- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- If I purchased an iPad through my work, and that is my only large expense, should I deduct that under Assets through the annual election?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchased an iPad through my work, and that is my only large expense, should I deduct that under Assets through the annual election?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I purchased an iPad through my work, and that is my only large expense, should I deduct that under Assets through the annual election?

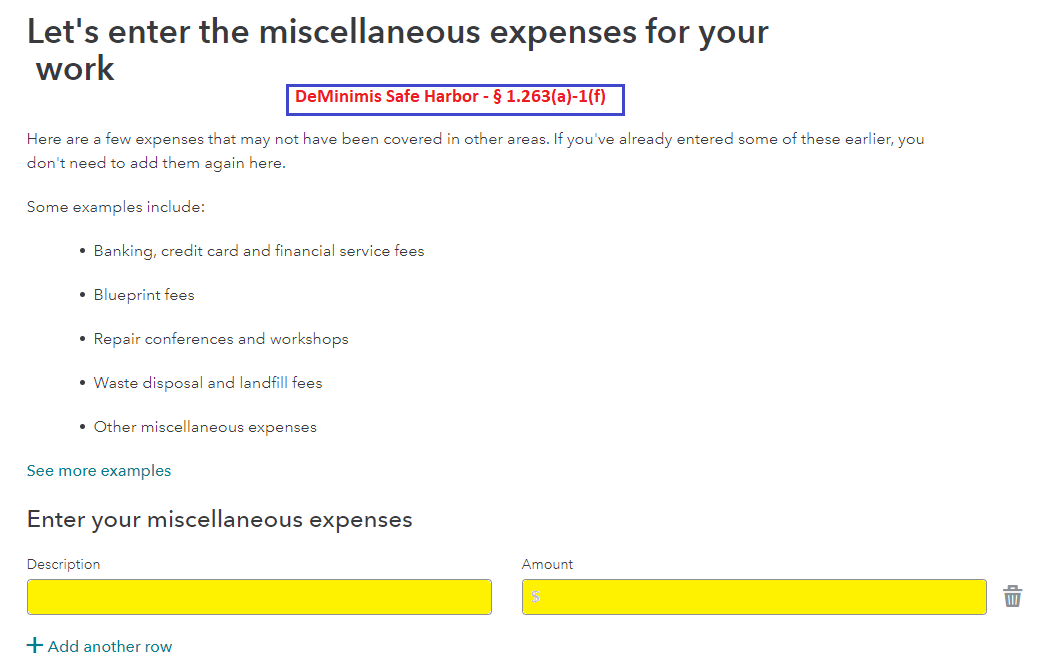

Yes. If you mean can you use the DeMinimis Safe Harbor to expense your iPad for your self employment activity.

De Minimis Safe Harbor Election

This election for items $2,500 or less is called the De Minimis Safe Harbor Election. This election is an option you can take each year that lets you write off/deduct items $2,500 or less as expenses instead of assets. Expenses typically reduce your income by a larger amount than depreciating an asset over multiple years does. This means you could get a bigger refund.

If you decide to take this option, a form called De Minimis Safe Harbor Election will show up in your tax return. This election will apply to all your businesses, rental properties or farms.

Here are the rules you need to meet to take this election:

- You don't have an applicable financial statement (most people don't).

- You have a consistent process for how you record expenses and assets.

- You record these items as expenses on your books/records.

- The cost of each item as shown on your receipt is $2,500 or less.

- Rental Property select Edit > Other expenses > Other Miscellaneous Expenses

- Enter Description (Safe Harbor ...) and amount (not entered as assets under this election)

Note: Because you are under the $2,500 threshold, you are not required to used section 179. You can list these expenses under Miscellaneous. If the amount was over 2,500, then you would enter these as assets and then would be able to choose the 179 option.

- Maintain a complete record with your tax return should you need to verify these items at a later time, this should include your receipt.

To record this in TurboTax use the following steps.

- When you come to the screen, under Assets (no you don't want to go directly to the asset summary) Did you buy any items that each cost $2,500 or less in 2020? mark the Yes button and click Continue.

- On the screen Let's see if you qualify to deduct these items as expenses, mark both of the Yes buttons and click Continue.

- On the Now, let's review each item you bought screen, mark whether all your new assets cost $2500 or less.

- If you mark that every item cost $2,500 or less, you will be brought to the Asset Summary screen. You have elected the De Minimis Safe Harbor provision.

-

Here's how to add your purchases that are $2,500 or less as Miscellaneous Expenses:

- Select Common Expenses (may have to select 'Show More') Continue and then Add expenses for this work.

- Choose Other miscellaneous expenses.

- Description (Safe Harbor-iPad) and amount

- See the image below.

-

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonny.angeles

New Member

gavronm

New Member

user17558684347

Level 1

loreyann

New Member

gerardh

New Member