- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- IRS Form 8606, Non-Deductible IRAs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8606, Non-Deductible IRAs

Background

I have a larger traditional IRA with a small non-deductible portion. I converted part of this traditional IRA to a Roth IRA this past year, in 2023, so I must file Form 8606. This is the second time I have converted some of this IRA to a Roth, so the second Form 8606 I have done.

Also, I have had an inherited traditional IRA that I have had to take RMDs for several years.

My Question

Unlike the first time I did a Roth conversion, TurboTax is putting the inherited IRA RMD distribution in line 7 and the product of the RMD distribution times line 10 in line 12! This seems odd that the inherited IRA is getting mixed in here with my IRA and it seems to conflict with what TurboTax did in 2020 for my first Roth conversion.

Does this make sense? Does anyone have any thoughts or hopefully solutions?

Thank you!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS Form 8606, Non-Deductible IRAs

The inherited IRA should be kept separate from your own IRAs.

TurboTax does not support 8606s for inherited IRAs. That is problematic for inherited IRAs with basis.

What is the box 7 distribution code on the inherited 1099-r? I have seen "4" meaning distribution to beneficiary). It seems that however it is coded/entered is causing TT to count it as yours and not inherited. When you went through the interview are you sure you indicated it was inherited?

While you're at it what is the code for the roth conversion distribution?

The TT "data source" help on 8606 line 7 says:

From the Form 1099-R Summary, line 5. This is the sum of the gross amount of all traditional, SEP, and SIMPLE IRA distributions (less any rollovers and recharacterization) from box 1 of the taxpayer's 1099-Rs (not including 1099-Rs with a code of "8" or inherited IRAs). This also does not include any amounts converted to a Roth IRA. However, if there is a star next to the amount on line 13, this field will be blank. Refer to the Taxable IRA Distribution Worksheet for the taxpayer.

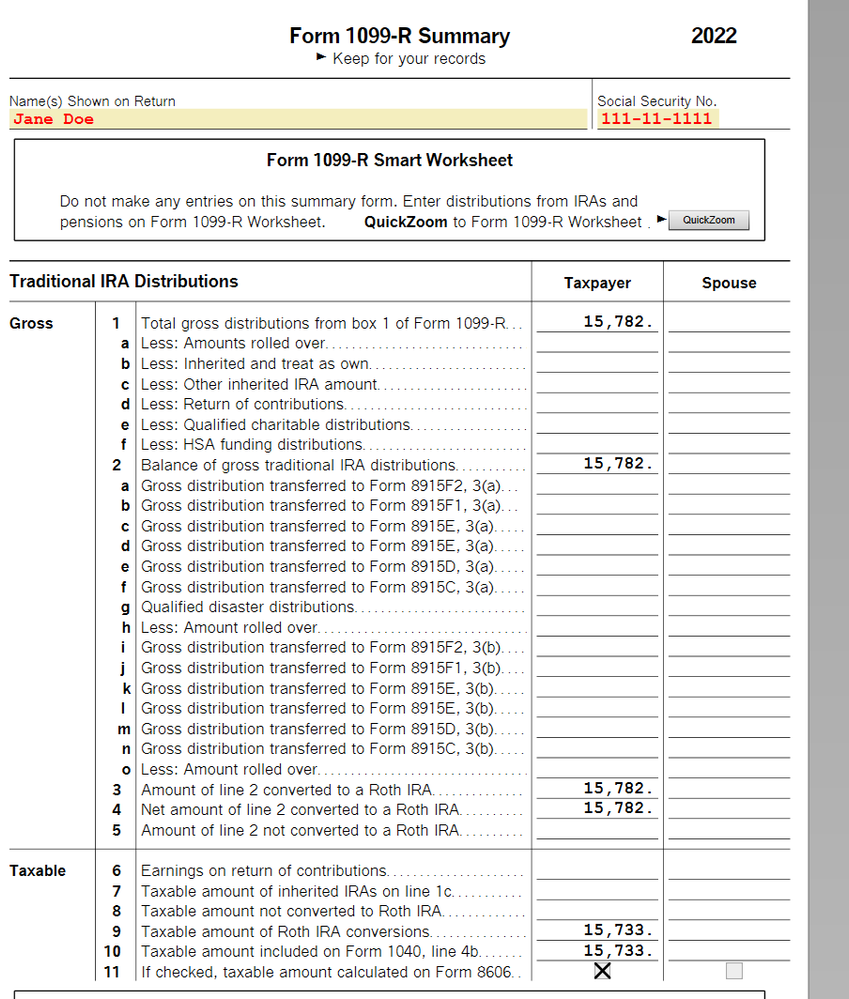

If you have access to all of the forms and can find the "1099-R Summary Line 5 - Taxpayer" that would be helpful. For example:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zzz8881

Returning Member

VAer

Level 4

thendric1956

Returning Member

dkonol2

Level 2

rougutou

New Member