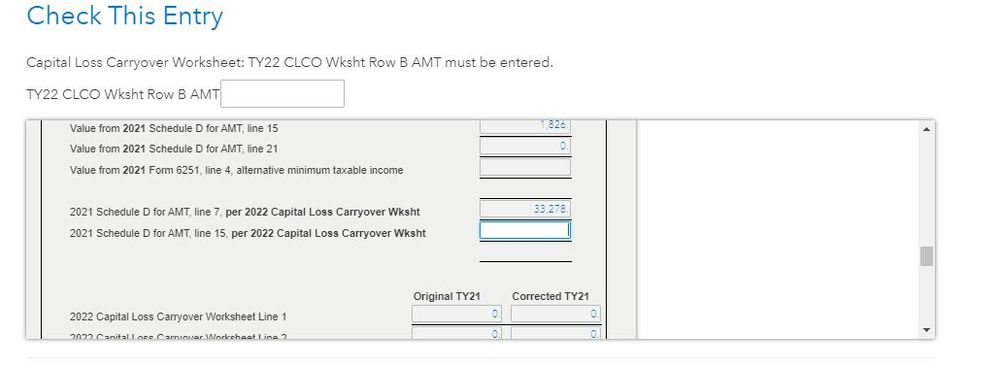

- Capital Loss Carryover Worksheet: TY2022 CLCO Wksht Row B AMT must be entered

- I had capital losses in 2022 that will carryover to 2023, but NO losses in 2021. So I do not see a capital loss carryover sheet on my 2022 return, as nothing was carried over from the previous year. There is reference to it in lines 6 and 14 of Schedule D, but those fields are blank.

- Also no mention of AMT on any of my previous returns

- Do I just enter zero in TT? If not, where do I find this number?

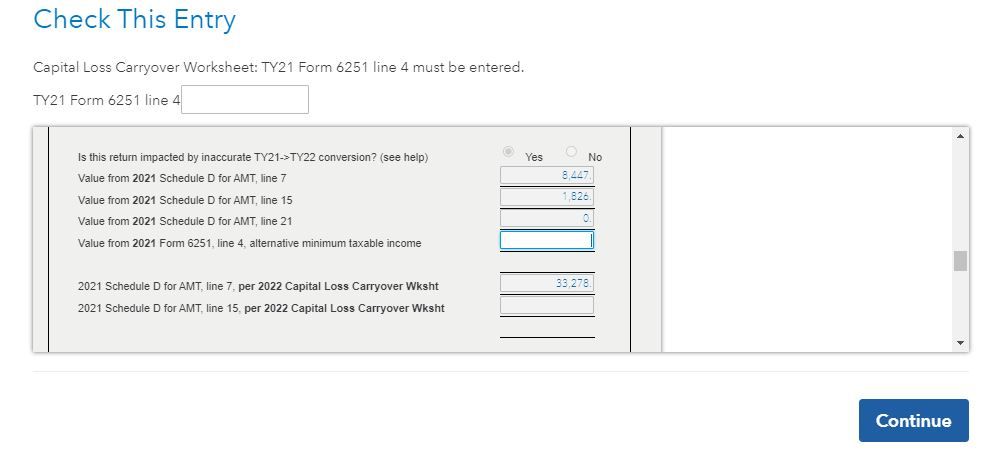

- Capital Loss Carryover Worksheet: TY2021 Form 6251 line 4 must be entered

- Again, I had no capital losses in 2021. I did in 2022, and that should carryover to 2023

- I do not have Form 6251 in my 2021 (or 2022) tax returns.

- Again, no mention of AMT on either

- Is this value also zero? If not, where do I find it?

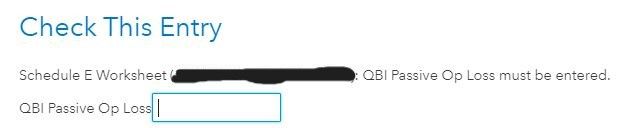

- Schedule E Worksheet (*Rental Property*): QBI Passive Op Loss must be entered

- Background: This is for a rental property that has significant bonus depreciation carrying over from previous year.

- What tax year? 2022? Current year? There is no indication.

- Is this the net income without the loss carryover? It will not allow a positive number.

- QBI is not mentioned anywhere on Schedule E. It doesn't seem to let me plug in my QBI operating loss

A google search seems to suggest the first two are related to correcting a TT bug in previous years. However, I can't pull numbers from forms I don't have. There is no "help" or "additional info" link. I snipped the prompts below, as there is also a smart form displayed.

Topics:

February 17, 2024

1:26 PM