- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- K-1 with box 20 N & Z

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

I input the K-1 data. However, there is no amount I can see to put in for box 20-Z into TT. I input the loss for the K-1 walking through TT's software (online) and left the "Z...199A" income blank as I don't see an amount to report. The only amount on Schedule A is the rental (loss)

Thank you in advance for the assistance and advice.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

- At the screen Enter Box 20 Info, select Z-Section 199A information but leave the Amount empty. This tells the software that Section 199A information will need to be entered for the income previously reported. Click Continue.

- At the screen We see you have Section 199A income, select the appropriate income description. Click How would I know this? for more information.

- At the screen We need some information about your 199A income, select the appropriate income description and amount from the Statement A attached to your K-1 information. Your Statement A is reporting no other information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

I’ve followed your advice and when I get to your 3rd bullet (pasted below) point I’m not able to enter an amount. I continued through the software and it brings me to a screen that says “Let’s take care of these details below” I click review where I’m brought to a screen that says “check this entry” “sch K-1 wks-partnership has been selected but no section 199A income has been entered on Statement A.”

I also notice on this screen that my capital account beginning balance is correct but the ending balance isn’t correct. What am I doing wrong?

- At the screen We need some information about your 199A income, select the appropriate income description and amount from the Statement A attached to your K-1 information. Your Statement A is reporting no other information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

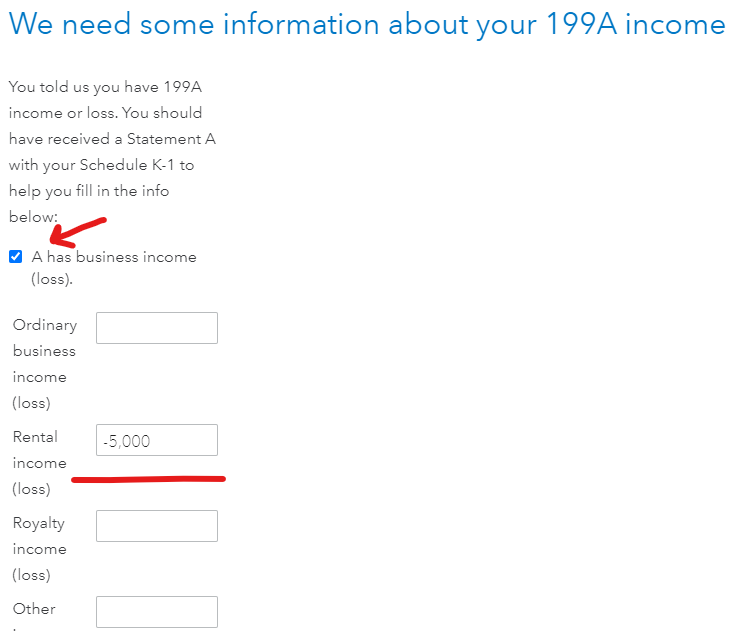

The We need some information about your 199A income screen has checkboxes to mark for each type of entry on your Statement A. Once you check the box, you will be able to enter the amounts from your form. If the only line listed on your Statement A is the rental (loss), your screen should look like this:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

Unfortunately, I'm not seeing those options on my screen. This is what I see. Any thoughts @AliciaP1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

Have you checked the first box (has business income) on the page "We need some information about your 1099A income"? When you check this box, the pop-up will give you a place to enter the income(loss) from the K-1, similar to what you're seeing for UBIA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

I did not click that box @PatriciaV because my schedule A doesn't have an amount in that box. It has the rental income loss and UBIA of qualified property filled in. This is a passive investment for me if that helps. Does that "has business income" box need to be checked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 with box 20 N & Z

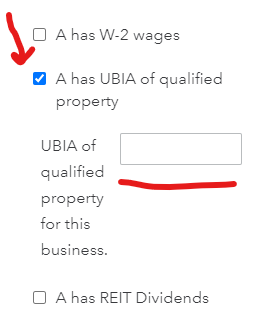

Yes, the line items don't populate on the screen until you click the box that shows. Once you click the "has business income" box as I indicated in the screenshot, the lines for Ordinary Business Income(loss), Rental Income (loss), Royalty Income (loss), etc., will pop up. Enter your Rental Income (loss) then scroll down to the XXX has UBIA of qualified property box and check it. Then enter your UBIA from your Statement A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MaxRLC

Level 3

MaxRLC

Level 3

jtomeldan

Level 1

Vivieneab

New Member

keenerbp

New Member