- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- K1 "sale" Limited partnership, help please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 "sale" Limited partnership, help please

I was wondering if someone can help me fill out my K1 “Sale” properly. Alot of confusing information out there and im not a tax expert by any means.

In dec 23 i had a K1 LP (Holly Energy Partners) that was bought by another company and i was compensated in stock and cash. I received both a 1099-B from fidelity and K1 sales Schedule. Between all the different numbers i have no clue where to start.

First: i put that the partnership ended in 2023 and that it was as a complete disposition of the K1. instead of disposition was not via sale, sold and am receiving payments and no entry. Please let me know if that is correct?

Next i put sold partnership interest instead of abandoned, liquidated or transferred. Im pretty sure that is correct.

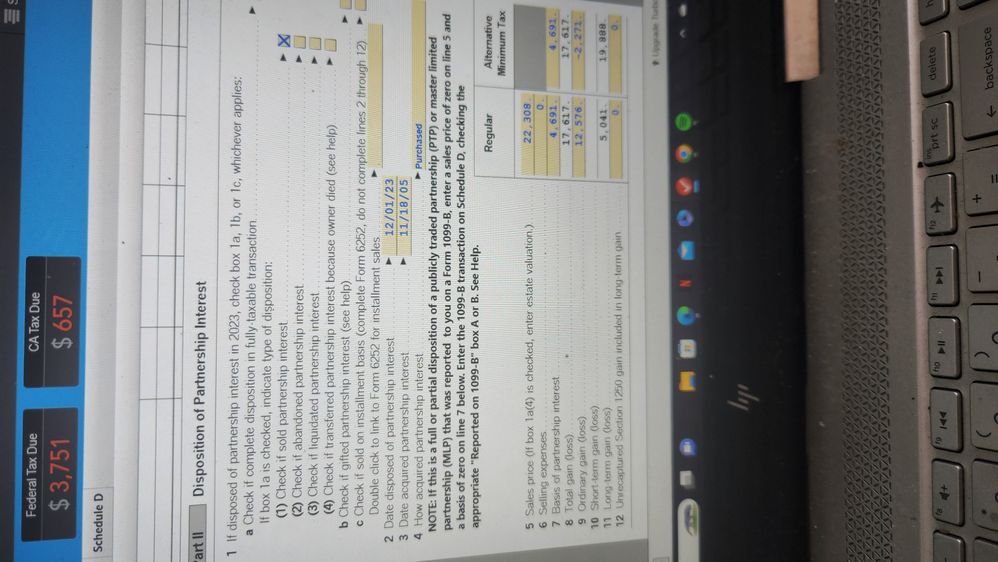

Next (picture attached) is the sale information which i am really struggling with.

Sale Price: pretty sure about this 22308 was confirmed by fidelity and by adding stock/cash per share.

Selling expense: didnt see anything about that so assuming 0

Partnership basis: i got a bunch of possible numbers.

Fidelity account says cost basis was 28793.90

fidelity 1099 says cost basis was 27378.58

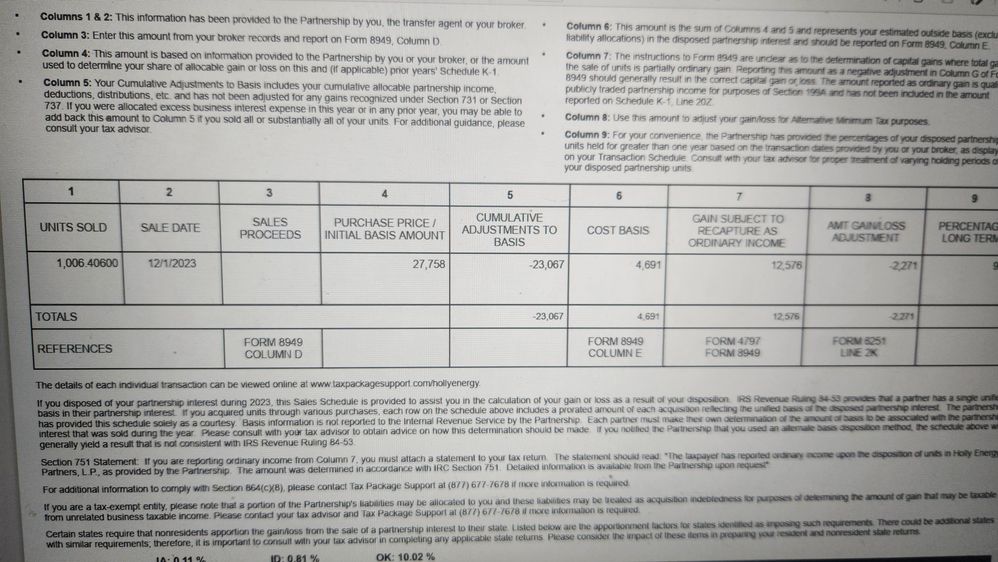

K1 says: initial basis was 27758. but it also has a cumulative adjustment to basis (idk what this means) of -23067 -> leading to a cost basis of 4691 . see attached K1 sales schedule

both the 1099 and K1 says use their value for Form 8949 Box E

Which one am I supposed to put in there for partnership basis?

