- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

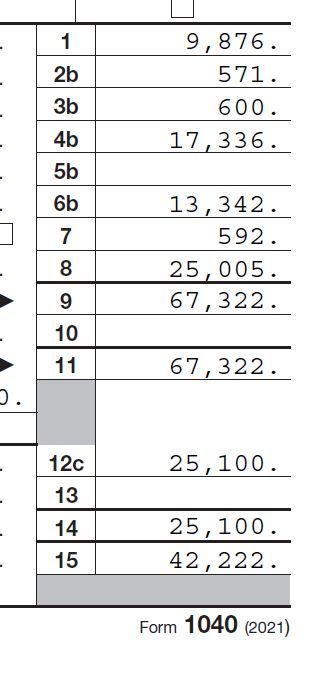

I don't know if I am misunderstand you, or if you are misunderstanding me. I'll try to be more clear, attach a screenshot

My total income, including change I found in the street, (kidding), is 67,322. (line 11)

That's from w2's, interest, dividends, unemployment, social security, ira withdrawals AND LONG TERM CAPITAL GAINS. (line 7)

From that amount TurboTax deducted the standard deduction of 25,100. Line 15 of my 1040 shows taxable income of 42,222

That figure includes my $592 in long term capital gains from line 7.

so-it looks to me like my LT CG was included in the calculation of how much income tax I am liable for. Is there someplace else it is listed as a deduction from my taxable income?

March 16, 2022

10:43 AM