- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

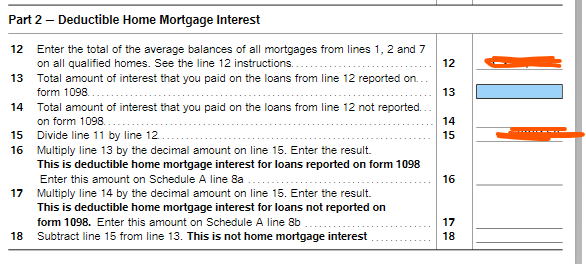

my home loan balance (from my primary residence and investment property) is higher than $1m, so i am using "Deductible Home Mortgage Interest Worksheet" form to calculate allowed deductible interest.

it is pulling correct principal amount, interest amount, origination date, etc from the number i entered. however in the Part 2 of the form, it is not calculating line 16, and is not allowing me to enter line 13. why? how should i fix that?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

We are aware of this experience. If you're experiencing the issue above, please go here to receive email notifications when any updates related to this issue become available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

We are aware of this experience. If you're experiencing the issue above, please go here to receive email notifications when any updates related to this issue become available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

It is correctly computing the deductible portion of my home mortgage interest on Part 2 Line 16 of the worksheet, but then it adds the deductible portion of my mortgage points to the amount on Line 16 before migrating it to Schedule A Line 8a. Then it is entering the deductible portion of the mortgage points a second time in Schedule A Line 8c.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

Please contact us by phone, for further assistance What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

Nashaya,

I have called several numbers several times each and it was always a dead end. Can you be more specific about how to find out if the IRS received my 2019 return? Please.

Linda T

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

You can verify that with IRS. TurboTax is not allowed to access your tax account with IRS because of Privacy Issues. Here is how to get a transcript for 2019 taxes and it will give you the information that you need.

How to Request a Transcript From IRS

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

The form is also not transferring the amounts to Schedule A, line 8a or 8c.

Schedule A, line 8a is only showing the full amount of interest shown on the form 1098.

Looks like a calculation error by Turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

Can you provide some more details about what kind of calculation issue you are having? Should line 8a include other amounts? Should it be limited or what amounts are showing on the Home Mortgage Interest Limitation Smart Worksheet (it is part of Home Int Wkst (xx prop descript xx)? How many forms do you have and what should be on 8c (points NOT in box 6)?

In addition to itemizing deductions on Schedule A, these conditions must be met for mortgage interest to be deductible:

- The loan is secured, which means the lender has some kind of guarantee of payment, usually in the form of property. If a borrower defaults on payments, the lender can seize the property that’s securing the loan. If you’re buying or refinancing a home, especially if it’s your first home, the loan is usually secured by the home you’re buying or refinancing

- The home with the secured loan must have sleeping, cooking, and toilet facilities

- The debt can’t exceed $750,000 (or $1,000,000 if the loan was taken before December 16, 2017) to get the full deduction

- You or someone on your tax return must have signed or co-signed the loan

- If you rented out the home, you must have used the home more than 14 days during the tax year or 10% of the number of days you rented it out, whichever is greater

@dsbroberts - This thread is a couple of years old, so if you want to start a new thread, you can click here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

Has this issue been fixed. I purchased a second home in December and the program is calculating the average mortgage balance as the beginning/ending balance. That's not correct. And I cannot override the math.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

limited interest isnt calculating in "Deductible Home Mortgage Interest Worksheet" form

Yes, for most mortgage interest situations, TurboTax is calculating the correct amount of deductible interest. If you have calculated a different amount using the instructions from IRS Pub 936 Part II, Limits on Home Mortgage Interest Deduction, you may enter this during the interview for Form 1098.

Click Done at the bottom of the 1098 Summary list and answer all questions until you come to the page "Your Mortgage Interest is limited." TurboTax provides a box on this page where can enter the deductible interest based on your calculations. No other overrides are necessary. Be sure to save your calculations with your other tax paperwork.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Blingy

New Member

johnorland

New Member

Asianhops

New Member

OldCarGuy

Level 4

NeUnhappy

New Member