- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

The inherited IRA should be kept separate from your own IRAs.

TurboTax does not support 8606s for inherited IRAs. That is problematic for inherited IRAs with basis.

What is the box 7 distribution code on the inherited 1099-r? I have seen "4" meaning distribution to beneficiary). It seems that however it is coded/entered is causing TT to count it as yours and not inherited. When you went through the interview are you sure you indicated it was inherited?

While you're at it what is the code for the roth conversion distribution?

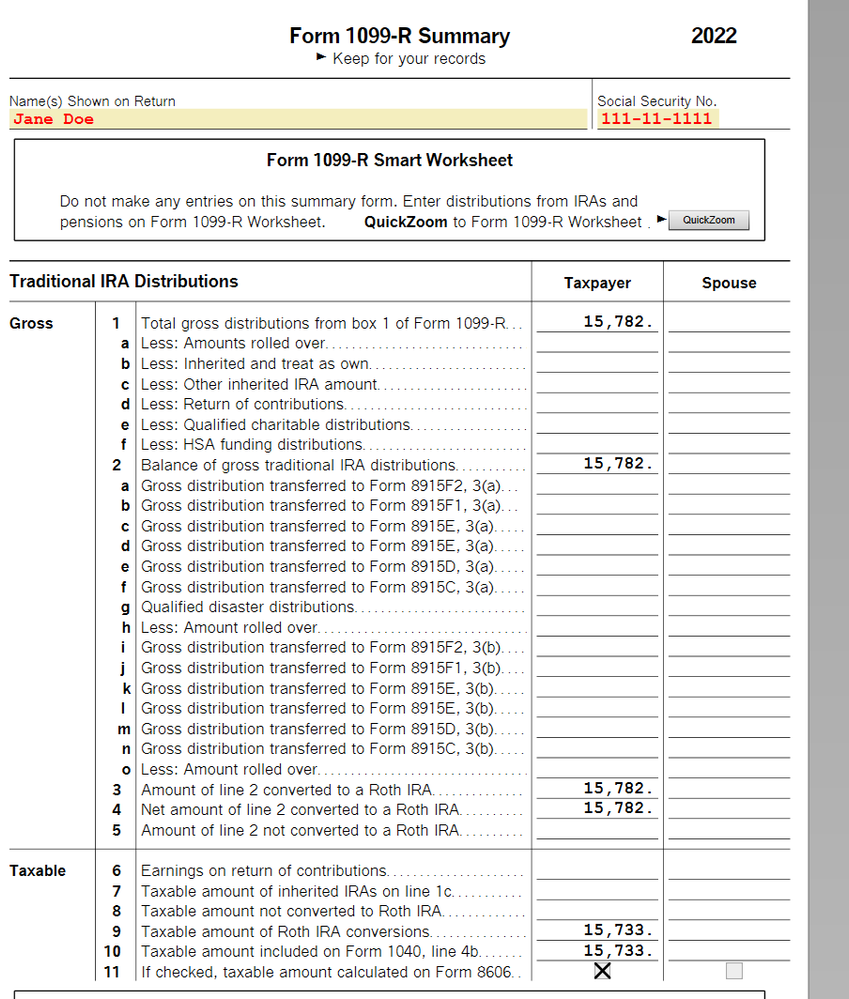

The TT "data source" help on 8606 line 7 says:

From the Form 1099-R Summary, line 5. This is the sum of the gross amount of all traditional, SEP, and SIMPLE IRA distributions (less any rollovers and recharacterization) from box 1 of the taxpayer's 1099-Rs (not including 1099-Rs with a code of "8" or inherited IRAs). This also does not include any amounts converted to a Roth IRA. However, if there is a star next to the amount on line 13, this field will be blank. Refer to the Taxable IRA Distribution Worksheet for the taxpayer.

If you have access to all of the forms and can find the "1099-R Summary Line 5 - Taxpayer" that would be helpful. For example:

**Mark the post that answers your question by clicking on "Mark as Best Answer"