Ordinary Gain: another one im struggling with

Using K1 sales (see attached) schedule shows this number as 12576 (in gain subject to recapture as ordinary income). Next column shows amt gain/loss adjustment as -2271. I entered them as seen in picture. The most important part and confusion part is the instructions listed to column 7; see below. See bold line

“Column 7:The instructions to Form 8949 are unclear as to the determination of capital gains where total gain on the sale of units is partially ordinary gain. Reporting this amount as a negative adjustment in Column G of Form 8949 should generally result in the correct capital gain or loss. The amount reported as ordinary gain is qualified publicly traded partnership income for purposes of Section 199A and has not been included in the amount reported on Schedule K-1, Line 20Z”

Does that mean i enter this number as a negative? Anyone know what this means?

1250 gain: i didnt see anything for this so i assumed no

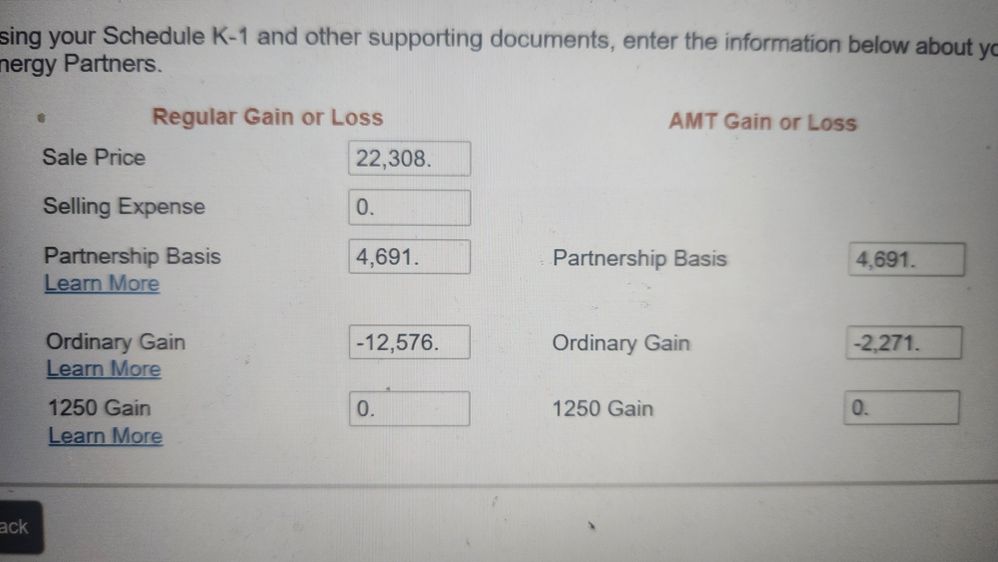

My last question: is do i enter this both as a 1099-B and K1 sales. Or only one. I feel like they are double dipping on tax. I saw on the one of the forms if you submitted at 1099-B and clicked appropriate box which i did then you list sales price and partnership basis as both 0? Is that right for this situation? (see attached picture)

This is weird oil transportation K1 that carries a lot of debt and lost me 6k . im struggling why i owe thousands in taxes. I assume it has to do with the distributions - i thought i was being taxed on that as it affected my total income in past years?

Any help with any of the questions would be much appreciated. I worried im going to have pay someone to submit my taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 "sale" Limited partnership, help please

I'll repeat my instructions because your entries are wrong and tell you what the numbers should be

line 5 - sales price 12578 from column 7

line 7 - basis zero

line 9 - ordinary income 12578

the other lines in the regular tax column should all be zero

you can't report the 1099-B info here. you'll get a mismatch notice from the iRS and are probably double counting the gain if you also reported the sale on form 8949/schedule D

for schedule D your tax basis is 4691 column 6 + 12578 column 7

you can contact Sinclair's (DINO) investor relations. they should have filed form 8937 with the IRS providing a method that owners of Holly can use for reporting the merger

22308 seems high. you got $4026 in cash ($4/share of Holly) + 317 shares of DINO (.315 for each share of Holly if i understand the merger terms correctly.

so subtracting the $4026 from the $22308 leaves 18282 divided by 317 means DINO average of high and low on the date of the merger should have been 57.67. the merger occurred on 12/1 when DINO was trading at about $53.585 per share so I have a different figure for the sales price which amounts to about $1000 difference.

however perhaps it goes like this

you paid 28794 originally for Holly, Fideilty 1099 is reporting cost of 27379 so a difference of 1415 that may get added to DINO tax basis so 317 * 53.585 (high/low average on merger date but other methods are also valid)= 16986+1415=18401 (what's fidelity showing as shares and basis for DINO)

18401 +cash of 4026 = 22427 that comes close to the 22308 Fideltiy is using for sales price.

