- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Incorrect Depreciation Calculations

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Depreciation Calculations

We bought and renovated a home in 2021. We are started airbnb-ing at the very beginning of 2022 and rent it 96% of the year. I am trying to depreciate the renovations. Land improvements depreciate over 15 years. Permanent fixtures to the house (tile and hardwood flooring, cabinets, etc.) depreciate over 27.5 years.

If I had $1,500 of land improvements, I should have at least $96 in depreciation (1/15 of the total improvement x 96%) in 2022. (And actually it should be more than $96 because the depreciation method that turbotax uses frontloads the depreciation so that it's more in the early years.) However, in this scenario, turbotax is calculating only about $50 of depreciation. I gone back over and over, re-entered, and it's doing the same thing with every land improvement that I have.

Also, on 27.5 depreciable year improvements to the home, instead of giving me 96% of the deduction (1/27.5 of the total improvement), it's giving me about 92%???

Any ideas? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Depreciation Calculations

TurboTax is using the basis for depreciation of Land Improvements of $1,440 (not $1,500) based on the information I entered below.

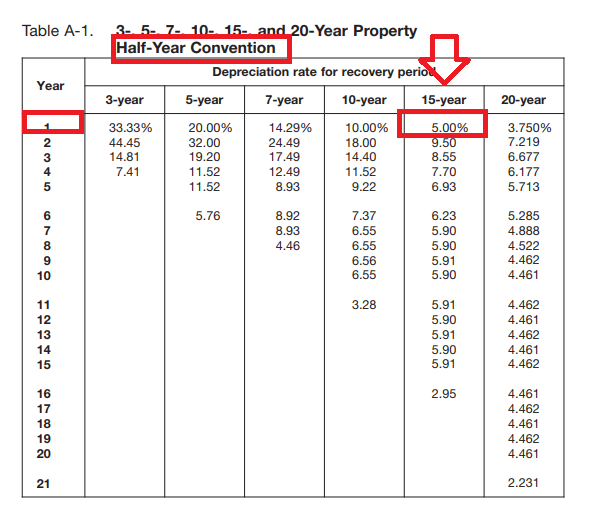

According to IRS Publication 946, Table A-1, page 69, the depreciation amount is 5% for year 1 for 15-year property which is $72. I was able to recreate that depreciation in TurboTax.

I did not try and recreate your rental building since I did not have any information. Please refer to IRS Pub 946.

Using the Home & Business version of TurboTax:

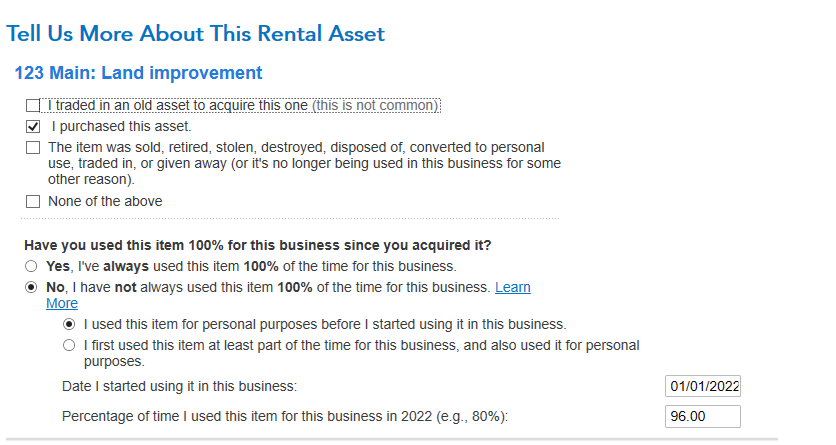

1. On the Tell Us About This Rental Asset screen, I entered Land improvement,

$1,500 and 2/1/2021 as the Date purchased or acquired.

3. On the Tell Us More About This Rental Asset screen, I entered:

- I purchased this asset

- No, I have not always used this item 100% of the time for this business.

- I first used this item at least part of the time for this business, and also used it for personal purposes.

- Date I started (or it was available to rent) using it in this business: 01/01/2022

- Percentage of time I used this item for this business in 2022: 96%

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect Depreciation Calculations

Thank you! Super helpful

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SB2013

Level 2

jjon12346

New Member

alvin4

New Member

iqayyum68

New Member

WadiSch

Level 1