- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

Based on your income, the long term capital gains should not have been taxed. I suggest you look the schedule D tax worksheet to verify that the gains are being taxed. The amount on line 22 of that form would be the income taxed at 0%.

It could be that you have a tax but it is not coming from your investment gains.

@jkvguharden

[Edited 3-15-22 @4:16 PM EST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

Line 22 on Schedule D looks like this:

22 Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a?

Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions

for Forms 1040 and 1040-SR, line 16.

No. Complete the rest of Form 1040, 1040-SR, or 1040-NR

and line 7 of my 1040 has $592.00

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

capital gains push other income into a higher bracket.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

My Long Term Capital gains are not taxable due to my taxable income is under 80,800.

And YET- Turbo tax placed that amount on line 7 of my 1040 thereby including that amount in my taxable income. I believe this is an error an the part of TurboTax. To whom would I speak regarding getting this corrected?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

As @Mike9241 stated above, long term capital gains are added to your other taxable income to determine your tax bracket.

Long term capital gains are taxed at 0% if your tax bracket is 12% or less (less than $81,050 of taxable income for MFJ)..

However, long term capital gains are included in your taxable income, and that part of long term gain which crosses over $81,050 is taxed at 15%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

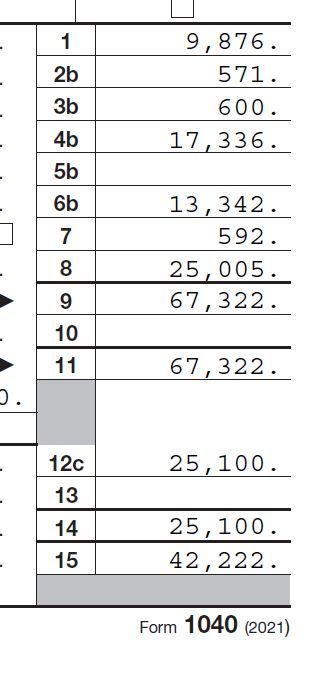

I don't know if I am misunderstand you, or if you are misunderstanding me. I'll try to be more clear, attach a screenshot

My total income, including change I found in the street, (kidding), is 67,322. (line 11)

That's from w2's, interest, dividends, unemployment, social security, ira withdrawals AND LONG TERM CAPITAL GAINS. (line 7)

From that amount TurboTax deducted the standard deduction of 25,100. Line 15 of my 1040 shows taxable income of 42,222

That figure includes my $592 in long term capital gains from line 7.

so-it looks to me like my LT CG was included in the calculation of how much income tax I am liable for. Is there someplace else it is listed as a deduction from my taxable income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

No, it is not subtracted from your income. Rather the total tax is calculated on the Qualified Dividends and Capital Gain Tax Worksheet.

On that worksheet the tax is calculated separately for the capital gains and the ordinary income and then added together. See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

Thanks for this! I do not see the standard deduction on this form that you shared. And I do not see that form in my return. I am truly appreciative of you efforts to help me understand.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

Oh, wait! I get it now. Line 1 on this form should have been the amount from line 15, not line 11.

You're awesome! thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

To get clarification to answer my question - I need to plan for all of my income, including long term capital gains to be below the 12% tax rate limit, for my LTCG to be 0 tax. Otherwise, they will be taxed at 15% for the portion over the tax tier limit - am i understanding correctly?

Thanks,

Kim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my AGI is 67k, and I am filing MFJ, why were my long term capital gains included in my tax liability?

Click this link for more info on Capital Gains Tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonia-yu

New Member

patizmom

New Member

MrsMacAdoo

New Member

Blue Storm

Returning Member

JQ6

Level 3