MLP and PTP reporting k-1 and 8949/1099-B

Enter the k-1 info

Check the PTP box

If total disposition proceed as follows:

Check final K-1 (s/b marked on actual k-1)

Check sold or otherwise disposed of entire interest

On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words “Gain subject to recapture as ordinary income” or similar wording. This info comes from the supplemental sales schedule that should have been provided. Its also now on the k-1 box 20AB - no 20AB, no ordinary income column then then sales price is zero. The numbers I’m using represent the line numbers in forms mode (desktop only)

- Sales Price = line 20AB (1065 k1)

- Selling expenses = 0

- Basis = 0 (zero – nothing else)

- Gain is computed and should be same as the sales price.

- Ordinary gain = enter the same amount as the sales price

This amount flows to form 4797 line 10 and is taxed as ordinary income. This step is necessary, so any suspended passive losses are now allowed assuming complete disposition.

10,11,12 should be blank/ZERO

Many do not understand the above. The 1099-B reporting is not entered in the above section. Doing so will report the sale twice once here. Once through the 1099-B entry. The above is only for purposes of entering the ordinary income upon disposition. NOTHING ELSE.

Now for the 8949/1099-B Capital gain/loss reporting

The broker’s form is probably coded as B or E – sales proceeds but not cost basis reported to the IRS. This is because the broker does not track the tax basis. It used what you paid originally which is not correct or it was adjusted due to a merger or acquisition.

The correct tax basis is (note that your sales schedule may have a column that reports the adjusted/average tax/cost basis excluding the ordinary income which must be added):

What’s on the sales schedule as purchase price/initial tax basis (usually column 4). it may differ from what you paid originally because of a merger or acquisition. Some of your original cost is allocated to the new securities received, if any.

Then there is a column on the sales schedule that says cumulative adjustments to basis. If it’s positive add it to the cost shown. If it’s negative subtract the amount.

Finally add the amount of ordinary income reported above, if any.

The result is your corrected cost/tax basis for form 8949 – the capital gain/loss portion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 "sale" Limited partnership, help please

Is there an issue if I have no K-1 Box 20AB or “Gain subject to recapture as ordinary income” but my Boxes 10/11/12 are not blank? I have positive amounts for 11C/ZZ.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 "sale" Limited partnership, help please

"On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words “Gain subject to recapture as ordinary income” or similar wording. This info comes from the supplemental sales schedule that should have been provided. Its also now on the k-1 box 20AB - no 20AB, no ordinary income column then then sales price is zero. The numbers I’m using represent the line numbers in forms mode (desktop only)

- Sales Price = line 20AB (1065 k1)

- Selling expenses = 0

- Basis = 0 (zero – nothing else)

- Gain is computed and should be same as the sales price.

- Ordinary gain = enter the same amount as the sales price"

just want to make sure i understand

I am reporting the sale in my 1099-B and turbo tax will take care of it there

what that doesnt take into account is my section 751 gain from the sale. so that i must address in the K1 part.

so i report in K1 as the sale price is my 751 gain of 12576 ( which from googling is recapturing as ordinary gain)

partnership basis is 0 because i address that in 1099 B/Schedule D

my ordinary gain is same as my sale price (12576) because that lets them know the 12576 should be ordinary gain and not capital gain?

On the directions it says to enter it so that it appears as a negative adjustment - do i ignore this, does turbo tax already do it for me? or do i enter as a negative number?

what do i do with column 8 where it says amt gain/loss adjustment of -2271 (nothing?)

for these ordinary gains im realizing, arent my loses/debt i have been carrying over supposed to help offset the gain?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 "sale" Limited partnership, help please

As you have discovered, this is a complex transaction to report. You may consider upgrading to TurboTax Live, and online service that provides step-by-step guidance from a tax expert to provide the assistance you need, either over the phone or by screensharing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

CharlieSol

Level 2

momeebee

Returning Member

jmillsp

Level 3

shak0000

Level 2

redpixel

Level 2